How do I report a car accident with GEICO? It’s a question that pops up in the most unexpected moments, usually when you’re dealing with the stress and confusion of an accident. Don’t worry, you’re not alone. GEICO has a straightforward process to help you navigate the aftermath and get back on the road.

From the initial steps you take at the scene to filing a claim and understanding your coverage, we’ll guide you through each stage of the process. We’ll also address common questions and concerns, so you can feel confident and prepared to handle this situation.

Initial Steps After an Accident

The aftermath of a car accident can be chaotic and stressful. However, it’s crucial to remain calm and take immediate action to ensure your safety and protect your rights. This section will guide you through the essential steps to take after an accident.

Ensuring Safety

After a car accident, your immediate priority should be to ensure the safety of yourself and anyone else involved. If your vehicle is disabled, move it to a safe location out of traffic, if possible. If you are unable to move your vehicle, turn on your hazard lights and set up warning flares or triangles behind your vehicle.

Once you are in a safe location, assess your injuries and the injuries of anyone else involved. If anyone is injured, call 911 immediately.

Calling Emergency Services

If you or anyone else involved in the accident is injured, or if there is significant damage to the vehicles, call 911 immediately. When you call 911, be prepared to provide the following information:

- Your location

- The nature of the accident

- The number of people involved

- The extent of any injuries

In addition to 911, you may also need to contact your local police department to report the accident. This is especially important if there are injuries or if the accident involves a hit-and-run.

Documenting the Scene

After ensuring the safety of everyone involved, it’s important to document the accident scene as thoroughly as possible. This documentation will be essential if you need to file a claim with your insurance company or if you are involved in a legal dispute.

Here are some tips for documenting the accident scene:

- Take photos and videos of the accident scene, including the damage to the vehicles, the location of the vehicles, and any skid marks or debris.

- Record the date, time, and location of the accident.

- Note the weather conditions, such as rain, snow, or fog.

- Sketch a diagram of the accident scene, including the positions of the vehicles, the direction of travel, and any other relevant details.

Exchanging Information

After documenting the accident scene, it’s important to exchange information with the other driver(s) involved. This information will be needed to file a claim with your insurance company. Be sure to exchange the following information:

- Names and addresses

- Driver’s license numbers

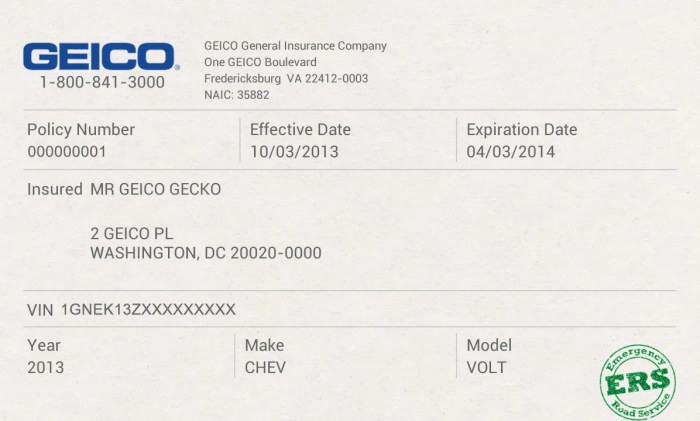

- Insurance company names and policy numbers

- Contact information, such as phone numbers and email addresses

- Vehicle identification numbers (VINs)

- License plate numbers

It’s also a good idea to get the names and contact information of any witnesses to the accident.

Taking Photos and Videos

Taking photos and videos of the accident scene is crucial for documenting the damage to the vehicles, the location of the vehicles, and any injuries. This evidence will be essential if you need to file a claim with your insurance company or if you are involved in a legal dispute.

Reporting a car accident with GEICO is a breeze! Just call their 24/7 claims hotline and provide the details. But first, make sure you have all the necessary information, like your policy number, which you can easily find by logging into your account and viewing your policy online How do I view my GEICO policy online.

