What makes GEICO a great insurance company sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. GEICO, a name synonymous with affordability and reliability in the insurance industry, has become a household name for a reason.

From its humble beginnings as a government-backed insurance program to its current position as a leading provider, GEICO’s journey is marked by innovation, customer focus, and a commitment to providing exceptional value. This exploration will delve into the key factors that contribute to GEICO’s success, examining its history, pricing strategies, coverage options, customer service, technological advancements, and financial stability.

GEICO’s success can be attributed to a combination of factors, including its competitive pricing, extensive coverage options, and commitment to customer satisfaction. The company’s history, marked by innovation and a customer-centric approach, has laid the foundation for its enduring reputation.

GEICO’s commitment to technology and innovation has further enhanced its offerings, providing customers with convenient online platforms and mobile apps for managing their policies. The company’s financial stability, reflected in its strong ratings and consistent performance, provides customers with peace of mind knowing their insurance needs are in capable hands.

GEICO’s History and Reputation

GEICO, a household name in the insurance industry, boasts a rich history and a stellar reputation for providing quality and affordable coverage. Its journey from a humble government-backed company to a leading insurance provider is a testament to its adaptability, innovation, and commitment to customer satisfaction.

GEICO’s Origins and Evolution

GEICO’s story begins in 1936 when the US government established the Government Employees Insurance Company (GEICO) to offer auto insurance to federal employees. The company’s initial success was attributed to its low premiums, made possible by its direct-to-consumer model, eliminating the need for expensive agents.

In 1948, GEICO became a publicly traded company, further expanding its reach and customer base.

- Early Success:GEICO’s direct-to-consumer model proved highly effective, attracting a large customer base with lower premiums and efficient service.

- Expansion and Diversification:Over the years, GEICO expanded its offerings beyond auto insurance, including motorcycle, homeowners, renters, and life insurance.

- Technological Advancements:GEICO embraced technological advancements, adopting online platforms and mobile apps to enhance customer experience and streamline operations.

- Acquisition by Berkshire Hathaway:In 1996, GEICO was acquired by Berkshire Hathaway, a move that provided significant financial stability and resources for further growth.

GEICO’s Brand Image and Reputation

GEICO has cultivated a strong brand image built on its commitment to affordability, convenience, and customer service. Its catchy advertising campaigns featuring iconic characters like the gecko and the cavemen have become synonymous with GEICO, making it a recognizable and trusted brand.

Customer Testimonials and Awards

GEICO’s commitment to customer satisfaction is reflected in its consistently high customer ratings and numerous awards. The company consistently ranks high in customer satisfaction surveys, such as J.D. Power’s U.S. Auto Insurance Satisfaction Study. GEICO has also been recognized for its innovative products and services, receiving awards for its mobile app and its customer service excellence.

Technology and Innovation

GEICO’s commitment to technological advancement is a key driver of its success. The company understands that embracing innovation is essential for delivering exceptional customer experiences and streamlining operations. GEICO has consistently invested in cutting-edge technologies, transforming the way insurance is bought, managed, and experienced.

Online Platforms and Mobile Apps

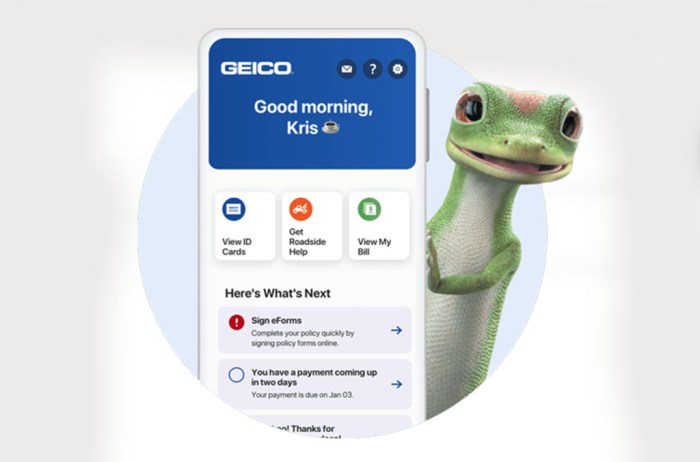

GEICO’s online platforms and mobile apps provide customers with a seamless and convenient way to interact with the company. These platforms are designed to simplify insurance-related tasks, offering a wide range of features and functionalities.

