Term life insurance, the unsung hero of financial planning, offers a lifeline to your loved ones in the event of your untimely departure. It’s like a safety net, ensuring their financial security when you’re no longer there to provide for them.

Think of it as a promise, a way to ensure your family can continue living comfortably, even in your absence.

The beauty of term life insurance lies in its simplicity. You pay a set premium for a specific period, and in the event of your death within that timeframe, your beneficiaries receive a lump sum payment. It’s like a temporary shield, protecting your family during their most vulnerable time.

What is Term Life Insurance?

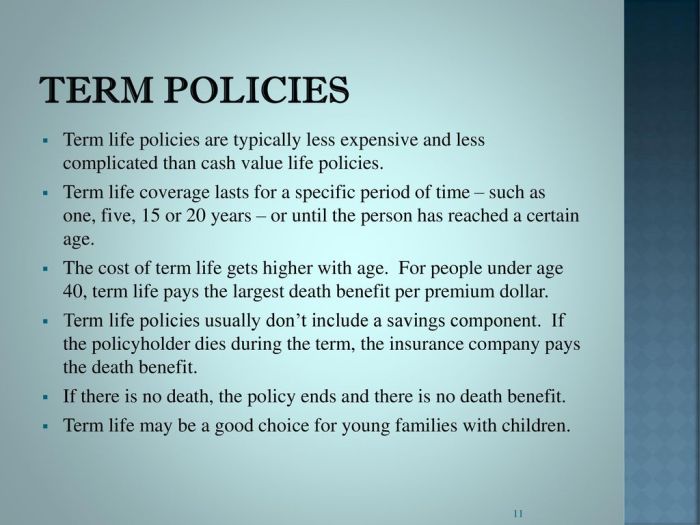

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to protect your loved ones financially if you die during the term of the policy.Term life insurance is a simpler and more affordable type of life insurance compared to permanent life insurance, which offers lifelong coverage.

It is often used to cover financial obligations such as a mortgage, outstanding loans, or to provide income replacement for dependents.

Term Life Insurance Explained

Imagine you are a young parent with a mortgage and a family to support. You want to ensure that your family is financially secure if something happens to you. Term life insurance provides a death benefit that your family can use to pay off the mortgage, cover living expenses, or fund your children’s education.

Key Features of Term Life Insurance

Term life insurance is characterized by several key features:* Temporary Coverage:Term life insurance provides coverage for a specific period, known as the “term.” After the term expires, the policy ends, and no death benefit is paid out.

Lower Premiums

Compared to permanent life insurance, term life insurance typically has lower premiums because it only provides coverage for a limited period.

No Cash Value

Term life insurance does not accumulate cash value like permanent life insurance. This means you cannot borrow against the policy or withdraw any funds.

Simple Structure

Term life insurance policies are generally straightforward and easy to understand.

Renewability

Most term life insurance policies offer the option to renew the policy at the end of the term, although the premiums will likely increase.

Term Life Insurance vs. Permanent Life Insurance

Term life insurance and permanent life insurance differ in several ways:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage | Temporary (specific term) | Lifelong |

| Premiums | Lower | Higher |

| Cash Value | No | Yes |

| Purpose | Temporary financial protection | Long-term financial planning, estate planning |

Examples of Term Life Insurance Use Cases

Term life insurance can be used for a variety of purposes, including:* Mortgage Protection:Term life insurance can help cover the outstanding mortgage balance if you die before it is paid off.

Income Replacement

Term life insurance can provide income replacement for dependents, such as a spouse or children, if you die while you are the primary breadwinner.

Final Expenses

Term life insurance can help cover funeral costs and other final expenses.

Debt Protection

Term life insurance can help pay off outstanding debts, such as loans or credit card balances.

Choosing the Right Term, Term life insurance

When choosing a term life insurance policy, it is important to consider the following factors:* Your Age and Health:Younger and healthier individuals typically qualify for lower premiums.

Your Financial Needs

Consider the amount of coverage you need to protect your loved ones.

Your Term Length

Choose a term length that aligns with your financial goals and the time frame you need coverage.

Conclusion

Term life insurance is a valuable tool for providing financial security for your loved ones in the event of your death. It is a simple and affordable option for temporary coverage, making it suitable for various life stages and financial situations.

Key Features of Term Life Insurance

Term life insurance is a straightforward and affordable type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away during the policy term.

