Health insurance quotes are your roadmap to navigating the complex world of health coverage. They provide a snapshot of potential costs, allowing you to compare different plans and find the best fit for your needs and budget. But deciphering these quotes can feel like trying to read a foreign language, with terms like “deductible,” “co-pay,” and “out-of-pocket maximum” swirling around.

Fear not, because we’re here to break it all down in a way that’s easy to understand and, dare we say, even a little fun!

From understanding the factors that influence quote variations to exploring different methods for obtaining quotes, we’ll guide you through the entire process. We’ll also arm you with essential tips for maximizing quote accuracy and efficiency, ensuring you get the best possible coverage at a price that works for you.

So, buckle up, because this journey into the world of health insurance quotes is about to get exciting!

Understanding Health Insurance Quotes

Health insurance quotes are crucial for understanding the cost of coverage and finding a plan that fits your needs and budget. They provide a snapshot of the potential premiums you might pay for a specific health insurance policy.

Factors Influencing Health Insurance Quote Variations

Several factors contribute to the variations in health insurance quotes. These factors are crucial for understanding why different individuals receive different quotes for similar plans.

- Age:Generally, older individuals tend to have higher health insurance premiums because they are statistically more likely to require healthcare services.

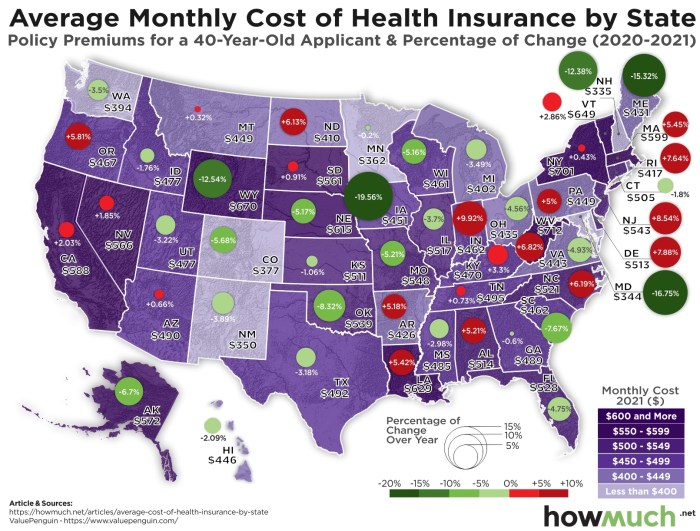

- Location:The cost of healthcare varies geographically, with some regions having higher medical expenses than others. This variation is reflected in health insurance premiums.

- Health Status:Individuals with pre-existing health conditions may face higher premiums as they are considered higher risk.

- Tobacco Use:Smokers typically pay higher premiums due to the increased risk of health issues associated with smoking.

- Plan Type:Different health insurance plans offer varying levels of coverage and benefits. For instance, plans with lower deductibles and copayments may have higher premiums compared to plans with higher deductibles.

- Coverage Level:Higher coverage levels, such as comprehensive plans with extensive benefits, tend to have higher premiums than plans with limited coverage.

- Family Size:Premiums for family plans are generally higher than individual plans due to the increased coverage for multiple individuals.

Components of a Health Insurance Quote

Health insurance quotes typically include the following key components:

- Monthly Premium:The amount you pay each month for your health insurance coverage.

- Deductible:The amount you pay out-of-pocket for healthcare services before your insurance coverage kicks in.

- Copayment:A fixed amount you pay for specific healthcare services, such as doctor visits or prescriptions, after meeting your deductible.

- Coinsurance:A percentage of the cost of healthcare services you pay after meeting your deductible.

- Out-of-Pocket Maximum:The maximum amount you will pay for healthcare services in a year, after which your insurance covers the remaining costs.

Obtaining Health Insurance Quotes

Getting health insurance quotes is the first step towards finding the right coverage for your needs and budget. But with so many options available, it can feel overwhelming to know where to start. Thankfully, there are several ways to obtain quotes, each with its own advantages and disadvantages.

Let’s explore the different methods and how to maximize their accuracy and efficiency.

