Vision insurance plans are like a superpower for your eyes, offering protection and savings on eye care. They help you see clearly, but also help you see clearly how much you can save on eye exams, glasses, and contact lenses.

Think of it as an investment in your vision, allowing you to enjoy a world of vibrant colors and sharp details without breaking the bank.

Vision insurance plans cover a range of eye care services, from routine checkups to more specialized treatments. They can help you manage eye conditions and prevent vision loss, ensuring that you can continue to enjoy your favorite activities for years to come.

Understanding Vision Insurance Plans

Vision insurance is a type of health insurance that helps cover the cost of eye care, including eye exams, eyeglasses, and contact lenses. It can be a valuable benefit, especially if you have a history of eye problems or are at risk for developing them.

Key Benefits of Vision Insurance

Having vision insurance offers several key advantages. Here are some of the most notable benefits:

- Cost Savings:Vision insurance significantly reduces the out-of-pocket expenses associated with eye care. You can save money on eye exams, eyeglasses, and contact lenses.

- Access to Comprehensive Eye Care:Vision insurance typically covers regular eye exams, which are crucial for detecting and managing eye conditions. Early detection and treatment can prevent vision loss and other complications.

- Wider Range of Coverage:Vision insurance plans often cover a wide range of eye care services, including:

- Eye exams

- Eyeglasses and contact lenses

- Laser eye surgery (in some plans)

- Other vision-related services

- Peace of Mind:Having vision insurance provides peace of mind knowing that you have financial protection for your eye care needs. You can access quality eye care without worrying about the high costs.

Types of Vision Insurance Plans

There are several different types of vision insurance plans available, each with its own coverage and benefits. Here are some common types:

- Individual Plans:These plans are purchased by individuals and cover only the policyholder. They are often more affordable than group plans but may have limited coverage.

- Group Plans:These plans are typically offered through employers or other organizations. They cover a group of people and often have more comprehensive coverage than individual plans.

- Stand-Alone Plans:These plans are purchased separately from other health insurance policies. They focus solely on eye care and are a good option for individuals who don’t have health insurance or whose health insurance doesn’t cover vision care.

- Vision Riders:These are add-ons to existing health insurance policies that provide coverage for vision care. They offer a more limited scope of coverage than stand-alone plans but can be a cost-effective option for individuals who already have health insurance.

Typical Coverage Offered by Vision Insurance Plans

Vision insurance plans typically cover a range of eye care services. The specific coverage varies depending on the plan and provider. Here are some common coverage elements:

- Eye Exams:Most vision insurance plans cover regular eye exams, usually at least once a year. These exams are essential for detecting and managing eye conditions, such as glaucoma, cataracts, and macular degeneration.

- Eyeglasses:Vision insurance plans typically cover a certain amount for eyeglasses, including frames and lenses. The amount of coverage varies by plan and may have a deductible or co-pay. Some plans may also have restrictions on the type of frames or lenses that are covered.

- Contact Lenses:Vision insurance plans may also cover contact lenses. Coverage may be limited to a certain number of pairs per year or may have a deductible or co-pay. Some plans may require a prescription from an eye doctor for contact lenses.

- Laser Eye Surgery:Some vision insurance plans may cover laser eye surgery, such as LASIK. However, coverage is typically limited and may have a high deductible or co-pay. It’s important to check the specific details of your plan to see if laser eye surgery is covered.

- Other Vision-Related Services:Vision insurance plans may also cover other vision-related services, such as:

- Eye drops

- Eye patches

- Vision therapy

- Low vision aids

Choosing the Right Vision Insurance Plan

Navigating the world of vision insurance can feel like deciphering a complex code. With so many plans and options available, it’s essential to find one that aligns with your unique needs and budget. Understanding the factors to consider, the coverage options, and the associated costs will empower you to make an informed decision.

Comparing Coverage Options

Different vision insurance plans offer varying levels of coverage and benefits. Understanding the key differences can help you choose a plan that provides the best value for your money.