This makes it an excellent option for individuals who need coverage for a particular period, such as while raising young children or paying off a mortgage.

Coverage Period

The coverage period, also known as the policy term, is the duration for which the policy provides death benefit coverage. It is a key feature of term life insurance. The term can range from a few years to several decades, depending on your individual needs and financial goals.

For example, if you have a 30-year mortgage and want to ensure your family can pay it off if you pass away, you might choose a 30-year term life insurance policy. Once the term expires, the policy terminates, and you will no longer receive coverage unless you renew it.

Premium Payments

Term life insurance premiums are typically fixed for the entire policy term. This means you pay the same amount each month, regardless of your age or health. This predictability makes budgeting for your insurance payments easier.

Death Benefit

The death benefit is the amount of money your beneficiaries will receive if you pass away during the policy term. It is a crucial element of term life insurance, as it provides financial security for your loved ones. The death benefit is typically a lump sum payment that can be used to cover expenses such as funeral costs, outstanding debts, or living expenses.

Renewal Options

Term life insurance policies often include renewal options. This allows you to extend the coverage period after the initial term expires. However, the premium for the renewed policy will generally be higher than the original premium, as you will be older and potentially at a higher risk.

Level Premium

Term life insurance policies usually have a level premium, meaning the premium remains constant throughout the policy term. This helps you budget for your insurance payments and avoids surprises as your age increases. The premium is calculated based on factors such as your age, health, and the policy’s coverage amount.

The level premium structure is beneficial for individuals who want predictable and affordable life insurance coverage.

Benefits of Term Life Insurance

- Affordable:Term life insurance is generally more affordable than other types of life insurance, such as whole life or universal life insurance. This is because term life insurance only provides coverage for a specific period, while other types of life insurance offer lifetime coverage and investment features.

- Simple:Term life insurance is a straightforward product with no complex investment components. It provides a clear death benefit for a specific period, making it easy to understand and manage.

- Flexible:Term life insurance policies offer various coverage options and terms, allowing you to customize your coverage to meet your specific needs.

- Temporary Coverage:Term life insurance is ideal for temporary coverage needs, such as covering a mortgage or providing financial support for young children while they are growing up.

Drawbacks of Term Life Insurance

- No Cash Value:Unlike whole life or universal life insurance, term life insurance does not build cash value. This means you cannot borrow against the policy or receive a refund if you cancel it before the term expires.

- Limited Coverage:Term life insurance provides coverage for a specific period, and the policy expires at the end of the term. If you need coverage beyond the initial term, you must renew the policy, which may result in higher premiums.

- Potential for Renewal Premium Increases:When you renew a term life insurance policy, the premium will generally be higher than the original premium due to your increased age and potential for higher risk.

How Term Life Insurance Works

Term life insurance operates on a straightforward principle: you pay premiums for a specific period, and if you pass away during that term, your beneficiaries receive a death benefit. This benefit helps them financially manage the loss of your income and cover expenses like funeral costs, debts, or mortgage payments.

Applying for Term Life Insurance

The application process for term life insurance is generally simple. It usually involves these steps:

- Contact an insurance agent or broker:You can start by reaching out to an insurance agent or broker to discuss your needs and explore different options.

- Provide personal information:You’ll be asked to provide personal information, such as your age, health history, and lifestyle habits.

- Complete a medical questionnaire:This questionnaire will assess your health risks and determine your premium rates.

- Undergo a medical exam (if required):Some policies may require a medical exam to further assess your health status.

- Review and sign the policy:Once the application is approved, you’ll receive a policy document to review and sign.

Factors Influencing Term Life Insurance Premiums

Several factors influence the cost of term life insurance premiums. These factors include:

