How do I report a GEICO insurance claim? This question often arises when unexpected events happen, leaving you wondering about the next steps. From car accidents to home damage, navigating the claim process can feel overwhelming. But fear not! This guide will equip you with the knowledge and strategies to confidently file a claim and get the support you need.

We’ll explore the various types of GEICO insurance claims, including auto, homeowners, and renters. We’ll break down the common scenarios that trigger a claim, and provide a straightforward guide to determine if you need to file one. We’ll also cover the different methods for filing a claim, from online platforms to phone calls, and analyze their pros and cons.

Understanding GEICO Insurance Claims

Navigating insurance claims can be confusing, especially when you’re dealing with a large and reputable company like GEICO. This guide will help you understand the basics of GEICO insurance claims, from identifying the different types to knowing when and how to file one.

Types of GEICO Insurance Claims, How do I report a GEICO insurance claim

GEICO offers a variety of insurance products, and each comes with its own set of claims procedures. Understanding the different types of claims will help you navigate the process more effectively.

- Auto Insurance Claims:These are the most common type of claims filed with GEICO. They cover damages to your vehicle and injuries to you or others in the event of an accident. This can include claims for collision, comprehensive coverage, and liability coverage.

- Homeowners Insurance Claims:These claims cover damages to your home and personal belongings due to events like fire, theft, or natural disasters.

- Renters Insurance Claims:Similar to homeowners insurance, renters insurance covers your personal belongings and liability if you’re renting an apartment or house.

- Other Types of Claims:GEICO also offers specialized insurance products, such as motorcycle, boat, and umbrella insurance, each with its own claims procedures.

Common Scenarios Leading to Filing a Claim

Knowing when you need to file a claim is crucial. Here are some common scenarios that typically warrant filing a claim:

- Car Accidents:If you’re involved in an accident, regardless of fault, you should report it to GEICO. This includes minor fender benders and incidents involving property damage.

- Home Damage:If your home suffers damage from a covered event like fire, theft, or a natural disaster, you’ll need to file a claim to receive compensation for repairs or replacement.

- Personal Injury:If you’re injured in an accident covered by your insurance, you should file a claim to cover medical expenses and lost wages.

- Theft or Vandalism:If your belongings are stolen or vandalized, you’ll need to file a claim with GEICO to receive compensation for your losses.

Determining If You Need to File a Claim

It’s important to understand when a situation warrants filing a claim. Here’s a step-by-step guide:

- Assess the Situation:Carefully examine the damage or injury and determine if it’s covered by your insurance policy.

- Review Your Policy:Check your policy documents for specific coverage details and limitations.

- Contact GEICO:If you’re unsure whether to file a claim, contact GEICO directly. They can help you understand your coverage and guide you through the process.

- Consider the Costs:Weigh the potential costs of repairs or medical expenses against the deductible and potential increase in your premium.

- File a Claim:If you decide to file a claim, follow the instructions provided by GEICO. This usually involves providing details about the incident and any supporting documentation.

Filing a GEICO Insurance Claim

Filing a GEICO insurance claim is a straightforward process, and GEICO offers various methods to make it convenient for you. Whether you’re dealing with a car accident, property damage, or another covered event, understanding the different options available can help you choose the best approach for your situation.

Methods for Filing a Claim

You can file a GEICO insurance claim through multiple channels, each offering its own advantages and disadvantages.

Reporting a GEICO insurance claim can be a breeze! Just call their friendly customer service line, or if you’re feeling tech-savvy, you can file it online. But hey, you might be wondering, Is GEICO a real company ? Don’t worry, they’re as real as the fender bender you just had! Once you’ve reported your claim, they’ll be there to help you get back on the road in no time.

- Online:Filing a claim online through GEICO’s website is a quick and convenient option. You can access the claim form directly from your computer or mobile device, providing details about the incident and uploading relevant documents. This method allows you to file a claim at any time, 24/7, and track its progress online.

- Phone:Calling GEICO’s customer service line is another common way to file a claim. A representative will guide you through the process, asking for necessary information and documenting your claim. This method is helpful if you prefer a more personal touch or have questions about the claim process.

- Mobile App:GEICO’s mobile app offers a user-friendly interface for filing claims on the go. You can access the app from your smartphone or tablet, capturing photos of the damage, uploading documents, and tracking your claim progress. This method is ideal for those who prefer a mobile-first approach.

Comparison of Filing Methods

Here’s a table comparing the pros and cons of each method:

| Method | Pros | Cons |

|---|---|---|

| Online | Convenient, 24/7 access, track claim progress online | May require uploading documents, potential technical issues |

| Phone | Personal touch, immediate assistance, can ask questions | Limited hours of operation, may require waiting on hold |

| Mobile App | Convenient, accessible on the go, easy to upload photos | May require a stable internet connection, limited functionality compared to website |

Information Required for Filing a Claim

Regardless of the method you choose, you’ll need to provide GEICO with certain information to file your claim. This information typically includes:

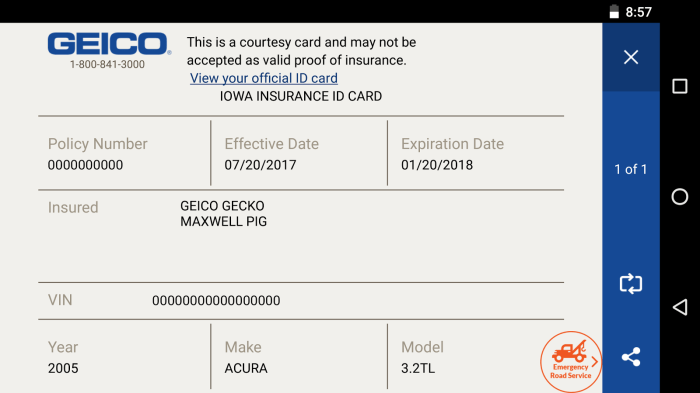

- Your policy information:This includes your policy number, the date your policy was issued, and your coverage details.

- Details about the incident:This includes the date, time, and location of the incident, as well as a description of what happened. If applicable, you’ll also need to provide information about the other parties involved.

- Details about the damage:This includes a description of the damage to your vehicle or property, along with any supporting documentation such as photos or repair estimates.

- Contact information:You’ll need to provide your contact information, including your name, address, phone number, and email address.

Closing Notes

Filing a GEICO insurance claim doesn’t have to be a stressful experience. By understanding the process, gathering the necessary information, and communicating effectively, you can navigate this journey with confidence. Remember, GEICO is there to support you during this time, so don’t hesitate to reach out with any questions or concerns.

Armed with this knowledge, you can face any insurance claim head-on and get the support you deserve.

FAQs: How Do I Report A GEICO Insurance Claim

What if I’m unsure if I need to file a claim?

It’s always best to err on the side of caution. Contact GEICO to discuss the situation. They can help you assess the damage and determine if a claim is necessary.

How long does it take for GEICO to process a claim?

The processing time varies depending on the complexity of the claim. However, GEICO strives to provide updates and progress reports throughout the process.

Can I track the status of my claim online?

Yes, GEICO offers online claim tracking through their website and mobile app, allowing you to monitor the progress of your claim.

What if my claim is denied?

If your claim is denied, you have the right to appeal the decision. GEICO will provide you with the necessary information and guidance on how to proceed.