Methods for Obtaining Quotes, Health insurance quotes

Knowing the different methods for obtaining quotes empowers you to choose the approach that best suits your preferences and circumstances.

- Online Quote Generators: Online platforms allow you to enter your information and receive instant quotes from multiple insurers. This method is convenient and efficient, offering a quick overview of available options.

- Phone Calls to Insurance Companies: Directly contacting insurance companies by phone provides an opportunity to speak with a representative and ask specific questions about their plans. This method allows for personalized guidance and clarification of any uncertainties.

- Working with a Broker: Insurance brokers act as intermediaries, comparing quotes from various insurers on your behalf. This method can be beneficial if you lack the time or expertise to navigate the insurance landscape independently.

Comparing the Methods

Each method for obtaining quotes has its own set of advantages and disadvantages.

| Method | Pros | Cons |

|---|---|---|

| Online Quote Generators | Convenient and efficient; allows for quick comparisons; often available 24/7. | May not provide personalized guidance; can be limited in the scope of information provided. |

| Phone Calls to Insurance Companies | Allows for personalized guidance and clarification of uncertainties; provides direct access to company representatives. | Can be time-consuming; may not offer a comprehensive comparison of options. |

| Working with a Broker | Offers expertise and guidance; simplifies the comparison process; can negotiate better rates on your behalf. | May involve additional fees; may not have access to all insurers. |

Maximizing Quote Accuracy and Efficiency

Obtaining accurate and efficient quotes is crucial for making informed decisions about your health insurance. Consider these tips to optimize the process:

- Be Honest and Thorough: Provide accurate information about your age, health status, location, and desired coverage.

- Compare Apples to Apples: Ensure you are comparing quotes for similar coverage levels and deductibles to avoid misleading comparisons.

- Explore Different Options: Don’t limit yourself to a single method for obtaining quotes. Explore online platforms, phone calls, and broker services to find the best fit for your needs.

- Read the Fine Print: Carefully review the terms and conditions of each quote, including coverage details, exclusions, and limitations.

- Ask Questions: Don’t hesitate to ask questions to clarify any uncertainties about the quotes you receive.

Key Considerations When Comparing Quotes

You’ve gathered a handful of health insurance quotes, and now it’s time to dive in and find the plan that best suits your needs. Comparing quotes isn’t just about finding the cheapest option; it’s about understanding the value each plan offers and how it aligns with your individual circumstances.

Coverage Levels and Deductibles

Coverage levels and deductibles are two key factors that significantly impact the cost and value of a health insurance plan. Understanding these elements is crucial for making an informed decision.

- Coverage Levels:This refers to the range of medical services covered by your insurance plan. A comprehensive plan will cover a wider array of services, including preventive care, hospitalization, surgery, and prescription drugs. A limited plan may only cover essential services like hospitalization and emergency care.

- Deductibles:The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means a lower monthly premium, but you’ll pay more upfront for medical expenses. A lower deductible means a higher monthly premium but less out-of-pocket expense when you need medical care.

Comparing Different Quote Scenarios

To illustrate the impact of coverage levels and deductibles, let’s compare two different quote scenarios:

| Scenario | Coverage Level | Deductible | Monthly Premium |

|---|---|---|---|

| Individual Plan | Comprehensive | $2,000 | $350 |

| Family Plan | Limited | $4,000 | $800 |

In this example, the individual plan offers comprehensive coverage with a lower deductible, but it also comes with a higher monthly premium. The family plan, while more affordable in terms of monthly premiums, has a limited coverage level and a higher deductible.

Remember: The ideal plan depends on your individual health needs, financial situation, and risk tolerance.

Understanding Quote Terminology

Health insurance quotes can seem confusing at first, but understanding the key terms is essential for making informed decisions. Let’s break down some of the most common terms you’ll encounter.

Common Health Insurance Terms

The terms used in health insurance quotes can be daunting, but understanding them is crucial for making informed decisions. Here’s a glossary of essential terms to help you navigate the process:

- Premium:This is the monthly amount you pay to your insurance company to maintain your coverage. Think of it as your recurring payment for the “peace of mind” of having health insurance.