Once you’ve reported the accident, GEICO will guide you through the next steps and help you get back on the road quickly!

- Take photos of the damage to all vehicles involved in the accident, including both exterior and interior damage.

- Take photos of the accident scene, including the location of the vehicles, any skid marks, debris, and any other relevant details.

- If anyone is injured, take photos of their injuries, but only with their consent.

- Take photos of any traffic signs or signals that may be relevant to the accident.

- Use your phone or camera to record a short video of the accident scene and the damage to the vehicles.

Filing a Claim with GEICO

After you’ve taken care of the immediate aftermath of the accident, it’s time to get the ball rolling with GEICO. Don’t worry, it’s not as daunting as it might sound. We’ll walk you through the steps to make sure you’re covered.

Filing a Claim

To begin the claims process, you’ll need to contact GEICO. You can do this by calling their customer service line, using their mobile app, or visiting their website. You’ll be asked to provide some basic information about the accident, including the date, time, location, and the parties involved.

Once you’ve reported the accident, GEICO will assign you a claims adjuster. The adjuster will be your point of contact for the entire claims process. They’ll be responsible for investigating the accident, gathering information, and determining the amount of your claim.

Gathering Necessary Documentation

To make the claims process as smooth as possible, it’s essential to gather all the necessary documentation. This will include:

- Police Report:If the police were called to the scene of the accident, you’ll need to obtain a copy of the police report. This report will provide a detailed account of the accident, including the names of the drivers involved, the vehicles involved, and the location of the accident.

It’s also a good idea to keep a copy of the police report for your own records.

- Photos and Videos:Take pictures or videos of the damage to your vehicle, as well as the surrounding area, to document the scene. These photos can be helpful in supporting your claim.

- Medical Records:If you were injured in the accident, you’ll need to provide your medical records to GEICO.

This will include any doctor’s notes, medical bills, and prescriptions.

- Repair Estimates:You’ll need to get repair estimates from a reputable auto repair shop. This will provide GEICO with an idea of how much it will cost to repair your vehicle.

Types of Claims

There are two main types of claims that can be filed with GEICO after an accident:

- Property Damage Claims:These claims cover the cost of repairs or replacement of your vehicle if it was damaged in the accident. This also includes any other property that was damaged, such as your personal belongings.

- Bodily Injury Claims:These claims cover medical expenses, lost wages, and pain and suffering if you were injured in the accident.

Understanding Your Coverage

Knowing what your GEICO insurance policy covers is crucial in the event of a car accident. This understanding helps you navigate the claims process smoothly and ensures you receive the necessary financial support for repairs, medical expenses, and other related costs.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident. It covers the other driver’s damages, including medical expenses, property damage, and lost wages.

Liability coverage is mandatory in most states.

- Bodily Injury Liability: This covers the medical expenses, lost wages, and other related costs of the other driver and passengers injured in an accident caused by you.

- Property Damage Liability: This covers the cost of repairing or replacing the other driver’s vehicle or any other property damaged in an accident caused by you.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

Collision coverage is optional, but it is often recommended if you have a loan or lease on your vehicle.

- Example: If you are involved in an accident with another vehicle and your car is damaged, collision coverage will help pay for the repairs, even if you were at fault.

Comprehensive Coverage

Comprehensive coverage protects you against damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

Comprehensive coverage is optional, but it is often recommended if you have a loan or lease on your vehicle.

- Example: If your car is damaged by a hailstorm, comprehensive coverage will help pay for the repairs.

Post-Accident Procedures: How Do I Report A Car Accident With GEICO

After the initial shock of the accident subsides, you’ll need to focus on getting your vehicle repaired and dealing with any other consequences of the accident. GEICO can help guide you through these steps, ensuring a smooth and efficient process.

Vehicle Repair, How do I report a car accident with GEICO

GEICO provides you with the option to choose a repair shop from their network of preferred shops. These shops are carefully vetted to ensure they meet GEICO’s standards for quality and efficiency. They often have experience working with insurance claims and can expedite the repair process.