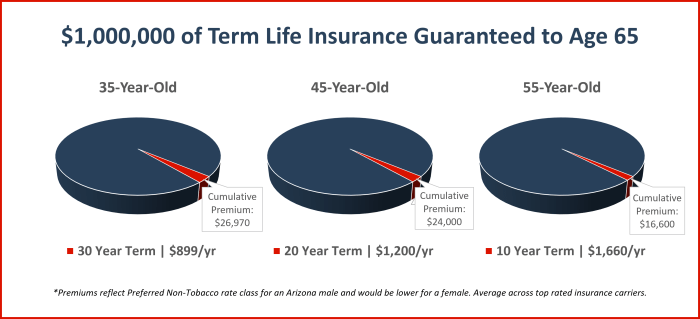

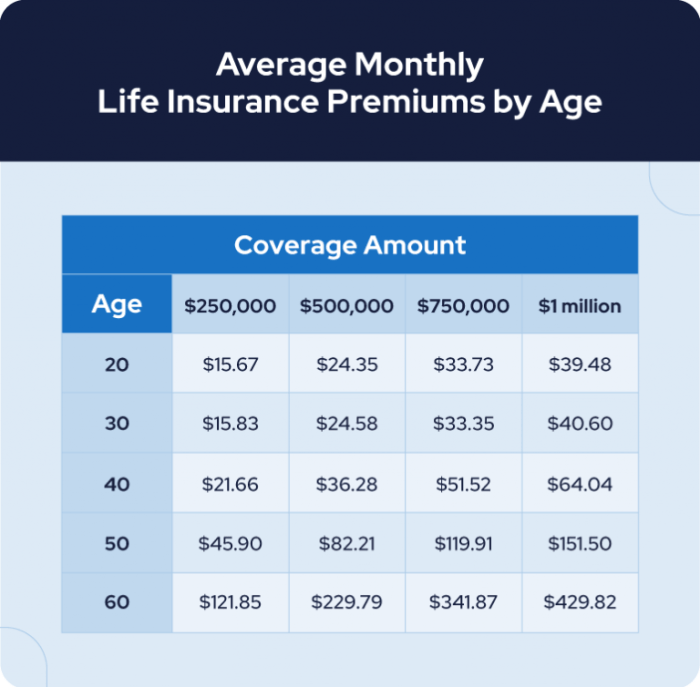

- Age:Premiums generally increase with age, as older individuals have a higher risk of mortality.

- Health:Individuals with pre-existing medical conditions may face higher premiums due to increased risk.

- Lifestyle:Certain lifestyle choices, such as smoking or engaging in risky activities, can lead to higher premiums.

- Coverage amount:The higher the death benefit, the higher the premium.

- Policy term:Longer terms generally result in higher premiums, as the insurance company assumes a greater risk over a longer period.

- Gender:In some cases, women may pay slightly lower premiums than men for similar coverage due to their longer life expectancy.

Receiving the Death Benefit

When the insured passes away during the policy term, the beneficiaries named in the policy receive the death benefit. The process for receiving the benefit typically involves:

- Notification of death:The beneficiaries must notify the insurance company of the insured’s death, providing necessary documentation such as a death certificate.

- Claim processing:The insurance company reviews the claim and verifies the validity of the policy and the death.

- Benefit payment:Once the claim is approved, the insurance company pays the death benefit to the designated beneficiaries.

Types of Term Life Insurance

Term life insurance policies come in different varieties, each tailored to specific needs and financial situations. Understanding the differences between these types can help you choose the policy that best aligns with your goals and budget.

Level Term Life Insurance

Level term life insurance provides a fixed death benefit for a set period, known as the term. This means the coverage amount remains the same throughout the policy’s duration, regardless of any changes in your health or circumstances.

- Pros:Level term life insurance offers predictable premiums and a guaranteed death benefit. It’s a straightforward and cost-effective option for individuals seeking a temporary coverage solution.

- Cons:The premiums may increase when the policy renews at the end of the term, and the coverage ends at the policy’s expiration.

- Suitable for:Individuals with a short-term need for life insurance, such as covering a mortgage or supporting a family while children are young.

Decreasing Term Life Insurance

Decreasing term life insurance provides a death benefit that gradually decreases over the policy’s term. The premiums remain fixed, but the coverage amount declines steadily.

- Pros:Decreasing term life insurance offers lower premiums compared to level term, as the coverage amount diminishes over time. It’s a suitable option for individuals with a decreasing financial need for life insurance, such as a mortgage that is gradually paid off.

- Cons:The death benefit is lower as the policy term progresses, potentially leaving less coverage for beneficiaries in later years.

- Suitable for:Individuals with a decreasing financial obligation, such as a mortgage or a loan that is being repaid over time.

Increasing Term Life Insurance

Increasing term life insurance provides a death benefit that increases over the policy’s term. This type of policy typically includes a cost-of-living adjustment (COLA), which helps to keep pace with inflation.

- Pros:Increasing term life insurance offers a death benefit that grows with inflation, ensuring that your beneficiaries receive adequate coverage even in the future. It’s a suitable option for individuals concerned about the erosion of their purchasing power over time.