- Basic Vision Plans:These plans typically offer coverage for routine eye exams and a limited allowance for eyeglasses or contact lenses. They may also include discounts on vision care products and services.

- Premium Vision Plans:These plans provide more comprehensive coverage, including higher allowances for eyeglasses or contact lenses, coverage for laser eye surgery, and discounts on vision care products and services.

- Vision Plans with Flexible Spending Accounts (FSAs):These plans allow you to set aside pre-tax dollars to pay for eligible vision care expenses. This can help you save money on your taxes.

Cost Considerations

The cost of vision insurance plans varies depending on factors such as:

- Coverage Level:Basic plans are generally more affordable than premium plans.

- Deductible:The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower monthly premium.

- Co-pay:The co-pay is the fixed amount you pay for each service, such as an eye exam or contact lens fitting.

- Network:The network is a group of eye care providers that your insurance plan covers. If you see a provider outside of the network, you may have to pay a higher co-pay or out-of-pocket expenses.

Evaluating Vision Insurance Plans

Here’s a checklist to help you evaluate vision insurance plans based on your individual needs:

- Determine your vision care needs:Do you need regular eye exams, eyeglasses, or contact lenses? Are you considering laser eye surgery?

- Consider your budget:How much can you afford to pay for vision insurance?

- Compare plans from different insurers:Don’t settle for the first plan you see. Compare plans from multiple insurers to find the best value.

- Check the network:Make sure your preferred eye care provider is in the plan’s network.

- Read the fine print:Pay attention to the deductible, co-pay, and other coverage details.

Table of Key Features

The following table Artikels key features of various vision insurance plans:

| Plan Type | Coverage | Deductible | Co-pay | Network | Cost |

|---|---|---|---|---|---|

| Basic Vision Plan | Routine eye exams, limited allowance for eyeglasses or contact lenses | $50

|

$10

|

Limited | $10

|

| Premium Vision Plan | Comprehensive coverage, including higher allowances for eyeglasses or contact lenses, coverage for laser eye surgery | $0

|

$0

|

Extensive | $20

|

| Vision Plan with FSA | Coverage for eligible vision care expenses | N/A | N/A | N/A | Variable, based on FSA contribution |

Coverage and Benefits

Vision insurance is a type of health insurance that helps cover the costs of eye care services. It can be a valuable benefit, especially if you wear glasses or contact lenses or have a family history of eye problems.

Vision insurance plans typically cover a range of services, including eye exams, eyeglasses, and contact lenses. The specific coverage and benefits will vary depending on the plan you choose.

Types of Eye Care Services Covered

Vision insurance plans usually cover a range of eye care services, including:

- Eye exams: These are essential for detecting and managing eye conditions, such as nearsightedness, farsightedness, astigmatism, and presbyopia. They also help to identify potential eye diseases, such as glaucoma, cataracts, and macular degeneration.

- Eyeglasses: Most vision insurance plans cover a portion of the cost of eyeglasses, including frames and lenses. The amount of coverage will vary depending on the plan.

- Contact lenses: Some vision insurance plans also cover the cost of contact lenses, including both soft and hard lenses. The coverage for contact lenses may be limited to a certain number of lenses per year.

- Vision therapy: This type of therapy is used to treat vision problems that can affect reading, writing, and other visual skills. It may be covered by some vision insurance plans.

- Laser eye surgery: While not typically covered by basic vision insurance plans, some plans may offer limited coverage for laser eye surgery.

Examples of Vision Insurance Benefits

Vision insurance plans offer a variety of benefits, such as:

- Discounts on eyeglasses: Many vision insurance plans provide discounts on the purchase of eyeglasses, both frames and lenses. These discounts can help you save money on your eye care costs.

- Discounts on contact lenses: Similar to eyeglasses, vision insurance plans may offer discounts on the purchase of contact lenses. This can be a significant benefit if you wear contact lenses regularly.

