Short-term health insurance is a hot topic these days, especially for those looking for a more affordable and flexible health coverage option. But is it truly the right fit for everyone? Let’s explore the ins and outs of this unique insurance type and see if it could be the answer you’ve been searching for.

Imagine you’re between jobs, waiting for your new employer’s health plan to kick in, or perhaps you’re self-employed and need temporary coverage. Short-term health insurance could be the bridge you need to avoid a gap in your medical protection. It’s designed to offer coverage for a limited period, usually ranging from a few months to a year, and it can be a great alternative to traditional health insurance in certain situations.

What is Short-Term Health Insurance?

Short-term health insurance is a type of health coverage that provides temporary protection against medical expenses. It’s designed to bridge gaps in coverage, such as when you’re between jobs or waiting for your traditional health insurance to kick in. Unlike traditional health insurance, short-term plans are not subject to the same regulations, which can make them more affordable but also less comprehensive.

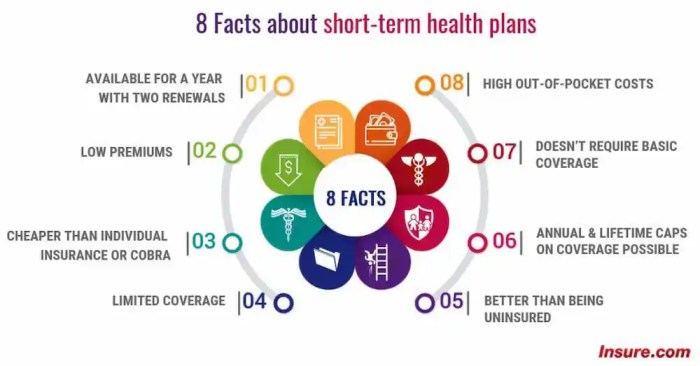

Key Features of Short-Term Health Insurance

Short-term health insurance offers several key features that distinguish it from traditional health insurance:

Coverage Duration

Short-term health insurance plans typically have a limited coverage duration, ranging from a few months to a year. This makes them a suitable option for temporary situations but not for long-term coverage needs.

Pre-existing Conditions

Short-term health insurance plans are not required to cover pre-existing conditions. This means if you have a health condition that existed before you enrolled in the plan, the insurer may deny coverage for related expenses.

Renewal Options

Short-term health insurance plans may offer renewal options, but these are not guaranteed. Insurers may choose not to renew your plan based on factors such as your health status or claims history.

Common Situations for Short-Term Health Insurance

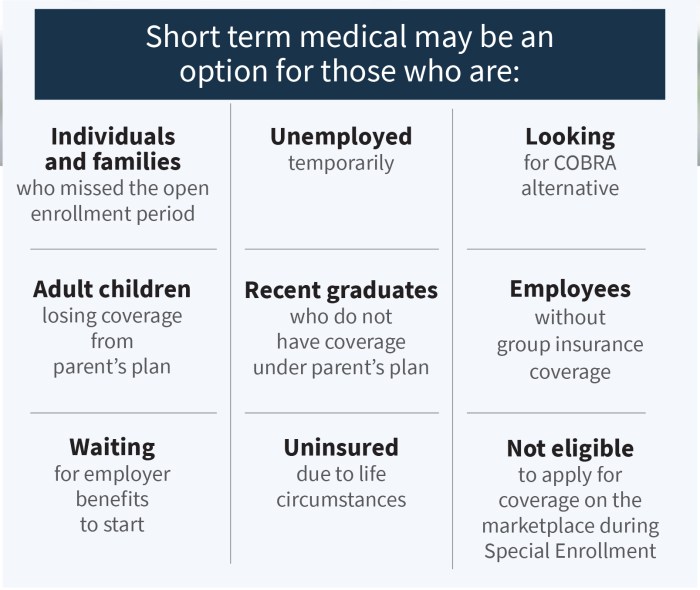

Short-term health insurance can be a suitable option in various situations:

Gap Coverage

Short-term health insurance can bridge the gap between jobs or while waiting for traditional health insurance to start. It can provide temporary coverage until you secure a new job with health benefits or enroll in a traditional health plan.