You can also choose to have your vehicle repaired at a shop of your choice. However, be aware that GEICO may have different procedures for non-preferred shops, potentially requiring you to obtain estimates and negotiate payment directly.

Working with Preferred Shops

- Convenient and Streamlined Process:GEICO’s preferred shops often have direct communication with the insurance company, simplifying the process of getting your vehicle repaired.

- Quality Assurance:GEICO’s preferred shops are vetted for quality and efficiency, ensuring your vehicle is repaired to the highest standards.

- Potential Discounts:Some preferred shops may offer discounts to GEICO policyholders, further reducing your out-of-pocket expenses.

Dealing with Non-Preferred Shops

- Obtain Multiple Estimates:If you choose a non-preferred shop, it’s crucial to obtain multiple estimates from different repair shops to ensure you’re getting a fair price.

- Negotiate Payment:You may need to negotiate payment directly with the repair shop and provide GEICO with the necessary documentation for reimbursement.

- Review the Shop’s Reputation:Before choosing a non-preferred shop, research their reputation and customer reviews to ensure they are reliable and trustworthy.

Dealing with Insurance Adjusters

The insurance adjuster is responsible for evaluating the damage to your vehicle and determining the amount of coverage you’re eligible for. They will also handle the negotiation process with the other party’s insurance company, if applicable.

Communication and Cooperation

- Be Prompt and Responsive:Respond to the adjuster’s requests for information and documentation promptly. This helps expedite the claims process.

- Be Honest and Accurate:Provide accurate details about the accident and your vehicle’s condition. Any inconsistencies can delay the claims process.

- Document Everything:Keep a record of all communication with the adjuster, including dates, times, and content of conversations.

Negotiating Settlements

- Understand Your Coverage:Before negotiating, thoroughly understand your policy’s coverage limits and deductibles. This will help you determine a fair settlement amount.

- Gather Supporting Documentation:Collect all relevant documentation, such as repair estimates, medical bills, and police reports, to support your claim.

- Be Prepared to Negotiate:The adjuster may offer an initial settlement that’s less than you believe is fair. Be prepared to negotiate and justify your position with supporting evidence.

Handling Medical Bills

If you’ve sustained injuries in the accident, you’ll need to address your medical bills.

Personal Injury Protection (PIP)

- Coverage for Medical Expenses:PIP coverage, also known as no-fault coverage, provides benefits for medical expenses regardless of who was at fault for the accident.

- Limited Coverage:PIP coverage typically has a limit on the amount of medical expenses it will cover. You may need to pay for any expenses exceeding the limit.

- Seek Medical Attention:It’s important to seek medical attention promptly after an accident, even if you feel fine. Some injuries may not be apparent immediately.

Potential Legal Issues

In some cases, a car accident may lead to legal issues, such as lawsuits or claims for damages.

Legal Representation

- Consult with an Attorney:If you believe your rights have been violated or you’re facing legal issues, consult with a personal injury attorney to understand your options.

- Understand Your Rights:An attorney can help you navigate the legal process, understand your rights, and protect your interests.

- Negotiate with the Other Party:Your attorney can negotiate with the other party’s insurance company or represent you in court, if necessary.

End of Discussion

Reporting a car accident with GEICO might seem daunting, but with a clear understanding of the process and the right steps, it becomes manageable. Remember, GEICO is there to support you through every stage. So, stay calm, gather the necessary information, and let GEICO help you get back on track.

FAQ Insights

What should I do if the other driver doesn’t have insurance?

If the other driver is uninsured or underinsured, your own GEICO coverage can help. You’ll need to contact GEICO to file a claim and they’ll guide you through the process.

What if I’m injured in the accident?

If you’re injured, seek medical attention immediately. GEICO’s medical payments coverage can help cover your medical expenses, even if the accident wasn’t your fault.

How long do I have to report the accident to GEICO?

It’s best to report the accident to GEICO as soon as possible, but they generally have a grace period for reporting. However, it’s always best to err on the side of caution and contact them right away.