- Deductible:This is the amount you need to pay out-of-pocket before your insurance coverage kicks in. Imagine it as a “threshold” you need to cross before your insurance starts covering costs.

- Co-pay:This is a fixed amount you pay for each medical service, such as a doctor’s visit or prescription. It’s like a small fee you pay for each service you receive.

- Co-insurance:This is a percentage of the medical costs you pay after your deductible has been met. It’s a way to share the costs with your insurance company.

- Out-of-Pocket Maximum:This is the maximum amount you’ll pay for medical expenses in a year. Once you reach this limit, your insurance company covers the rest of your costs for the remainder of the year.

Examples of Terminology in Action

To understand how these terms affect your overall costs, let’s consider a real-life example. Imagine you have a health insurance plan with a $1,000 deductible, a $20 co-pay for doctor visits, and a 20% co-insurance rate.If you need to see a doctor for a routine check-up, you’ll pay the $20 co-pay upfront.

However, if you need surgery that costs $10,000, you’ll first pay your $1,000 deductible. After that, your insurance company will cover 80% of the remaining $9,000, and you’ll pay the remaining 20% (which is $1,800) as your co-insurance.

If you have an out-of-pocket maximum of $5,000, you’ll only pay a maximum of $5,000 for medical expenses that year, even if your medical costs exceed that amount. Your insurance company will cover the rest.

Understanding these terms is crucial for making informed decisions about your health insurance coverage.

Factors Influencing Health Insurance Premiums

Understanding how health insurance premiums are calculated is crucial for making informed decisions about your coverage. Several factors play a significant role in determining the cost of your health insurance plan.

Age

Age is one of the most significant factors influencing health insurance premiums. Generally, older individuals tend to have higher premiums than younger individuals. This is because older individuals are statistically more likely to require healthcare services.

- As people age, they are more susceptible to chronic health conditions, leading to increased healthcare utilization and costs.

- Insurance companies use actuarial data to assess the risk associated with different age groups and adjust premiums accordingly.

Location

Your geographic location also plays a role in determining your health insurance premium. Premiums can vary based on factors such as:

- Cost of living: Areas with higher costs of living tend to have higher healthcare costs, which can translate to higher premiums.

- Availability of healthcare providers: Regions with a limited number of healthcare providers may experience higher premiums due to reduced competition.

- Prevalence of health conditions: Areas with a higher prevalence of certain health conditions may have higher premiums to reflect the increased risk.

Health Status

Your health status is a key factor influencing your health insurance premium. Individuals with pre-existing health conditions generally have higher premiums than those with no pre-existing conditions.

- Insurance companies assess your health history to determine the likelihood of you requiring healthcare services in the future.

- Individuals with chronic conditions, such as diabetes or heart disease, may face higher premiums due to the higher probability of incurring healthcare expenses.

Pre-existing Conditions

Pre-existing conditions are health issues you have before enrolling in a health insurance plan. These conditions can significantly impact your premiums.

- Insurance companies may charge higher premiums for individuals with pre-existing conditions because they are considered higher risk.

- The severity and complexity of the pre-existing condition can influence the premium increase.

Lifestyle Choices

Lifestyle choices, such as smoking, excessive alcohol consumption, and unhealthy eating habits, can also affect your health insurance premium.

- Individuals engaging in these habits are statistically more likely to develop health problems, leading to higher healthcare utilization and costs.

- Insurance companies may offer discounts for individuals who adopt healthy lifestyle habits, such as not smoking or maintaining a healthy weight.

Tips for Finding Affordable Health Insurance: Health Insurance Quotes

Navigating the world of health insurance can feel like a maze, especially when trying to find affordable coverage. However, with a bit of planning and savvy, you can secure a policy that fits your budget without sacrificing essential benefits.

Exploring Different Insurance Plans and Coverage Options

Understanding the various types of health insurance plans is crucial for making an informed decision. Each plan offers a different balance of cost and coverage, so carefully evaluating your needs and budget is key.