- Cons:The premiums for increasing term life insurance are generally higher than those for level term, as the death benefit increases over time.

- Suitable for:Individuals with a growing financial need for life insurance, such as parents of young children or those with a significant estate that may be subject to inflation.

Choosing the Right Term Life Insurance

Choosing the right term life insurance policy is a crucial decision, as it provides financial security for your loved ones in the event of your untimely demise. To make an informed choice, consider various factors that influence the suitability of a policy.

Factors to Consider When Choosing Term Life Insurance

The decision to purchase term life insurance is often driven by the need to protect your family’s financial well-being. Before committing to a specific policy, it’s essential to consider the following factors:

- Your Financial Needs and Goals:Consider your dependents’ financial requirements, such as mortgage payments, children’s education, or outstanding debts. The coverage amount should be sufficient to cover these obligations.

- Your Age and Health:Your age and health status influence your insurance premiums. Younger and healthier individuals generally qualify for lower premiums.

- Your Lifestyle:If you engage in high-risk activities or have a hazardous occupation, your premiums may be higher. Be transparent with your insurer about your lifestyle and any pre-existing medical conditions.

- Your Budget:Term life insurance premiums vary based on factors like coverage amount, policy term, and your personal circumstances. Determine a budget that you can comfortably afford.

- Your Policy Term:The policy term is the duration for which your coverage remains active. Consider the time frame you need coverage, such as until your children are financially independent or your mortgage is paid off.

- The Insurer’s Reputation:Choose a reputable insurance provider with a proven track record of financial stability and excellent customer service. Look for companies with high ratings from independent agencies like A.M. Best.

- Policy Features and Riders:Review the policy’s features, such as the coverage amount, premium payment options, and available riders. Riders are additional benefits that can enhance your policy’s coverage, such as accidental death benefit or terminal illness coverage.

Determining the Appropriate Coverage Amount

The coverage amount, also known as the death benefit, is the sum paid to your beneficiaries upon your death. It’s essential to determine an appropriate coverage amount that adequately meets your family’s financial needs.

- Calculate Your Family’s Expenses:Estimate your family’s annual expenses, including mortgage payments, rent, utilities, groceries, and education costs.

- Consider Outstanding Debts:Include any outstanding debts, such as loans, credit card balances, or mortgages.

- Factor in Future Expenses:Consider future expenses, such as college tuition for your children or long-term care costs.

- Use a Life Insurance Calculator:Online life insurance calculators can help you estimate the coverage amount based on your financial circumstances.

Selecting a Reputable Insurance Provider

Choosing a reputable insurance provider is crucial for ensuring that your policy is secure and your claims are processed efficiently.

- Research Insurance Companies:Investigate the financial stability, customer satisfaction ratings, and claims processing procedures of various insurance companies.

- Check for Financial Strength Ratings:Look for companies with high ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s.

- Read Reviews and Testimonials:Explore online reviews and testimonials from previous customers to gauge their experiences with the insurer.

- Compare Quotes:Obtain quotes from multiple insurance companies to compare premiums and policy features.

Term Life Insurance vs. Other Types of Life Insurance

Choosing the right type of life insurance can be a daunting task, especially when you’re faced with a wide array of options. While term life insurance is a popular choice for its affordability and simplicity, it’s crucial to understand how it compares to other types of life insurance, such as whole life insurance and universal life insurance.

This comparison will help you make an informed decision that best suits your individual needs and financial situation.

Term Life Insurance vs. Whole Life Insurance

Term life insurance and whole life insurance differ significantly in their structure, benefits, and costs. Understanding these differences is crucial for making an informed decision.

- Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you die within that term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you no longer receive coverage.

Term life insurance is generally more affordable than whole life insurance, making it an attractive option for those seeking temporary coverage.

- Whole life insurance, on the other hand, provides lifetime coverage. This means that your beneficiaries will receive a death benefit regardless of when you die. Whole life insurance also functions as a savings vehicle, accumulating cash value over time that you can borrow against or withdraw.

However, whole life insurance is significantly more expensive than term life insurance, making it less suitable for individuals seeking cost-effective coverage.

Term Life Insurance vs. Universal Life Insurance

Universal life insurance offers more flexibility than term life insurance or whole life insurance, allowing you to adjust your premiums and death benefit over time.

