How do I access my GEICO policy? It’s a question many of us have pondered, especially when we need to check coverage details, update our information, or make a claim. Fortunately, GEICO offers several convenient ways to access your policy, from the comfort of your home or on the go.

Whether you prefer the sleek interface of their website or the ease of their mobile app, accessing your GEICO policy is a breeze.

This guide will explore the different methods available, walk you through the steps, and even provide some helpful tips for navigating the process smoothly. So, buckle up, and let’s get started!

Accessing Your GEICO Policy Online: How Do I Access My GEICO Policy

Accessing your GEICO policy online is a convenient way to review your coverage details, make changes, or manage your account. This digital platform allows you to access your policy information anytime, anywhere, eliminating the need for physical documents.

Navigating the GEICO Website to Access Your Policy

To access your policy information, you’ll need to log in to your GEICO account. Here’s how:

- Visit the GEICO website, [Website URL].

- Click on the “My Account” or “Log In” button, typically located in the top right corner of the page.

- Enter your registered email address and password.

- Click “Log In” to access your account.

Once logged in, you can access your policy information by following these steps:

- Navigate to the “Policies” or “My Policies” section of your account.

- Select the policy you want to view.

- Review the policy details, including coverage information, premiums, and payment history.

You can also access specific policy documents, such as your declarations page or insurance card, directly from your account.

“GEICO’s online portal provides a user-friendly interface for accessing your policy information. You can quickly and easily view your coverage details, make changes, and manage your account.”

Accessing Your GEICO Policy Through the Mobile App

The GEICO mobile app offers a convenient and user-friendly way to access your insurance policy details anytime, anywhere. With a few taps on your phone, you can quickly view your policy information, manage your account, and even make payments.

Navigating the GEICO Mobile App

The GEICO mobile app is designed to be intuitive and easy to use. Once you’ve downloaded and logged in, you’ll be greeted with a dashboard that provides quick access to your most important policy information. The app’s features include:

- Viewing your policy details: Access your policy number, coverage details, deductibles, and other essential information.

- Managing your account: Make payments, update your contact information, and view your payment history.

- Filing a claim: Report a claim directly through the app, submit photos, and track the status of your claim.

- Roadside assistance: Request roadside assistance, including towing, jump-starts, and tire changes.

- Policy changes: Modify your coverage, add or remove vehicles, and make other policy adjustments.

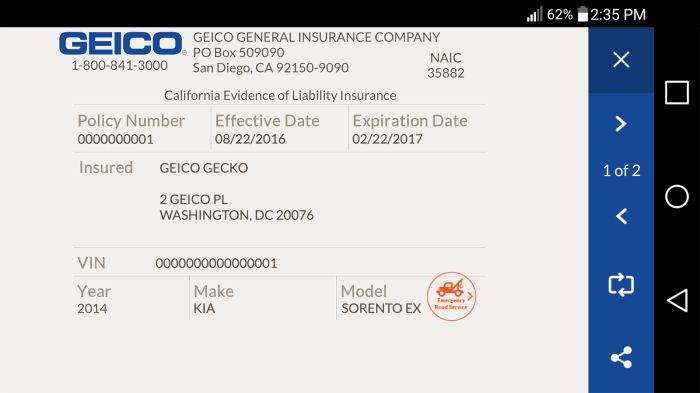

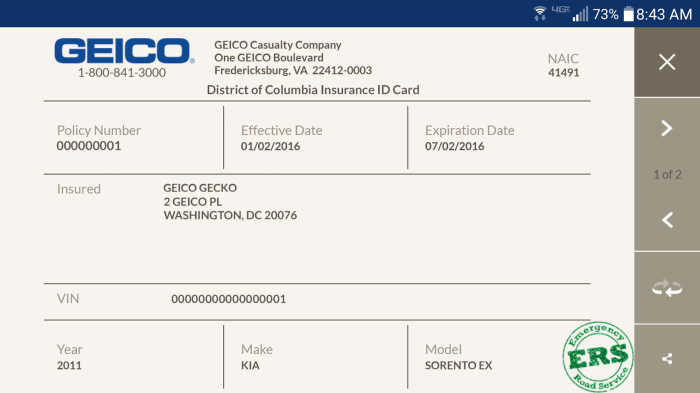

- Accessing your ID cards: View and download digital copies of your insurance ID cards.