- Health Maintenance Organizations (HMOs):HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) within their network. You’ll need a referral from your PCP to see specialists.

- Preferred Provider Organizations (PPOs):PPOs provide more flexibility, allowing you to see providers outside their network, though it may cost more.

- Exclusive Provider Organizations (EPOs):EPOs are similar to HMOs, but with fewer restrictions on seeing specialists. You’ll usually need a referral from your PCP.

- Point of Service (POS) Plans:POS plans offer a blend of HMO and PPO features. You can see providers outside the network, but you’ll pay higher costs.

Leveraging Discounts and Financial Assistance Programs

Several avenues can help you reduce your health insurance premiums. Explore these options to maximize savings:

- Employer-Sponsored Plans:If you’re employed, check if your employer offers health insurance. Employer-sponsored plans often provide lower premiums and broader coverage.

- Government Subsidies:If you meet certain income requirements, you may qualify for government subsidies through the Affordable Care Act (ACA) Marketplace. These subsidies can significantly reduce your monthly premiums.

- Discounts:Some insurers offer discounts for healthy habits like non-smoking, maintaining a healthy weight, or participating in wellness programs.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurers is essential to ensure you’re getting the best deal.

- Online Comparison Tools:Websites like eHealth and HealthMarkets allow you to compare quotes from different insurers side-by-side.

- Directly Contact Insurers:You can also contact insurers directly to get personalized quotes.

- Independent Brokers:Independent insurance brokers can provide guidance and help you find the most suitable plan.

The Importance of Choosing the Right Coverage

Selecting the right health insurance coverage is crucial, as it directly impacts your financial well-being and access to healthcare. Choosing a plan that’s too limited could leave you with significant out-of-pocket expenses, while a plan that’s overly comprehensive might lead to higher premiums than necessary.

Consequences of Underinsured or Overinsured Plans

Understanding the potential consequences of choosing an underinsured or overinsured plan is essential for making informed decisions.

Underinsured Plans

- Higher Out-of-Pocket Costs:Underinsured plans often have high deductibles, copayments, and coinsurance, leading to substantial out-of-pocket expenses for medical services. This can be financially burdensome, especially for unexpected medical emergencies or chronic conditions.

- Limited Access to Care:Underinsured plans may restrict coverage for certain medical services, specialists, or treatments, limiting your access to necessary healthcare. This could delay diagnosis and treatment, potentially leading to more severe health complications.

- Financial Strain:Unexpected medical bills from underinsured plans can lead to financial stress and hardship, impacting your ability to manage other financial obligations.

Overinsured Plans

- Higher Premiums:Overinsured plans typically have higher premiums, as they cover a wider range of services and have lower deductibles and copayments. This can be a significant financial burden, especially if you rarely utilize the extensive coverage.

- Unnecessary Coverage:Overinsured plans might cover services you rarely use, leading to unnecessary expenses. This could be considered a waste of money, as you’re paying for coverage you may not need.

Factors to Consider When Selecting Coverage

Several factors should be considered when selecting the right coverage level:

- Health Status:Individuals with pre-existing conditions or chronic illnesses may require more comprehensive coverage to manage their health needs.

- Lifestyle and Health Habits:Individuals with active lifestyles or risky health habits may benefit from higher coverage to protect against potential injuries or health issues.

- Financial Situation:Your financial situation, including income and savings, should be considered when choosing a plan. A higher premium might be manageable for some, while others may need to prioritize affordability.

- Future Healthcare Needs:Consider your future healthcare needs, such as potential pregnancy, family planning, or anticipated medical expenses as you age.

- Coverage for Specific Services:Determine your specific healthcare needs and ensure the plan covers essential services, such as preventive care, prescription drugs, mental health services, and hospitalization.

Checklist for Evaluating Plan Options

To help you evaluate different plan options, consider using the following checklist:

- Deductible:The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copayments:Fixed amounts you pay for specific medical services, such as doctor’s visits or prescriptions.

- Coinsurance:Percentage of medical expenses you pay after reaching your deductible.

- Out-of-Pocket Maximum:The maximum amount you’ll pay for covered medical expenses in a year.