- Universal life insurance provides lifetime coverage, similar to whole life insurance. However, it allows for more flexibility in premium payments and death benefit adjustments. This can be advantageous if your financial situation changes or your insurance needs evolve over time.

- Universal life insurance also accumulates cash value, like whole life insurance, but the growth rate is typically tied to the performance of the underlying investment account. This can lead to higher returns than whole life insurance, but also comes with higher risks.

- Universal life insurance is generally more expensive than term life insurance, but less expensive than whole life insurance. The cost depends on factors such as your age, health, and the amount of coverage you choose.

Key Differences in a Table

Here’s a table summarizing the key differences between term life insurance, whole life insurance, and universal life insurance:

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Period | Specific Term (e.g., 10, 20, 30 years) | Lifetime | Lifetime |

| Premiums | Fixed for the term | Fixed | Flexible |

| Death Benefit | Fixed | Fixed | Adjustable |

| Cash Value | None | Accumulates | Accumulates |

| Cost | Most affordable | Most expensive | Between term and whole life |

Term Life Insurance and Financial Planning

Term life insurance is a valuable tool for incorporating into a comprehensive financial plan. It provides a safety net for your loved ones, ensuring their financial stability in the event of your untimely passing. By understanding how term life insurance works and its role in protecting your dependents, you can make informed decisions about its inclusion in your overall financial strategy.

Term life insurance is a safety net for your loved ones, ensuring they’re financially protected in case of your unexpected passing. But what about your own well-being? Don’t forget to explore health insurance quotes to secure your health and peace of mind.

Just like term life insurance provides financial security for your family, health insurance safeguards your future and ensures you receive the best possible medical care when you need it most.

Protecting Dependents and Mitigating Financial Risks

Term life insurance plays a crucial role in safeguarding your dependents and mitigating financial risks. It provides a lump-sum death benefit that can be used to cover various financial obligations and expenses, such as:

- Mortgage payments: Ensuring that your family can remain in their home without the burden of a large mortgage debt.

- Outstanding debts: Covering outstanding loans, credit card balances, or other financial obligations.

- Living expenses: Providing financial support for your family’s everyday living expenses, such as groceries, utilities, and transportation.

- Education costs: Funding your children’s education, ensuring they can pursue their academic goals without financial hardship.

- Income replacement: Providing a source of income for your family, particularly for stay-at-home parents or those with limited savings.

Covering Specific Financial Needs

Term life insurance can be tailored to meet specific financial needs, offering flexibility and peace of mind. Here are some examples:

- Mortgage protection: By purchasing a term life insurance policy with a death benefit equal to your mortgage balance, you ensure that your family can pay off the mortgage in the event of your death, preventing foreclosure and financial strain.

- College tuition: If you have children who are planning to attend college, a term life insurance policy can provide the funds needed to cover their education expenses, ensuring their future success.

- Income replacement: A term life insurance policy can be used to replace your income, ensuring that your family maintains their standard of living in your absence. The death benefit can be used to cover living expenses, debt payments, and other financial obligations.

“Term life insurance is an affordable and effective way to protect your loved ones and ensure their financial security in the event of your death.”

Common Misconceptions about Term Life Insurance

Term life insurance is a valuable tool for financial protection, but it is often misunderstood. Many people believe that it is only for young families or that it is not a valuable investment. However, these are simply misconceptions.

Term life insurance can be a wise choice for individuals of all ages and financial situations.

Term Life Insurance is Only for Young Families

It is a common misconception that term life insurance is only for young families with children. However, this is not true. Term life insurance can be beneficial for individuals of all ages and life stages. For example, if you are a single person with a mortgage or student loans, term life insurance can help your loved ones pay off these debts if you pass away.

Similarly, if you are a retiree with a spouse who relies on your income, term life insurance can provide financial security for your spouse in the event of your death.

Term Life Insurance is Not a Valuable Investment

Another misconception about term life insurance is that it is not a valuable investment. While term life insurance does not provide a cash value like whole life insurance, it is still a valuable investment in your family’s financial security.

Term life insurance provides peace of mind knowing that your loved ones will be financially protected if you pass away. This can be especially important if you have dependents who rely on your income.

Term Life Insurance is Expensive

Term life insurance premiums are generally affordable, especially when you compare them to the potential financial burden your death could place on your loved ones. The cost of term life insurance premiums can vary depending on several factors, including your age, health, and the amount of coverage you need.

