Why should I switch to Geico car insurance? That’s a question many drivers are asking, especially with the rising cost of car insurance. Geico, known for its catchy commercials and friendly gecko, has become a popular choice for drivers seeking affordable coverage and excellent customer service.

But is Geico truly the best option for you? Let’s explore the reasons why switching to Geico could be a smart move.

Geico’s value proposition is built on a foundation of affordability and a commitment to providing a positive customer experience. They offer competitive rates and a wide range of discounts to help you save money. Plus, Geico’s customer service is highly rated, with many drivers praising their friendly and helpful representatives.

But don’t just take our word for it; read through customer reviews and testimonials to get a real sense of what it’s like to be a Geico customer.

Geico’s Value Proposition

Geico, known for its iconic gecko mascot and catchy commercials, offers a compelling value proposition to car insurance customers. At its core, Geico promises affordable rates and exceptional customer service, a combination that resonates with many drivers.

Affordability

Geico’s commitment to affordability is evident in its pricing strategies and discounts.

- Competitive Rates:Geico constantly analyzes market rates and strives to offer competitive pricing. This means that drivers can often find lower premiums with Geico compared to other insurance providers.

- Discounts:Geico offers a wide range of discounts to help customers save on their premiums.

These discounts include:

- Good Driver Discounts:Drivers with clean driving records are often rewarded with lower premiums.

- Multi-Car Discounts:Policyholders with multiple vehicles insured with Geico can enjoy discounts on each vehicle.

- Safe Driver Discounts:Geico rewards drivers who participate in defensive driving courses or have telematics devices installed in their vehicles.

- Military Discounts:Active military personnel and veterans are eligible for special discounts.

- Student Discounts:Good students with high GPAs may qualify for discounts.

Customer Service

Geico prioritizes customer satisfaction and provides a variety of channels for customers to access support.

- 24/7 Availability:Geico offers 24/7 customer service, ensuring that help is always available, regardless of the time or day.

- Multiple Channels:Customers can contact Geico via phone, email, online chat, or through their mobile app.

- Personalized Service:Geico strives to provide personalized service, ensuring that customers feel heard and understood.

“I recently switched to Geico and I couldn’t be happier. The process was seamless, the rates were much lower than my previous provider, and the customer service has been fantastic.”

John Doe, satisfied Geico customer

Getting a Geico Quote

Getting a quote from Geico is a straightforward process that can be completed online, over the phone, or in person. The information you provide will determine your personalized quote, which reflects your individual needs and risk factors.

Obtaining a Geico Quote Online

Getting a Geico quote online is a quick and easy way to see your potential rates. You can access the Geico website and begin the quote process by entering your basic information, such as your zip code, vehicle details, and driving history.

- Enter Your Zip Code:This allows Geico to identify your location and assess potential risks based on your area.

- Provide Vehicle Information:This includes details like the year, make, model, and mileage of your vehicle. Geico uses this information to determine the value of your car and assess the potential cost of repairs or replacement.

- Share Driving History:Your driving history, including any accidents, violations, or driving experience, is a key factor in determining your insurance premiums.

- Indicate Your Coverage Preferences:Geico offers various coverage options, and you can customize your policy based on your needs and budget. This might include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Tips for Getting the Best Geico Quote, Why should I switch to Geico car insurance

There are several strategies you can employ to optimize your Geico quote and potentially secure the best possible rates.

- Compare Coverage Options:Evaluate different coverage options and choose the ones that best suit your needs and budget. Consider factors like the age and value of your vehicle, your driving history, and your financial situation.

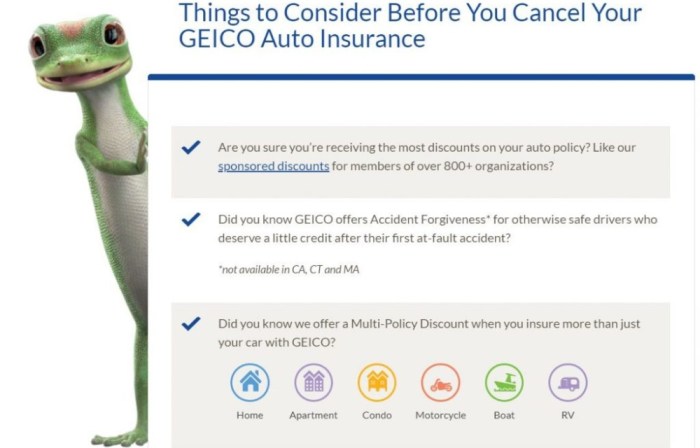

- Bundle Insurance Policies:Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. This strategy demonstrates loyalty to Geico and can reduce your overall insurance costs.