Self-Employed Individuals

Self-employed individuals who are not eligible for employer-sponsored health insurance may consider short-term health insurance as a temporary solution. It can provide basic coverage while they explore other options or wait for open enrollment periods.

Travelers

Short-term health insurance can be beneficial for travelers who are visiting a foreign country or are on an extended trip within the United States. It can provide coverage for unexpected medical emergencies or illnesses while abroad.

Benefits of Short-Term Health Insurance

Short-term health insurance can be a valuable option for individuals seeking temporary coverage. It offers several advantages that may align with specific needs and circumstances.

Short-term health insurance is like a quick fix for a sudden medical need, just like getting Classic car insurance for a vintage vehicle you’re driving for a special occasion. Both are temporary solutions that provide coverage for a specific period, offering peace of mind when you need it most.

Just remember, like a classic car, your health needs regular maintenance too, so consider a long-term plan for comprehensive protection.

Lower Premiums

Short-term health insurance plans often have lower premiums compared to traditional health insurance plans. This is because they typically have shorter coverage periods and may exclude certain benefits or have higher deductibles.

Flexibility in Coverage

Short-term health insurance provides flexibility in coverage options. Individuals can choose plans that meet their specific requirements, such as coverage for specific medical conditions or a limited period of time.

Real-World Scenarios

Short-term health insurance can be beneficial in various situations.

Individuals Between Jobs

Short-term health insurance can bridge the gap between jobs, providing coverage during periods of unemployment or transitioning to a new employer. This can be particularly helpful for individuals who are ineligible for COBRA or are waiting for open enrollment in their new employer’s health plan.

Individuals Awaiting Enrollment in Other Plans

Short-term health insurance can serve as a temporary solution for individuals who are awaiting enrollment in other health plans, such as Medicare or Medicaid. This can provide coverage until they become eligible for their desired plan.

Individuals with Specific Needs

Short-term health insurance can be a suitable option for individuals with specific medical needs, such as those recovering from an injury or illness, who require temporary coverage while they explore other health insurance options.

Limitations of Short-Term Health Insurance

Short-term health insurance can seem like a tempting option, especially if you’re looking for affordable coverage. However, it’s crucial to understand its limitations before making a decision. Unlike traditional health insurance, short-term plans have specific restrictions that might not meet your needs.

Limited Coverage

Short-term health insurance plans generally provide less comprehensive coverage than traditional health insurance. This means they may not cover all the essential healthcare services you require.

- Essential health benefits:Short-term plans often exclude essential health benefits mandated by the Affordable Care Act (ACA), such as maternity care, mental health services, and prescription drug coverage.

- Preventive care:While some short-term plans might offer coverage for preventive services, the scope may be limited compared to traditional plans.

- Specific conditions:Short-term plans may exclude coverage for specific conditions or treatments, such as pre-existing conditions, chronic illnesses, or certain types of surgeries.

Pre-Existing Condition Exclusions

One of the most significant drawbacks of short-term health insurance is its exclusion of pre-existing conditions. This means if you have a health condition diagnosed before purchasing the plan, it may not be covered.

- Pre-existing condition limitations:Short-term plans are not required to cover pre-existing conditions, which can leave you financially vulnerable if you need treatment for a pre-existing condition.

- Limited access to care:The exclusion of pre-existing conditions can make it difficult to access the healthcare you need, as many providers may not accept short-term plans.

- Higher out-of-pocket costs:If you do need treatment for a pre-existing condition, you may face significantly higher out-of-pocket costs, as short-term plans typically have high deductibles and co-pays.

Potential for Higher Out-of-Pocket Costs

Short-term health insurance plans often have higher deductibles, co-pays, and out-of-pocket maximums compared to traditional health insurance plans. This means you might end up paying a larger portion of your healthcare costs.

- High deductibles:Short-term plans often have high deductibles, which you must pay before your insurance coverage kicks in. This can lead to significant out-of-pocket expenses, especially if you need frequent medical care.

- Limited coverage:The limited coverage of short-term plans can result in higher out-of-pocket costs, as you may have to pay for services not covered by the plan.

- Higher co-pays:Short-term plans often have higher co-pays, which are the fixed amounts you pay for each medical service. This can add up quickly, especially if you need frequent medical care.