- Finding a GEICO agent: Locate nearby GEICO agents for in-person assistance.

Steps to Access Your Policy Details

To access your policy details through the GEICO mobile app, follow these simple steps:

- Download the GEICO mobile app from the Apple App Store or Google Play Store.

- Open the app and log in using your GEICO account credentials.

- Navigate to the “My Policies” or “Policy Details” section.

- Select the policy you wish to view.

- Review your policy information, including coverage details, deductibles, and payment history.

Advantages of Using the Mobile App

Using the GEICO mobile app offers several advantages over accessing your policy information through the website:

- Convenience: Access your policy details anytime, anywhere, without needing a computer.

- Speed: Quick and easy access to your policy information with just a few taps.

- Notifications: Receive important notifications and updates regarding your policy, such as payment reminders or claim updates.

- Mobile-friendly design: The app is optimized for mobile devices, providing a seamless and user-friendly experience.

Contacting GEICO Customer Service

If you need to access your GEICO policy information but can’t find it online or through the mobile app, contacting GEICO customer service is your next best option. They can help you retrieve your policy details, make changes to your coverage, or answer any questions you may have.

Ways to Contact GEICO Customer Service

You can reach out to GEICO customer service in a few different ways:

- Phone:This is the most common and often fastest way to connect with a GEICO representative. You can find their phone number on their website or on your policy documents. GEICO’s customer service phone number is available 24/7, so you can reach them whenever you need assistance.

- Email:If your inquiry is not urgent, you can send an email to GEICO customer service. They have a dedicated email address for customer inquiries.

- Chat:GEICO also offers a live chat option on their website. This is a good choice if you have a quick question and don’t want to wait on hold.

Information Needed to Access Your Policy

To access your policy information, you’ll need to provide GEICO with some basic information:

- Your name:The name on your policy.

- Your policy number:This is a unique identifier for your policy. You can find it on your policy documents or your GEICO account online.

- Your date of birth:This helps GEICO verify your identity.

- Your phone number:This is used for communication purposes.

- Your email address:This is used for communication purposes.

Wait Times and Response Times

Wait times and response times for GEICO customer service can vary depending on the time of day and the volume of calls. Generally, you can expect to wait on hold for a few minutes if you call during peak hours.

Response times for emails and chat can also vary, but you can typically expect a response within 24 hours.

Pro Tip:If you’re calling during peak hours, consider calling later in the day or early in the morning to avoid longer wait times.

Want to peek at your GEICO policy? You can access it online, through the mobile app, or by calling their customer service line. But if you prefer a face-to-face chat, you might wonder, Where do GEICO Insurance Agents reside ?

Luckily, GEICO has a vast network of agents, so you can likely find one in your neighborhood to discuss your policy in person.

Understanding Your GEICO Policy

Your GEICO policy is a comprehensive document that Artikels the terms and conditions of your insurance coverage. It’s important to understand the key sections of your policy to ensure you have the protection you need.

Key Sections of a GEICO Policy

The sections of your GEICO policy are organized to provide a clear and concise overview of your coverage. Here are some of the key sections and their importance:

- Declarations Page:This page summarizes your policy information, including your name, address, policy number, coverage dates, and premium amount.

- Insuring Agreement:This section Artikels the specific risks covered by your policy and the insurer’s commitment to provide financial protection in the event of a covered loss.

- Exclusions:This section lists events or situations that are not covered by your policy. It’s crucial to review this section carefully to understand any limitations on your coverage.

- Conditions:This section Artikels the responsibilities of both the insured and the insurer. It may include details about reporting claims, cooperating with investigations, and providing proof of loss.

- Definitions:This section provides definitions of key terms used throughout the policy, ensuring clear understanding of the language used.

