How much does Geico car insurance cost? That’s a question many drivers ask themselves when considering their insurance options. Geico, known for its iconic gecko mascot and catchy commercials, is a popular choice for car insurance, but how do its rates stack up against the competition?

The truth is, there’s no one-size-fits-all answer. Geico’s car insurance premiums vary based on a number of factors, from your driving history to the type of car you drive. This article will delve into the key factors that influence Geico’s car insurance costs, helping you understand what might impact your own premium.

We’ll explore how your driving history, vehicle type, location, and coverage choices can affect your rates. We’ll also compare and contrast the influence of age, gender, and credit score on your insurance premiums. Armed with this knowledge, you’ll be better equipped to understand your own Geico quote and make informed decisions about your car insurance.

Factors Influencing Geico Car Insurance Costs

Getting a quote for car insurance can feel like deciphering a secret code. But don’t worry, it’s not as complicated as it seems. Several factors determine how much you’ll pay for your Geico car insurance. Understanding these factors can help you make informed decisions to potentially save money.

Driving History

Your driving history is a significant factor in determining your Geico car insurance premiums. A clean driving record with no accidents or traffic violations will result in lower premiums. However, if you have a history of accidents, speeding tickets, or other offenses, your rates will likely be higher.

This is because insurance companies view drivers with a history of accidents as higher risk, making them more likely to file claims.

“The more accidents you have, the more likely you are to have another accident.”

For example, if you have been involved in two accidents within the past five years, your Geico car insurance premiums could be significantly higher than someone with a clean driving record.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance costs. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and value when calculating your premiums.

- Luxury carsand high-performance vehiclesare often more expensive to insure because they are more expensive to repair and replace.

- Vehicles with advanced safety featureslike anti-lock brakes, airbags, and stability control may qualify for discounts, as they are considered safer and less likely to be involved in accidents.

- Older vehiclesmay have lower premiums than newer vehicles, as they depreciate in value and are less expensive to repair or replace.

Location

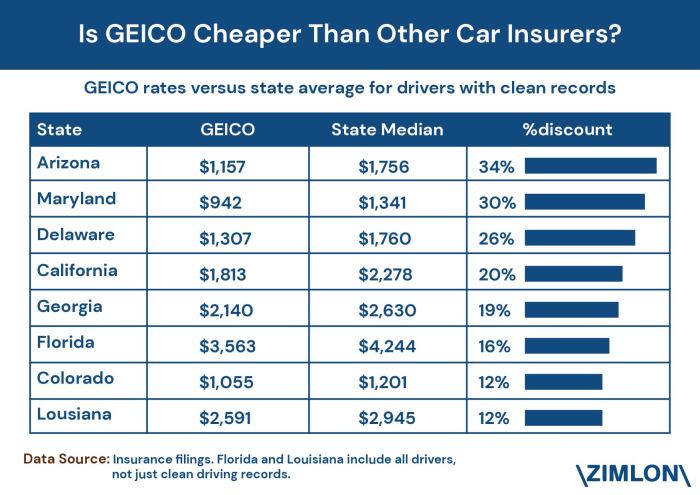

Where you live significantly impacts your Geico car insurance premiums.

- Urban areastend to have higher insurance rates due to increased traffic density, higher risk of theft, and more frequent accidents.

- Rural areasgenerally have lower insurance rates due to lower traffic density and fewer accidents.

Insurance companies also consider the crime rate and the frequency of natural disasters in your area when setting premiums.

Coverage Options

The type of coverage you choose for your car insurance policy will also influence your premiums.

- Liability coverageis the minimum required by law and covers damages to other people’s property or injuries caused by an accident.

- Collision coveragepays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault.

- Comprehensive coverageprotects your vehicle from damage caused by events like theft, vandalism, and natural disasters.

The more coverage you choose, the higher your premiums will be.