Choosing the Right Short-Term Health Insurance Plan

Finding the perfect short-term health insurance plan can feel like navigating a maze. But don’t worry, we’re here to help you find your way. The key is to carefully consider your individual needs and weigh your options to make the best choice for you.

Factors to Consider

To ensure you choose the right plan, it’s essential to consider your individual needs and priorities. Here’s a checklist of factors to help you navigate the selection process:

- Coverage Needs:Think about the type of medical care you anticipate needing. Do you require coverage for routine checkups, prescriptions, or potential hospitalizations? Short-term plans vary in the types of services they cover, so choose one that aligns with your needs.

- Budget:Short-term plans are often more affordable than traditional health insurance, but premiums can vary depending on factors like coverage level, age, and health status. Set a budget and explore plans that fit within your financial constraints.

- Pre-existing Conditions:Short-term plans generally don’t cover pre-existing conditions, meaning any health issues you had before enrolling may not be covered. If you have a pre-existing condition, you may need to consider other insurance options.

- Duration of Coverage:Short-term plans are designed for temporary coverage, typically lasting a few months to a year. Determine the length of coverage you need and choose a plan that aligns with your timeline.

- Customer Service:Research the provider’s reputation for customer service. Read reviews and check for information on their claims processing procedures, communication methods, and responsiveness to inquiries.

Comparing Providers

Once you’ve considered these factors, it’s time to compare different short-term health insurance providers. Here’s a table showcasing key features to help you make an informed decision:

| Provider | Premium | Coverage | Customer Service |

|---|---|---|---|

| Provider A | $200/month | Covers doctor visits, hospital stays, and prescription drugs | Excellent customer service, responsive claims processing |

| Provider B | $150/month | Limited coverage for doctor visits and basic medical services | Average customer service, some delays in claims processing |

| Provider C | $250/month | Comprehensive coverage, including dental and vision | Exceptional customer service, dedicated support team |

Decision-Making Flowchart

To visualize the decision-making process, here’s a flowchart illustrating the steps involved in choosing a suitable short-term health insurance plan:

StartDetermine Coverage Needs:What type of medical care do you anticipate needing? Set a Budget:What can you afford to spend on premiums? Consider Pre-existing Conditions:Do you have any pre-existing conditions? Choose Duration of Coverage:How long do you need coverage? Research Providers:Compare premiums, coverage, and customer service ratings.

Select a Plan:Choose the plan that best meets your needs and budget. Enroll:Complete the enrollment process and begin your coverage. End

Understanding the Cost of Short-Term Health Insurance

Short-term health insurance can be a cost-effective alternative to traditional health insurance, but understanding the factors that influence its cost is crucial.

Factors Influencing Cost

Several factors play a significant role in determining the cost of short-term health insurance.

- Age:Younger individuals typically pay lower premiums than older individuals, as they generally have lower healthcare costs.

- Health Status:Individuals with pre-existing conditions may face higher premiums, as they are considered higher risk.

- Coverage Options:The level of coverage you choose directly impacts the cost. Plans with higher coverage limits, including more comprehensive benefits, will generally be more expensive.

- Location:Premiums can vary depending on the state you reside in, as healthcare costs can differ geographically.

- Insurance Company:Different insurance companies have different pricing structures and may offer varying rates for similar plans.

Typical Costs Associated with Short-Term Health Insurance

Short-term health insurance plans typically include the following costs:

- Premiums:These are the monthly payments you make to maintain your coverage.

- Deductibles:This is the amount you pay out-of-pocket before your insurance coverage kicks in.

- Copayments:These are fixed amounts you pay for specific services, such as doctor visits or prescription drugs.

- Coinsurance:This is a percentage of the cost of covered services that you pay after meeting your deductible.

Estimating the Overall Cost

To estimate the overall cost of short-term health insurance, consider the following:

- Coverage Period:Determine the length of coverage you require, as premiums are calculated on a monthly basis.

- Expected Healthcare Costs:Consider your anticipated healthcare needs, such as doctor visits, prescriptions, or potential medical procedures.

- Deductible and Copayments:Factor in the deductible and copayment amounts for your chosen plan.

- Comparison Shopping:Obtain quotes from multiple insurance companies to compare premiums and coverage options.