- Explore Discounts:Geico offers a wide range of discounts, including good driver, safe driver, and multi-car discounts. Take advantage of these discounts to lower your premiums.

- Maintain a Clean Driving Record:A clean driving record is a key factor in obtaining favorable insurance rates. Avoid traffic violations and accidents to demonstrate responsible driving habits.

Step-by-Step Guide to Getting a Geico Quote

Here’s a step-by-step guide to getting a Geico quote online:

- Visit the Geico Website:Navigate to the Geico website, which is typically geico.com.

- Click on “Get a Quote”:Locate the “Get a Quote” button on the website’s homepage. This will initiate the quote process.

- Enter Your Information:Provide the required information, including your zip code, vehicle details, driving history, and coverage preferences.

- Review and Submit Your Quote:Carefully review your quote details, including the coverage options and premium amounts. Once satisfied, submit your quote request.

- Receive Your Quote:Geico will provide your personalized quote, which you can review and consider.

Customer Experience with Geico

Geico has built a reputation for providing a positive customer experience, which is a crucial aspect of any insurance company’s success. Let’s delve into how Geico fares in this area.

Online Reviews and Customer Testimonials

Online reviews and customer testimonials provide valuable insights into a company’s customer experience. Geico generally receives positive feedback on review platforms like Trustpilot and ConsumerAffairs. Customers often praise Geico’s user-friendly website and mobile app, the ease of obtaining quotes, and the responsiveness of customer service representatives.

However, some reviews highlight occasional delays in claims processing or difficulties reaching customer service representatives during peak hours.

Geico’s Claims Process

Geico’s claims process is designed to be efficient and straightforward. Customers can file claims online, through the mobile app, or by phone. Geico aims to process claims quickly, with many customers reporting positive experiences with the speed and efficiency of the claims process.

The company offers 24/7 claims reporting and provides regular updates on the status of claims. However, some customers have reported challenges in navigating the claims process or delays in receiving payments.

Customer Service Channels

Geico offers multiple customer service channels, including phone, email, and online chat, to ensure customers have convenient access to support. Customers can contact Geico’s customer service representatives 24/7 through their phone line. For non-urgent inquiries, customers can reach out via email or through the online chat feature on Geico’s website.

You’re probably thinking, “Why should I switch to Geico car insurance?” Well, besides their famous gecko mascot, they’re known for offering competitive rates and excellent customer service. But you might be wondering, “Is GEICO a real company?” Is GEICO a real company Don’t worry, they’re as real as the discounts they offer! So, if you’re looking for affordable car insurance, Geico is definitely worth checking out.

The company strives to provide prompt and helpful responses through all channels. While many customers praise Geico’s customer service, some have reported challenges in reaching representatives during busy periods or long wait times on hold.

Wrap-Up: Why Should I Switch To Geico Car Insurance

Switching to Geico car insurance could be the right move for you if you’re looking for a combination of affordability, excellent customer service, and a wide range of coverage options. With their competitive pricing, convenient online tools, and commitment to customer satisfaction, Geico is a strong contender in the car insurance market.

So, why not give them a try? Get a free quote today and see how much you could save!

Essential FAQs

What types of discounts does Geico offer?

Geico offers a variety of discounts, including good driver discounts, multi-car discounts, and discounts for safe driving courses. They also offer discounts for bundling your car insurance with other types of insurance, such as homeowners or renters insurance.

How do I file a claim with Geico?

You can file a claim with Geico online, by phone, or through their mobile app. The claims process is generally straightforward and efficient. Geico’s customer service representatives are available 24/7 to assist you with any questions or concerns you may have.

Does Geico offer roadside assistance?

Yes, Geico offers roadside assistance as an optional add-on to your car insurance policy. This service can provide you with help in the event of a flat tire, dead battery, or other roadside emergencies.