Age, Gender, and Credit Score

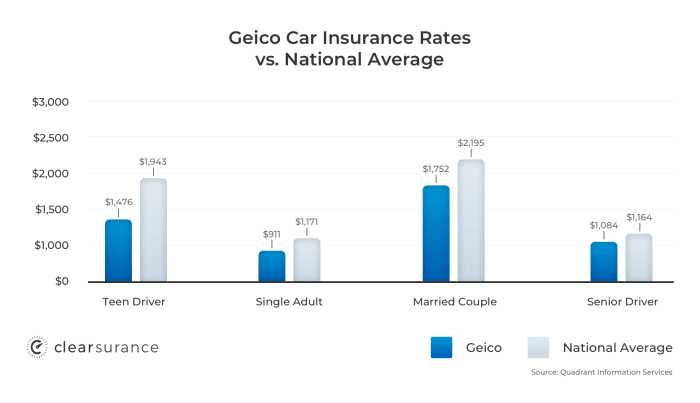

Your age, gender, and credit score can also influence your Geico car insurance premiums.

- Younger driversare generally considered higher risk due to their lack of experience.

- Older driversmay also face higher premiums if they have health issues that could affect their driving abilities.

- Gendercan also play a role in insurance rates, with some studies showing that women tend to be safer drivers than men.

- Credit scoreis increasingly being used by insurance companies to assess risk. Drivers with good credit scores are often considered more responsible and less likely to file claims, resulting in lower premiums.

Obtaining a Geico Car Insurance Quote: How Much Does Geico Car Insurance Cost

Getting a quote for car insurance from Geico is a straightforward process. You can obtain a quote online, over the phone, or through a Geico agent.

Getting a Geico Car Insurance Quote Online

The easiest and most convenient way to get a Geico car insurance quote is online. The process is quick and simple, allowing you to compare different coverage options and prices.

- Visit the Geico website and click on the “Get a Quote” button.

- Enter your zip code and select the type of vehicle you want to insure.

- Provide basic information about yourself, including your date of birth, driving history, and contact details.

- Enter details about your vehicle, such as its make, model, year, and mileage.

- Choose the desired coverage options and deductibles.

- Review your quote and submit it if you are satisfied with the price.

Getting a Geico Car Insurance Quote Over the Phone

If you prefer to talk to a representative, you can get a quote over the phone by calling Geico’s customer service line.

- Call the Geico customer service number and provide the necessary information to the representative.

- The representative will guide you through the quote process and answer any questions you may have.

Getting a Geico Car Insurance Quote Through an Agent

You can also obtain a quote by visiting a Geico agent in person.

- Find a Geico agent near you using the Geico website or app.

- Schedule an appointment with the agent and provide them with the required information.

- The agent will help you choose the right coverage options and answer any questions you may have.

Tips for Providing Accurate Information During the Quote Process

To ensure you get the most accurate and competitive quote, it is crucial to provide accurate information during the quote process.

- Be honest about your driving history, including any accidents, tickets, or violations. Providing inaccurate information can lead to higher premiums or even policy cancellation.

- Include all relevant details about your vehicle, such as its make, model, year, mileage, and any modifications. Omitting information can result in an inaccurate quote.

- Provide accurate information about your driving habits, including your average daily commute, the number of miles you drive annually, and your parking location. This helps Geico assess your risk profile and determine the appropriate premium.

- Consider adding additional coverage options, such as comprehensive and collision coverage, roadside assistance, and rental car reimbursement, if needed. This can help you protect yourself from unexpected expenses in case of an accident or other unforeseen events.

Comparing Geico Car Insurance Quote Options

Geico offers various coverage options and discounts, allowing you to customize your policy to fit your specific needs and budget. Here’s a table comparing different quote options and their features:

| Quote Option | Features |

|---|---|

| Basic Coverage | Liability, Personal Injury Protection (PIP), Uninsured/Underinsured Motorist Coverage (UM/UIM) |

| Comprehensive Coverage | Protects against damage caused by non-collision events, such as theft, vandalism, or natural disasters. |

| Collision Coverage | Covers damage to your vehicle in case of an accident, regardless of fault. |

| Roadside Assistance | Provides assistance in case of a breakdown, flat tire, or lockout. |

| Rental Car Reimbursement | Covers the cost of a rental car while your vehicle is being repaired. |

Geico Coverage Options and Their Costs

Geico offers a range of coverage options to cater to different needs and budgets. Understanding these options and their associated costs is crucial for making an informed decision about your car insurance policy.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person or their property. It covers the costs of:

- Medical expenses for the injured party.

- Property damage repairs.

- Legal fees and court costs.

Liability coverage is typically divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the injured party.

- Property Damage Liability: This covers damage to the other person’s vehicle or property.