- Network:The doctors, hospitals, and other healthcare providers covered by your plan.

- Prescription Drug Coverage:The formulary (list of covered drugs) and copayments for prescriptions.

- Mental Health Coverage:The plan’s coverage for mental health services, including therapy and medication.

- Preventive Care Coverage:Coverage for preventive services, such as screenings and vaccinations.

- Customer Service:Evaluate the plan’s reputation for customer service and responsiveness.

Resources for Health Insurance Information

Navigating the world of health insurance can be overwhelming, but luckily, there are many resources available to help you make informed decisions. From government agencies to consumer protection organizations, you have access to a wealth of information to guide your search for the right coverage.

Government Agencies

Government agencies play a crucial role in regulating and providing information about health insurance. They offer valuable resources to help consumers understand their options and navigate the complexities of the insurance market.

- The Centers for Medicare & Medicaid Services (CMS):This agency administers Medicare and Medicaid, the federal health insurance programs for seniors, people with disabilities, and low-income individuals. CMS also oversees the Health Insurance Marketplace, where individuals and families can compare and purchase health insurance plans.

- The Department of Health and Human Services (HHS):This department oversees the nation’s health and human services programs, including health insurance.

HHS provides information on a variety of health topics, including health insurance, and offers resources to help consumers make informed decisions.

Consumer Protection Organizations

Consumer protection organizations are dedicated to protecting consumers’ rights and interests, including in the realm of health insurance. These organizations provide valuable information and advocacy to help consumers navigate the insurance market.

Finding the right health insurance quote can feel like a journey into the unknown, but it doesn’t have to be! Just like saying “Hello world!” marks the beginning of a new adventure, getting a quote is the first step to securing your health.

Check out Hello world! for a world of information, and then compare quotes to find the perfect plan for you.

- The National Association of Insurance Commissioners (NAIC):This organization represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. The NAIC provides resources for consumers, including information on insurance regulations, consumer complaints, and fraud prevention.

- The National Consumer Law Center (NCLC):This organization advocates for low- and moderate-income consumers on a variety of issues, including health insurance.

The NCLC provides resources and legal assistance to help consumers understand their rights and navigate the complexities of the insurance system.

Online Platforms and Tools

The internet provides a wealth of resources for researching health insurance plans. Several online platforms and tools can help you compare quotes, understand coverage options, and find the best plan for your needs.

- The Health Insurance Marketplace (Healthcare.gov):This website allows individuals and families to compare and purchase health insurance plans offered through the Affordable Care Act (ACA). The Marketplace provides information on plan options, costs, and subsidies.

- Insurance Comparison Websites:Several websites allow you to compare quotes from different insurance companies.

These websites can be a valuable tool for finding the best deal, but it’s important to compare plans carefully to ensure you’re getting the coverage you need.

- Consumer Reports:This organization provides independent reviews and ratings of products and services, including health insurance plans.

Consumer Reports can be a valuable resource for finding reliable information about insurance companies and plans.

Outcome Summary

Understanding health insurance quotes is a crucial step in securing your health and financial well-being. By arming yourself with knowledge and utilizing the resources available, you can confidently navigate the process and choose the plan that best meets your individual needs.

Remember, this isn’t just about numbers; it’s about finding peace of mind knowing you have the right coverage in place when you need it most. So, don’t hesitate to explore your options, ask questions, and make informed decisions about your health insurance.

Your future self will thank you for it!

Key Questions Answered

What is the difference between a deductible and a co-pay?

A deductible is the amount you pay out-of-pocket before your insurance starts covering costs. A co-pay is a fixed amount you pay for a specific service, like a doctor’s visit, even after meeting your deductible.

How often can I get a health insurance quote?

You can get a health insurance quote at any time, but you’ll typically only be able to enroll in a plan during open enrollment periods or if you have a qualifying life event.

What happens if I don’t have health insurance?

Not having health insurance can leave you vulnerable to significant financial hardship in case of a medical emergency. You could face hefty medical bills and penalties, making it crucial to have some form of coverage.