- Coverage for eye exams: Most vision insurance plans cover at least one eye exam per year. This is essential for maintaining good eye health and detecting any potential problems early on.

- Coverage for eye care services: Vision insurance plans can also cover other eye care services, such as vision therapy, laser eye surgery, and contact lens fittings. The specific services covered will vary depending on the plan.

Limitations and Exclusions

While vision insurance plans offer many benefits, they also have some limitations and exclusions. It’s important to understand these limitations before choosing a plan. Some common limitations and exclusions include:

- Annual coverage limits: Most vision insurance plans have annual coverage limits, which means there is a maximum amount of money you can use from your plan each year. This limit can apply to both eyeglasses and contact lenses.

- Coverage for certain services: Some vision insurance plans may not cover certain eye care services, such as laser eye surgery or vision therapy. It’s important to check the plan details to see what services are covered.

- Coverage for specific brands or products: Some vision insurance plans may limit coverage to certain brands or products. This means you may not be able to choose the frames or lenses you want if they are not on the plan’s approved list.

- Waiting periods: Some vision insurance plans have waiting periods, which means you have to wait a certain amount of time before you can use your benefits. This waiting period can be as short as a few months or as long as a year.

Deductibles and Copayments

Like other types of health insurance, vision insurance plans may have deductibles and copayments. A deductible is the amount of money you have to pay out of pocket before your insurance starts covering your eye care costs. A copayment is a fixed amount you pay for each service you receive.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance starts covering your eye care costs. For example, if your deductible is $50, you would have to pay the first $50 of your eye care costs before your insurance kicks in.

Vision insurance plans are great for keeping your peepers in tip-top shape, but what happens if an injury or illness leaves you unable to work? That’s where Disability insurance comes in, providing financial support when you need it most.

So, while your vision plan keeps you seeing clearly, disability insurance helps you keep your finances from blurring during tough times.

- Copayments: A copayment is a fixed amount you pay for each service you receive. For example, you might have to pay a copayment of $20 for each eye exam or $10 for each pair of eyeglasses.

Cost and Affordability: Vision Insurance Plans

Vision insurance, like any other type of insurance, comes with a cost. Understanding the factors that influence the cost of vision insurance plans is crucial for making informed decisions about your coverage.

Factors Influencing Vision Insurance Costs

Several factors influence the cost of vision insurance plans. These include:

- Age:Younger individuals typically pay lower premiums than older individuals, as they generally have fewer vision needs.

- Location:The cost of vision insurance can vary depending on the geographic location. Areas with a higher cost of living may have higher premiums.

- Coverage Level:Plans with more comprehensive coverage, such as those that include eye exams, eyeglasses, and contact lenses, tend to be more expensive than plans with limited coverage.

- Provider Network:Vision insurance plans that have a wider network of providers may be more expensive than plans with a smaller network.

- Deductibles and Co-pays:The amount of your deductible and co-pays can significantly impact the overall cost of your vision insurance.

- Plan Type:Different types of vision insurance plans, such as individual or group plans, can have varying costs.

Average Cost of Vision Insurance

The average cost of vision insurance can vary depending on the provider and the specific plan. However, here’s a general overview of average costs:

- Individual Plans:Individual vision insurance plans can range from $10 to $50 per month.

- Group Plans:Group vision insurance plans, often offered through employers, can range from $5 to $20 per month per employee.

Estimating the Overall Cost of Vision Insurance

To estimate the overall cost of vision insurance, consider the following:

Total Cost = Annual Premium + Out-of-Pocket Expenses

- Annual Premium:This is the amount you pay for your vision insurance each year. You can calculate it by multiplying your monthly premium by 12.

- Out-of-Pocket Expenses:These are the costs you pay directly for vision care, such as deductibles, co-pays, and any expenses not covered by your insurance.