However, with a little research and comparison shopping, you can find an affordable term life insurance policy that meets your needs.

Term Life Insurance is Difficult to Understand

Term life insurance is actually quite straightforward. It is a simple and affordable way to provide financial protection for your loved ones in the event of your death. There are many resources available to help you understand term life insurance, including websites, brochures, and insurance agents.

You Need to Buy Term Life Insurance From a Specific Company

It is important to shop around and compare quotes from multiple companies before purchasing term life insurance. This will help you ensure that you are getting the best possible price for your policy. Many online comparison tools can help you compare quotes from different insurance companies.

Resources for Learning More about Term Life Insurance

There are many excellent resources available to help you learn more about term life insurance and make informed decisions. From reputable websites and publications to professional organizations, you can find a wealth of information to guide you.

Websites

These websites offer comprehensive information about term life insurance, including explanations of different types, policy features, and tips for choosing the right coverage.

- The National Association of Insurance Commissioners (NAIC):The NAIC is a non-profit organization that represents state insurance regulators. Their website provides information on insurance topics, including term life insurance, as well as consumer resources and tools. [https://www.naic.org/](https://www.naic.org/)

- The Insurance Information Institute (III):The III is a non-profit organization that provides information about insurance topics, including life insurance. Their website offers resources for consumers, including articles, FAQs, and calculators. [https://www.iii.org/](https://www.iii.org/)

- The Consumer Financial Protection Bureau (CFPB):The CFPB is a federal agency that protects consumers in the financial marketplace. Their website provides information about financial products and services, including life insurance. [https://www.consumerfinance.gov/](https://www.consumerfinance.gov/)

Publications

These publications provide in-depth analysis and insights into term life insurance.

- Consumer Reports:Consumer Reports is a non-profit organization that provides unbiased product reviews and consumer advice. They publish articles and reports on various insurance topics, including term life insurance. [https://www.consumerreports.org/](https://www.consumerreports.org/)

- Kiplinger’s Personal Finance:Kiplinger’s is a financial publication that provides advice on personal finance topics, including insurance. They publish articles and guides on term life insurance, covering aspects like choosing the right policy and understanding policy features. [https://www.kiplinger.com/](https://www.kiplinger.com/)

- Money Magazine:Money Magazine is a financial publication that provides information on various financial topics, including insurance. They publish articles and guides on term life insurance, covering aspects like policy comparisons and tips for saving money. [https://money.com/](https://money.com/)

Professional Organizations

These organizations provide resources and information for consumers and professionals in the insurance industry.

- The American Council of Life Insurers (ACLI):The ACLI is a trade association that represents life insurance companies in the United States. Their website provides information on life insurance topics, including term life insurance, and consumer resources. [https://www.acli.com/](https://www.acli.com/)

- The National Association of Insurance and Financial Advisors (NAIFA):NAIFA is a professional association for insurance and financial advisors. Their website provides resources for consumers, including information on life insurance and how to find a qualified advisor. [https://www.naifa.org/](https://www.naifa.org/)

Ultimate Conclusion

Term life insurance, though often overlooked, plays a crucial role in building a secure financial future for your loved ones. It’s a powerful tool that allows you to protect them from the unexpected, providing peace of mind knowing they’ll be taken care of.

By carefully considering your needs and exploring the different options available, you can find a policy that fits your unique circumstances and provides the level of protection your family deserves. So, don’t leave them in the dark. Take the time to understand the benefits of term life insurance and secure their future.

Essential FAQs

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage. Term life is generally more affordable, but it doesn’t build cash value. Whole life is more expensive but offers cash value accumulation, which can be borrowed against.

How long should I get a term life insurance policy for?

The duration of your policy should align with your financial needs. Consider the time it will take your dependents to become financially independent, such as until your children graduate college or your mortgage is paid off.

What factors affect the cost of term life insurance?

Several factors influence the cost, including your age, health, lifestyle, and the amount of coverage you need. Younger and healthier individuals generally pay lower premiums.

Can I get term life insurance if I have a pre-existing condition?

Yes, you can usually get term life insurance even with a pre-existing condition. However, you might be required to pay a higher premium or undergo a more thorough medical evaluation.

What happens if I need to cancel my term life insurance policy?

Most term life insurance policies allow you to cancel them at any time. You might receive a refund of any unused premiums, but you may also be subject to surrender charges.