The amount of liability coverage you need depends on your individual circumstances and the laws in your state.

Collision Coverage, How much does Geico car insurance cost

Collision coverage protects you against damage to your own vehicle caused by an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus your deductible. Collision coverage is optional, but it’s often required if you have a loan or lease on your vehicle.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than accidents, such as:

- Theft

- Vandalism

- Natural disasters

- Fire

- Hail

Like collision coverage, comprehensive coverage is optional, but it’s often required if you have a loan or lease on your vehicle.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. It covers medical expenses, lost wages, and property damage.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages after an accident, regardless of who is at fault. It’s mandatory in some states.

Coverage Levels and Premium Ranges

The following table provides a general overview of the various coverage levels and their corresponding premium ranges.

| Coverage Type | Coverage Level | Premium Range |

|---|---|---|

| Liability | $25,000/$50,000/$25,000 | $500

|

| $50,000/$100,000/$50,000 | $700

|

|

| $100,000/$300,000/$100,000 | $1,000

|

|

| Collision | Actual Cash Value (ACV) | $200

|

| Replacement Cost Value (RCV) | $300

|

|

| Comprehensive | Actual Cash Value (ACV) | $150

|

| Replacement Cost Value (RCV) | $250

Figuring out how much Geico car insurance costs can be a bit of a puzzle, especially if you’re new to the whole insurance thing. But let’s say you’ve got your policy sorted and, unfortunately, you find yourself in a fender bender. Don’t worry, Geico’s got your back! You can report your accident quickly and easily by following these steps: How do I report a car accident with GEICO?. Once you’ve taken care of that, you can relax knowing that Geico’s got you covered, both in terms of your accident and your insurance costs.

|

Note:Premium ranges are estimates and can vary significantly based on individual factors such as age, driving history, vehicle type, and location.

Discounts and Savings with Geico

Geico is known for offering a wide array of discounts to help customers save on their car insurance premiums. These discounts can significantly reduce your overall cost, making Geico a more affordable option for many drivers. By understanding the different discounts available and how to qualify for them, you can potentially save hundreds of dollars annually.

Discounts Available with Geico

Geico offers a diverse range of discounts to cater to different situations and driving habits. These discounts can be applied individually or combined to maximize your savings. Here is a breakdown of some of the most common discounts:

- Good Driver Discount:This discount is awarded to drivers with a clean driving record, demonstrating responsible driving behavior. The discount percentage may vary depending on your driving history and the length of time you have been accident-free.

- Good Student Discount:Students who maintain a certain GPA (usually 3.0 or higher) can qualify for this discount. Geico recognizes that good students often exhibit responsible behavior, including safe driving habits.

- Multi-Car Discount:If you insure multiple vehicles with Geico, you can benefit from this discount. This discount is a reward for loyalty and signifies that you are a valued customer.

- Defensive Driving Course Discount:Completing a certified defensive driving course can demonstrate your commitment to safe driving practices and earn you a discount on your insurance premiums. These courses are designed to enhance your driving skills and awareness.

- Homeowner Discount:If you own a home and insure it with Geico, you may qualify for a discount on your car insurance. This discount reflects the overall lower risk associated with homeowners, as they tend to be more responsible individuals.

- Military Discount:Active military personnel, veterans, and their families may be eligible for a discount on their car insurance premiums. Geico recognizes the service and sacrifices made by those who serve in the military.

- Federal Employee Discount:Geico offers a discount to employees of the federal government, including those working for the U.S. Postal Service. This discount is a way to show appreciation for federal employees.

- Emergency Services Discount:If you work in emergency services, such as law enforcement, firefighting, or emergency medical services, you may be eligible for a discount. This discount recognizes the valuable contributions of these professionals.

- Other Discounts:Geico may offer additional discounts based on your specific circumstances, such as discounts for vehicle safety features, anti-theft devices, and membership in certain organizations.

Maximizing Savings with Geico Discounts

To maximize your potential savings with Geico discounts, consider the following tips:

- Review your eligibility for all available discounts:Go through the list of discounts offered by Geico and carefully assess whether you meet the eligibility criteria for each one. Don’t assume you don’t qualify without checking.

- Maintain a clean driving record:Avoid traffic violations and accidents to qualify for the good driver discount. Safe driving practices are crucial for keeping your premiums low.