Impact of Health Insurance Plans on Vision Insurance Coverage

Some health insurance plans may include vision coverage as part of their benefits. This can affect your need for a separate vision insurance plan.

- Integrated Vision Coverage:If your health insurance plan includes vision coverage, it may be sufficient for your needs, eliminating the need for a separate vision insurance plan.

- Limited Vision Coverage:Some health insurance plans may offer limited vision coverage, such as a certain number of eye exams per year, but may not cover eyeglasses or contact lenses. In these cases, a separate vision insurance plan may be necessary for comprehensive coverage.

Vision Insurance Providers

Choosing the right vision insurance plan involves understanding the different providers available and the features they offer. This section will guide you through the major vision insurance providers in the market, highlighting their key features and differences, and providing a comparison of their coverage, benefits, and pricing.

Major Vision Insurance Providers, Vision insurance plans

Several major vision insurance providers dominate the market, each offering a range of plans with varying coverage and benefits. Here are some of the prominent players:

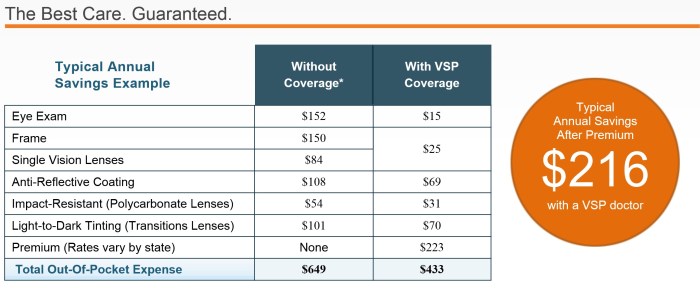

- VSP (Vision Service Plan):VSP is one of the largest vision insurance providers in the United States, offering a wide range of plans with extensive coverage for eye exams, eyeglasses, and contact lenses. They have a large network of eye care professionals across the country, making it easier for members to find providers in their area.

- EyeMed:EyeMed is another major vision insurance provider with a large network of eye care professionals. They offer a variety of plans, including plans that cover laser eye surgery. EyeMed also offers discounts on various vision products and services.

- Humana:Humana is a well-known health insurance provider that also offers vision insurance plans. Their vision plans are typically bundled with their health insurance plans, offering comprehensive coverage for vision care.

- UnitedHealthcare:UnitedHealthcare is another large health insurance provider that offers vision insurance plans. They offer a variety of plans with different levels of coverage, including plans that cover laser eye surgery.

- Anthem:Anthem is a major health insurance provider that also offers vision insurance plans. Their vision plans are typically bundled with their health insurance plans, offering comprehensive coverage for vision care.

Key Features and Differences

While these providers offer similar services, they have key differences in their coverage, benefits, and pricing. Here’s a breakdown of some key features and differences:

- Network Size:VSP and EyeMed have extensive networks of eye care professionals, providing members with greater flexibility in choosing their provider.

- Coverage for Eye Exams:Most providers offer coverage for routine eye exams, but the frequency and co-pays can vary. Some plans may cover more specialized eye exams, such as glaucoma screening or diabetic eye exams.

- Coverage for Eyeglasses and Contact Lenses:The coverage for eyeglasses and contact lenses varies greatly among providers. Some plans may offer a specific allowance for frames and lenses, while others may offer a fixed amount for each pair of glasses or contact lenses.

- Coverage for Laser Eye Surgery:Some providers, like EyeMed and UnitedHealthcare, offer coverage for laser eye surgery, while others do not. Coverage for laser eye surgery is typically limited and may require meeting specific criteria.

- Pricing:The cost of vision insurance plans varies based on the provider, the level of coverage, and the individual’s age and location. It’s essential to compare prices and benefits from different providers to find the best value for your needs.