Types of Coverage in a GEICO Policy

GEICO offers a variety of coverage options to meet the diverse needs of its policyholders. The following table summarizes the common types of coverage included in a GEICO policy:

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you financially if you are legally responsible for causing injury or damage to another person or their property. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault. |

| Medical Payments Coverage | Provides coverage for medical expenses incurred by you or your passengers, regardless of fault, up to a specified limit. |

Common Policy Terms and Definitions

Understanding common policy terms is essential for interpreting your coverage and making informed decisions. Here are some examples:

Deductible:The amount you pay out of pocket before your insurance coverage kicks in.

Premium:The amount you pay for your insurance coverage.

Limit:The maximum amount your insurance company will pay for a covered loss.

Claim:A formal request for payment from your insurance company for a covered loss.

Policy Period:The duration of your insurance coverage, typically one year.

Making Changes to Your GEICO Policy

Making changes to your GEICO policy is a straightforward process that can be done online, through the mobile app, or by contacting customer service. Whether you need to update your personal information, add or remove coverage, or adjust your payment details, GEICO provides various convenient options to ensure your policy remains accurate and reflects your current needs.

Updating Your Personal Information

To ensure your policy accurately reflects your current details, it’s crucial to update your personal information whenever necessary. This includes changes to your address, phone number, email address, or any other relevant details. Here’s how you can update your personal information:

- GEICO Website:Log in to your GEICO account and navigate to the “My Policy” section. You’ll find an option to update your personal information. Follow the prompts to enter the new details and submit the changes.

- GEICO Mobile App:Open the GEICO mobile app and log in to your account. Similar to the website, you’ll find an option to update your personal information. Enter the new details and submit the changes.

- GEICO Customer Service:Call GEICO customer service at 1-800-434-2600 and inform them of the changes you need to make. They’ll guide you through the process and ensure your information is updated correctly.

Adding or Removing Coverage

Your insurance needs may evolve over time. You might need to add coverage for a new vehicle, adjust your liability limits, or remove coverage for a vehicle you’ve sold. GEICO allows you to easily add or remove coverage from your policy.

Here’s how you can make these changes:

- GEICO Website:Log in to your GEICO account and navigate to the “My Policy” section. You’ll find options to add or remove coverage. Select the appropriate option and follow the prompts to make the desired changes.

- GEICO Mobile App:Open the GEICO mobile app and log in to your account. Similar to the website, you’ll find options to add or remove coverage. Select the appropriate option and follow the prompts to make the desired changes.

- GEICO Customer Service:Call GEICO customer service at 1-800-434-2600 and inform them of the coverage changes you need to make. They’ll guide you through the process and ensure your policy is updated accordingly.

Making Changes to Your Payment Information, How do I access my GEICO policy

Keeping your payment information up-to-date is crucial for ensuring your premium payments are processed smoothly. You can easily update your payment method, billing address, or other payment-related information.Here’s how you can make these changes:

- GEICO Website:Log in to your GEICO account and navigate to the “My Payment” section. You’ll find options to update your payment information, including adding a new payment method or modifying your existing one.

- GEICO Mobile App:Open the GEICO mobile app and log in to your account. Similar to the website, you’ll find options to update your payment information. Select the appropriate option and follow the prompts to make the desired changes.

- GEICO Customer Service:Call GEICO customer service at 1-800-434-2600 and inform them of the payment information changes you need to make. They’ll guide you through the process and ensure your payment information is updated correctly.

Final Thoughts

In the end, accessing your GEICO policy is a straightforward process, with multiple options to suit your preference. Whether you’re a tech-savvy individual who prefers online access or someone who enjoys the personal touch of customer service, GEICO has you covered.

So, the next time you need to access your policy, remember the options available and choose the method that best suits your needs. Now, go forth and confidently navigate the world of GEICO policy access!

FAQs

How do I change my address on my GEICO policy?

You can update your address through your online account, mobile app, or by contacting customer service.

What if I forgot my GEICO login credentials?

No worries! You can reset your password by clicking on the “Forgot Password” link on the GEICO website or within the app.

Can I access my policy details from multiple devices?

Absolutely! You can access your policy from any device that has internet access, whether it’s your computer, tablet, or smartphone.

Is there a fee for accessing my GEICO policy online?

Accessing your policy online is free of charge. GEICO does not charge for using their website or mobile app.