How do I view my GEICO policy online? It’s a question many of us have asked ourselves, especially when we need to check coverage details, payment history, or make a change to our policy. Luckily, GEICO makes it easy to access your policy information online, whether you’re a tech-savvy user or just starting your digital journey.

This guide will walk you through the steps, from logging in to navigating the platform and managing your policy with just a few clicks.

From the comfort of your couch or on the go, GEICO offers a seamless experience. You can access your policy details on their website or through their mobile app, which means you’re always just a tap away from important information.

Let’s explore the ins and outs of managing your GEICO policy online and how to navigate any hurdles you might encounter along the way.

Managing Your Policy Online

Your GEICO policy is more than just a piece of paper; it’s your key to peace of mind on the road. And with GEICO’s online tools, managing your policy is easier than ever. From updating your contact information to making payments and even requesting changes to your coverage, you can handle everything from the comfort of your home or on the go.

Making Payments Online, How do I view my GEICO policy online

Making a payment on your GEICO policy is simple and convenient. You can choose from a variety of payment methods, including:

- Credit card:Visa, Mastercard, Discover, and American Express are all accepted.

- Debit card:You can use your debit card to make a payment as well.

- Electronic check:Pay directly from your checking account.

- GEICO EasyPay:Set up automatic payments to ensure you never miss a deadline.

To make a payment online, follow these steps:

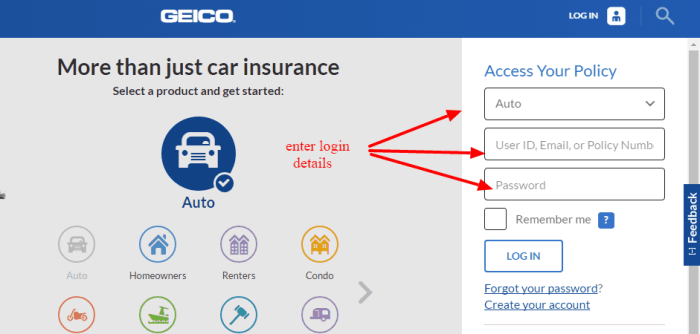

- Log in to your GEICO account:Go to the GEICO website and enter your username and password.

- Select “Make a Payment”:You’ll find this option in the main menu or under the “My Policy” section.

- Choose your payment method:Select the payment method you prefer from the list provided.

- Enter your payment details:Enter your credit card information, debit card information, or checking account details, depending on your chosen method.

- Review and submit:Double-check your information and submit your payment. You’ll receive a confirmation email once your payment is processed.

Requesting a Policy Change Online

GEICO understands that your needs may change over time. Whether you’re adding a new driver to your policy, changing your coverage, or simply updating your contact information, you can request these changes online.To request a policy change, follow these steps:

- Log in to your GEICO account:Visit the GEICO website and enter your username and password.

- Select “My Policy”:This section will allow you to manage your policy details.

- Choose the change you want to make:Depending on the specific change you need, you’ll find options for adding a driver, changing coverage, updating your contact information, and more.

- Provide the necessary information:GEICO will guide you through the process, requesting relevant information like driver details, coverage changes, or new contact information.

- Review and submit:Carefully review your changes and submit your request. GEICO will process your request and notify you of any updates or changes to your policy.

Security and Privacy Considerations

Your GEICO account contains sensitive personal and financial information, so it’s crucial to prioritize its security. Protecting your account helps prevent unauthorized access and safeguards your data.

GEICO’s Security Measures

GEICO implements various security measures to protect your data. These measures include:

- Encryption:GEICO uses encryption to protect your data while it’s transmitted over the internet. This means your information is scrambled and unreadable to anyone who intercepts it.

- Multi-factor authentication (MFA):MFA adds an extra layer of security by requiring you to provide more than just your password to access your account. This could involve a one-time code sent to your phone or email, or a biometric scan.

- Secure servers:GEICO stores your data on secure servers that are protected by firewalls and other security measures to prevent unauthorized access.

- Regular security audits:GEICO regularly conducts security audits to identify and address any vulnerabilities in its systems.

Best Practices for Account Security

You can also play a role in protecting your GEICO account by following these best practices:

- Use strong passwords:Choose passwords that are at least 12 characters long and include a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like your birthdate or pet’s name.

- Avoid public Wi-Fi for sensitive transactions:Public Wi-Fi networks are not secure, so avoid accessing your GEICO account or making sensitive transactions while connected to them.

- Enable MFA:If GEICO offers MFA, enable it for an extra layer of protection. This helps prevent unauthorized access even if someone steals your password.

- Regularly review account activity:Check your GEICO account activity regularly for any suspicious transactions or unauthorized access. If you see anything unusual, contact GEICO immediately.

- Be cautious of phishing scams:Phishing scams are attempts to trick you into giving away your personal information. Be wary of emails or websites that ask for your GEICO login information or other sensitive data. Never click on links in suspicious emails or visit websites that you don’t recognize.

Curious about the details of your GEICO policy? It’s easy! Just log in to your online account and you’ll find all the information you need. Maybe you’re even considering switching to GEICO – Why should I switch to Geico car insurance – and want to compare coverage options.

Once you’re logged in, you can also manage your policy, make payments, and even get a quote for a new vehicle. So, go ahead, take a peek at your policy and see what’s covered!

Last Recap

Managing your GEICO policy online empowers you to take control of your insurance needs, anytime and anywhere. With just a few clicks, you can review your coverage, track payments, make changes, and even report claims – all without picking up the phone.

So, the next time you need to access your GEICO policy, remember the ease and convenience that comes with managing it online. Stay informed, stay in control, and keep your peace of mind!

FAQ Insights: How Do I View My GEICO Policy Online

What if I forget my GEICO login information?

No worries! You can easily reset your password by clicking on the “Forgot Password” link on the GEICO login page. You’ll need to provide your email address or policy number to verify your identity, and then follow the instructions to create a new password.

Can I view my policy details on my phone?

Absolutely! Download the GEICO mobile app from the Apple App Store or Google Play Store. It allows you to access all the same features as the website, right on your phone.

How do I update my contact information?

Once you’re logged in, navigate to your account settings. You’ll find an option to update your contact information, including your address, phone number, and email address. Make sure to save your changes!

Is it safe to make payments online?

GEICO uses industry-standard encryption technology to protect your payment information during online transactions. You can be confident that your data is secure.