Comparing Vision Insurance Providers

The following table provides a comparison of coverage, benefits, and pricing for some of the major vision insurance providers:

| Provider | Coverage for Eye Exams | Coverage for Eyeglasses | Coverage for Contact Lenses | Coverage for Laser Eye Surgery | Pricing (Estimated Monthly Premium) |

|---|---|---|---|---|---|

| VSP | Routine eye exams covered every 12 months | Allowance for frames and lenses | Allowance for contact lenses | Not typically covered | $10-$30 |

| EyeMed | Routine eye exams covered every 12 months | Allowance for frames and lenses | Allowance for contact lenses | May be covered with certain plans | $15-$40 |

| Humana | Routine eye exams covered every 12 months | Allowance for frames and lenses | Allowance for contact lenses | Not typically covered | $10-$25 |

| UnitedHealthcare | Routine eye exams covered every 12 months | Allowance for frames and lenses | Allowance for contact lenses | May be covered with certain plans | $12-$35 |

| Anthem | Routine eye exams covered every 12 months | Allowance for frames and lenses | Allowance for contact lenses | Not typically covered | $10-$28 |

Examples of Vision Insurance Plans

Here are some examples of specific vision insurance plans offered by major providers:

- VSP Vision Care:This plan from VSP offers comprehensive coverage for eye exams, eyeglasses, and contact lenses. It includes a yearly allowance for frames and lenses and a separate allowance for contact lenses.

- EyeMed Advantage:This plan from EyeMed offers a wide range of benefits, including coverage for routine eye exams, eyeglasses, and contact lenses. It also includes coverage for laser eye surgery with certain plans.

- Humana Vision:This plan from Humana offers comprehensive coverage for vision care, including routine eye exams, eyeglasses, and contact lenses. It’s typically bundled with Humana’s health insurance plans.

- UnitedHealthcare Vision:This plan from UnitedHealthcare offers a variety of coverage options, including plans that cover laser eye surgery. It also offers discounts on vision products and services.

- Anthem Vision:This plan from Anthem offers comprehensive coverage for vision care, including routine eye exams, eyeglasses, and contact lenses. It’s typically bundled with Anthem’s health insurance plans.

Utilizing Vision Insurance

Vision insurance can be a valuable asset in managing your eye care expenses. Understanding the enrollment process, claim filing procedures, and tips for maximizing benefits will help you leverage your plan to its fullest potential.

Enrolling in a Vision Insurance Plan

Enrolling in a vision insurance plan is typically a straightforward process. You can usually enroll through your employer, if offered as a benefit, or directly through an insurance provider.

- If enrolling through your employer, you will usually be presented with a selection of vision insurance plans during open enrollment periods. You can choose the plan that best suits your needs and budget.

- If enrolling directly through an insurance provider, you can compare different plans and choose the one that best meets your requirements. The enrollment process may involve completing an application form and providing basic information.

Filing a Vision Insurance Claim

When you need vision care services, you can file a claim with your vision insurance provider. The claim process may vary depending on the provider, but generally involves the following steps:

- Obtain a claim formfrom your insurance provider or download one from their website.

- Complete the claim formwith your personal information, the details of the vision care services you received, and the cost of the services.

- Submit the claim formto your insurance provider, either by mail, fax, or online.

- Your insurance provider will review your claimand determine the amount of coverage you are eligible for. You will receive a notification of the approved amount, and the remaining balance will be your responsibility to pay.

Maximizing Vision Insurance Benefits

Here are some tips for getting the most out of your vision insurance:

- Understand your plan’s coverage: Familiarize yourself with the details of your plan, including the benefits, limitations, and any exclusions.

- Choose in-network providers: Utilizing in-network providers typically results in lower out-of-pocket expenses, as they have negotiated discounted rates with your insurance company.

- Schedule regular eye exams: Most vision insurance plans cover annual eye exams, which are crucial for maintaining good eye health and detecting potential problems early.

- Take advantage of preventive care benefits: Many plans offer coverage for preventive services, such as glaucoma screening and contact lens fitting.