Example:Let’s say you are a 30-year-old individual in good health and need short-term coverage for 3 months. You find a plan with a monthly premium of $200, a deductible of $1,000, and a copayment of $20 for doctor visits. Based on this information, your estimated total cost for the 3-month period would be $600 (premiums) + $1,000 (deductible) + (potential copayments).

The Future of Short-Term Health Insurance

The future of short-term health insurance is uncertain, influenced by a dynamic interplay of policy changes, technological advancements, and evolving consumer preferences. As the healthcare landscape continues to shift, understanding the potential trajectory of short-term health insurance is crucial for individuals and policymakers alike.

The Impact of Healthcare Policy Changes

Recent healthcare policy changes have significantly impacted the availability and affordability of short-term health insurance. For example, the Affordable Care Act (ACA) introduced regulations that limited the duration of short-term health insurance plans, aiming to prevent individuals from relying solely on these plans for long-term coverage.

These regulations have led to a decrease in the availability of longer-term short-term plans, making them less attractive for individuals seeking extended coverage.

- The Trump administration’s rollback of some ACA regulations, including the duration limit on short-term plans, has increased their availability and affordability in some states. However, these changes have also raised concerns about the potential for individuals to face higher healthcare costs in the long run, as short-term plans typically offer limited coverage and may not cover pre-existing conditions.

- The ongoing debate over healthcare reform continues to influence the future of short-term health insurance. Proposed changes to the ACA, such as the elimination of the individual mandate, could further impact the market for short-term plans. For instance, if fewer individuals are required to purchase health insurance, the pool of healthy individuals eligible for short-term plans could decrease, potentially leading to higher premiums.

The Role of Technology and Innovation

Technological advancements are playing a transformative role in the health insurance industry, including the short-term health insurance market. Digital platforms, mobile apps, and online marketplaces are streamlining the process of obtaining short-term health insurance, making it more convenient and accessible for consumers.

- The use of artificial intelligence (AI) and machine learning (ML) is enabling insurers to better assess risk, personalize coverage options, and automate administrative tasks. This can lead to more efficient and cost-effective short-term health insurance plans.

- The integration of wearable technology and telehealth services into short-term health insurance plans can create opportunities for personalized risk management and preventative care, potentially lowering healthcare costs for both individuals and insurers.

The Potential for Short-Term Health Insurance as a Viable Alternative

As healthcare costs continue to rise and traditional health insurance plans become increasingly expensive, short-term health insurance may emerge as a more viable alternative for certain individuals. This is particularly true for individuals who are healthy, young, and require coverage for a limited period.

- Short-term health insurance can provide affordable coverage for individuals who are between jobs, experiencing a gap in coverage, or seeking temporary protection while waiting for a more comprehensive plan to take effect.

- However, it’s crucial to remember that short-term health insurance plans typically offer limited coverage and may not cover pre-existing conditions. Therefore, it’s essential for individuals to carefully evaluate their needs and compare plans before making a decision.

End of Discussion

So, while short-term health insurance can be a valuable option for those seeking temporary coverage, it’s crucial to weigh its benefits against its limitations. Do your research, carefully consider your individual needs, and choose a plan that truly aligns with your current health and financial situation.

Remember, your health is your greatest asset, and it’s worth taking the time to make informed decisions about your insurance coverage.

Top FAQs: Short-term Health Insurance

What are the main differences between short-term health insurance and traditional health insurance?

Short-term health insurance plans are designed for temporary coverage and typically have shorter durations, limited benefits, and may not cover pre-existing conditions. Traditional health insurance, on the other hand, offers comprehensive coverage for a longer period and is generally more expensive.

Can I use short-term health insurance if I have a pre-existing condition?

Most short-term health insurance plans exclude coverage for pre-existing conditions. It’s important to check the specific plan details before purchasing.

Is short-term health insurance right for everyone?

Short-term health insurance is not a one-size-fits-all solution. It’s ideal for those needing temporary coverage for a limited period, but it may not be suitable for individuals with pre-existing conditions or those seeking long-term coverage.

Can I renew my short-term health insurance plan?

Renewal options vary depending on the insurer and the plan. Some plans allow for multiple renewals, while others may have limitations. Be sure to check the terms and conditions before purchasing.