- Online Quotes and Policy Management:Customers can easily obtain personalized insurance quotes, manage their existing policies, and make payments online. This eliminates the need for phone calls or physical visits, providing a hassle-free experience.

- Mobile App Features:The GEICO mobile app extends these functionalities to smartphones and tablets. Customers can access their policy information, file claims, contact customer support, and even track the status of their claims, all from their mobile devices. This convenience enhances customer satisfaction and fosters loyalty.

- Personalized Recommendations:GEICO’s online platforms utilize data analytics to provide customers with personalized recommendations for insurance coverage, discounts, and other relevant services. This tailored approach ensures that customers receive the most appropriate insurance solutions for their individual needs.

Enhanced Customer Experience and Efficiency, What makes GEICO a great insurance company

GEICO leverages technology to improve customer experience and efficiency in various ways. The company’s online platforms and mobile apps are designed to be user-friendly and intuitive, simplifying the insurance process for customers.

- Automated Processes:GEICO has implemented automated processes for tasks such as policy issuance, claim processing, and customer support inquiries. This automation streamlines operations, reduces processing times, and minimizes human error.

- Real-time Information:Customers have access to real-time information about their policies, claims, and account details through online platforms and mobile apps. This transparency and accessibility foster trust and build confidence in the company.

- Improved Communication:GEICO utilizes various communication channels, including email, text messages, and push notifications, to keep customers informed about important updates, policy changes, and claim status. This proactive communication ensures that customers are always in the loop.

Innovative Initiatives

GEICO is constantly exploring and implementing innovative initiatives to enhance its products and services.

GEICO is known for its competitive rates and excellent customer service. They’re also a leader in the insurance industry, offering a wide range of coverage options. But what happens when you need to reach out about a specific policy, like a flood policy?

Don’t worry, you can easily connect with GEICO by visiting How do I contact GEICO If I have a flood policy for detailed instructions. This commitment to accessibility and clear communication is just another reason why GEICO continues to be a top choice for insurance.

- Telematics Programs:GEICO offers telematics programs that use devices to track driving behavior and provide feedback to customers. This data helps identify potential risks and promotes safe driving practices, leading to potential discounts for safe drivers.

- Artificial Intelligence (AI):GEICO is leveraging AI to automate tasks, personalize customer experiences, and improve fraud detection. For example, AI-powered chatbots can provide instant customer support, answering common inquiries and resolving issues quickly.

- Digital Marketing:GEICO has adopted sophisticated digital marketing strategies to reach a wider audience and engage with potential customers. This includes targeted advertising campaigns, social media marketing, and content marketing initiatives.

Ultimate Conclusion: What Makes GEICO A Great Insurance Company

So, what makes GEICO a great insurance company? It’s a blend of affordability, comprehensive coverage, cutting-edge technology, and a dedication to customer satisfaction. GEICO has carved a niche for itself in the insurance market by consistently delivering value and exceeding expectations.

Whether you’re a seasoned driver or a new car owner, GEICO’s offerings are designed to meet your individual needs and provide you with the protection and peace of mind you deserve.

Frequently Asked Questions

What is GEICO’s history?

GEICO was founded in 1936 as a government-backed insurance program for federal employees. Over the years, it expanded its offerings and transitioned into a private company, becoming a major player in the insurance industry.

How does GEICO compare to other insurance companies in terms of pricing?

GEICO is known for its competitive pricing, often offering lower rates compared to other insurance companies. This is achieved through a combination of factors, including efficient operations, a focus on low-risk customers, and effective marketing strategies.

What types of insurance does GEICO offer?

GEICO offers a wide range of insurance products, including auto insurance, motorcycle insurance, homeowners insurance, renters insurance, and more. They also offer various discounts and bundles to help customers save money.

How is GEICO’s customer service?

GEICO is known for its responsive and helpful customer service. Customers can contact GEICO through various channels, including phone, email, and online chat, and they typically receive prompt assistance with their inquiries.

What is GEICO’s financial strength?

GEICO is a financially strong company with consistently high ratings from independent financial institutions. This indicates their ability to meet their financial obligations and provide reliable insurance coverage to their customers.