- Utilize your vision insurance for glasses and contact lenses: Vision insurance can help offset the cost of glasses, contact lenses, and other vision care products. Be sure to check your plan’s coverage limits and restrictions.

Understanding the Terms and Conditions

It is essential to understand the terms and conditions of your vision insurance plan.

- Coverage Limits: These determine the maximum amount your insurance will pay for certain services, such as eyeglasses or contact lenses.

- Deductible: This is the amount you must pay out-of-pocket before your insurance begins covering any costs.

- Co-pay: This is a fixed amount you pay for each service, such as an eye exam or a prescription for glasses.

- Waiting Period: This is the time you must wait before you can use your insurance for certain services.

- Exclusions: These are services that are not covered by your insurance, such as cosmetic procedures or specialized lenses.

Vision Insurance and Health

Vision insurance is more than just covering eye exams and glasses. It plays a crucial role in safeguarding your overall health by enabling regular eye checkups, which can detect early signs of various health conditions.

The Role of Regular Eye Exams in Detecting Health Conditions

Regular eye exams are vital for maintaining good vision, but they also serve as a window into your overall health. Your eyes can reveal signs of underlying medical conditions that may not be apparent elsewhere. For example, a dilated eye exam can detect:

- Diabetes:Changes in blood vessels in the retina can indicate diabetes.

- High Blood Pressure:Blood vessel damage in the retina can be a sign of high blood pressure.

- High Cholesterol:Deposits in the blood vessels of the eye can signal high cholesterol levels.

- Multiple Sclerosis:Optic nerve damage can be a symptom of multiple sclerosis.

- Brain Tumors:Swelling in the optic nerve can indicate a brain tumor.

Vision Insurance Coverage for Specific Eye Conditions

Vision insurance can help cover the cost of treatments for various eye conditions, including:

- Cataracts:Vision insurance can cover the cost of cataract surgery, which involves removing the clouded lens and replacing it with an artificial lens.

- Glaucoma:Vision insurance can help cover the cost of eye drops and laser treatments to manage glaucoma, a condition that damages the optic nerve.

- Macular Degeneration:Vision insurance may cover the cost of treatments, such as laser therapy or injections, to slow the progression of macular degeneration, a condition that affects central vision.

- Diabetic Retinopathy:Vision insurance can cover the cost of laser treatments or injections to treat diabetic retinopathy, a complication of diabetes that damages the blood vessels in the retina.

How Vision Insurance Can Support Healthy Vision Practices

Vision insurance can encourage healthy vision practices by:

- Covering Regular Eye Exams:This ensures that you receive regular eye checkups, which are crucial for detecting early signs of eye conditions and maintaining good vision.

- Providing Discounts on Eyeglasses and Contact Lenses:This makes it more affordable to get the corrective lenses you need, encouraging you to wear them as prescribed.

- Covering Vision-Related Procedures:This helps cover the cost of treatments for eye conditions, preventing them from worsening and potentially causing vision loss.

Closure

Vision insurance plans are an essential part of a comprehensive healthcare strategy, providing peace of mind and financial protection for your eye health. By understanding the benefits and choosing the right plan for your needs, you can ensure that you have the coverage you need to maintain healthy vision and enjoy a clear view of the world around you.

FAQ Insights

What is the difference between vision insurance and health insurance?

Vision insurance specifically covers eye care services, while health insurance covers a broader range of medical services, including some eye care needs. However, health insurance may not fully cover all eye care expenses, which is where vision insurance comes in.

How often can I get an eye exam with vision insurance?

Most vision insurance plans cover an eye exam every 12-24 months, but the frequency can vary depending on your plan.

Do vision insurance plans cover LASIK surgery?

Vision insurance plans typically do not cover elective procedures like LASIK surgery. However, some plans may offer discounts or financing options for these procedures.

How do I choose the right vision insurance plan?

Consider your individual needs, such as your vision health, the frequency of eye exams, and your budget. Compare different plans based on coverage, benefits, and cost.