- Enroll in a defensive driving course:Completing a certified defensive driving course can not only enhance your driving skills but also earn you a discount on your insurance premiums.

- Bundle your insurance policies:If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling them with Geico. You can often get a significant discount when you bundle your policies with the same insurer.

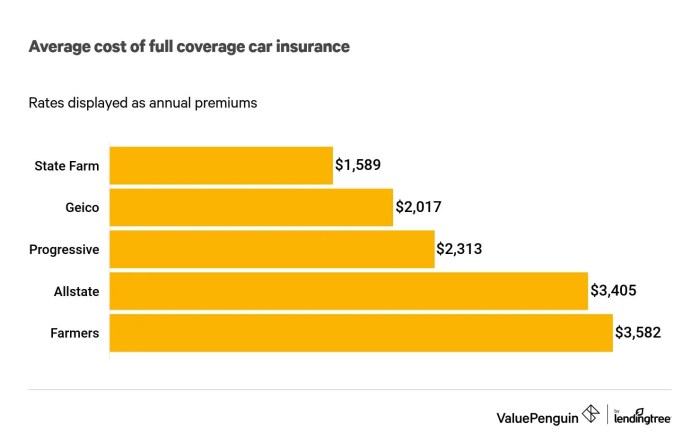

- Shop around for the best rates:While Geico is a reputable insurer, it’s always wise to compare quotes from other insurance companies to ensure you are getting the most competitive rates. Use online comparison tools or contact multiple insurers directly to obtain quotes.

Customer Reviews and Experiences

Understanding what real customers say about Geico is crucial when deciding if it’s the right insurance provider for you. Reviews offer valuable insights into the company’s strengths and weaknesses, helping you make an informed decision.

Customer Satisfaction with Geico

Geico generally receives positive customer reviews, with many praising its affordability, user-friendly website and mobile app, and straightforward claims process. However, like any insurance company, Geico also faces criticism, particularly regarding customer service and claims handling.

- Positive Reviews:Many customers highlight Geico’s competitive rates, often significantly lower than other providers. They appreciate the convenience of online and mobile services for managing policies and filing claims. Geico’s straightforward communication and clear explanations of coverage are also frequently mentioned as positive aspects.

- Negative Reviews:Some customers express frustration with long wait times for customer service and difficulty reaching a representative. There are also reports of challenges in getting claims approved or receiving timely payouts. Some users have reported issues with Geico’s online platform, including technical glitches and slow loading times.

Comparison with Other Insurance Providers

To get a comprehensive view of Geico’s customer service and claims handling, it’s essential to compare it with other leading insurance providers. While Geico often receives positive reviews for its affordability and user-friendly platform, some competitors may excel in specific areas, such as customer service responsiveness or claims processing speed.

- Progressive:Progressive is known for its innovative features, such as its “Name Your Price” tool that allows customers to set their desired premium and find coverage options accordingly. However, some users have reported difficulties navigating its website and experiencing long wait times for customer service.

- State Farm:State Farm is a well-established insurance company with a strong reputation for its customer service and claims handling. However, its rates are generally higher than Geico’s, making it less appealing for price-conscious customers.

- Allstate:Allstate offers a range of insurance products and services, including auto, home, and life insurance. While it has a good reputation for its claims handling, its rates are often higher than Geico’s, and its website and mobile app can be challenging to navigate.

Final Review

Understanding how much Geico car insurance costs is essential for making informed decisions about your financial well-being. By considering the factors that influence premiums, you can gain a clear picture of what to expect. Remember, getting a personalized quote from Geico is the best way to determine your exact costs.

With this information, you can compare rates, explore discounts, and ultimately choose the coverage that best suits your needs and budget. So, take the time to gather the necessary information and explore your options – you might be surprised by the savings you can find.

Popular Questions

What are the most common factors that influence Geico car insurance rates?

Your driving history, vehicle type, location, age, gender, and credit score are some of the most common factors that influence Geico car insurance rates.

How can I get a free Geico car insurance quote?

You can easily get a free quote online, over the phone, or by visiting a local Geico office.

What are some of the discounts Geico offers?

Geico offers a variety of discounts, including safe driver, good student, multi-car, and defensive driving discounts.

Is Geico’s customer service good?

Geico generally receives positive reviews for its customer service, but it’s always a good idea to check online reviews and compare experiences with other insurance providers.