Cancer Insurance Plans offer a lifeline of financial security in the face of a devastating diagnosis. These plans provide crucial support, helping you navigate the medical, emotional, and financial challenges that come with cancer treatment. Whether you’re looking for coverage for medical expenses, income replacement, or a combination of both, cancer insurance can act as a safety net, allowing you to focus on your health and recovery without the added burden of financial worry.

Imagine a world where you don’t have to worry about the cost of treatments, lost wages, or the financial strain of managing your illness. Cancer insurance plans can make that a reality. By providing financial support, they empower you to focus on your well-being and receive the best possible care, knowing that your financial future is protected.

Understanding Cancer Insurance

Cancer insurance is a specialized type of health insurance designed to provide financial protection against the high costs associated with a cancer diagnosis and treatment. It offers a safety net for individuals and families facing the financial burden of cancer, ensuring access to necessary medical care without overwhelming debt.

Types of Cancer Insurance Plans

Cancer insurance plans come in various forms, each tailored to meet different needs and budgets. Understanding the different types helps you choose a plan that aligns with your specific requirements.

- Individual Cancer Insurance:This type of plan offers coverage to an individual, typically purchased independently. It provides a lump-sum benefit upon diagnosis, which can be used for various expenses, including treatment, medical bills, lost income, and daily living costs.

- Group Cancer Insurance:Often offered as an employee benefit, group cancer insurance provides coverage to a group of individuals, such as employees of a company. It typically offers lower premiums than individual plans, making it a cost-effective option for employers seeking to provide valuable benefits to their workforce.

- Critical Illness Insurance:This comprehensive plan covers various critical illnesses, including cancer. It offers a lump-sum benefit upon diagnosis, which can be used for a range of expenses related to the illness, including treatment, rehabilitation, and financial support.

Key Features and Benefits of Cancer Insurance

Cancer insurance plans offer a range of features and benefits designed to provide comprehensive financial support during a cancer diagnosis and treatment.

- Lump-Sum Benefit:Upon diagnosis, cancer insurance provides a lump-sum benefit that can be used for a wide range of expenses, including medical bills, treatment costs, lost income, and daily living expenses. This financial support alleviates the financial burden and ensures access to necessary medical care.

- Coverage for Various Stages:Most cancer insurance plans cover all stages of cancer, from early detection to advanced stages, providing financial security throughout the treatment journey.

- Waiver of Premium:This feature allows you to stop paying premiums if you are diagnosed with cancer. This ensures continued coverage without the added financial stress of premium payments during treatment.

- Coverage for Specific Treatments:Some plans offer coverage for specific treatments, such as chemotherapy, radiation therapy, or surgery, ensuring financial support for the most effective treatment options.

- Additional Benefits:Certain plans offer additional benefits, such as coverage for alternative therapies, second opinions, or palliative care, providing comprehensive support during the cancer journey.

Coverage and Benefits

Cancer insurance plans are designed to provide financial support during a challenging time. These plans offer a range of coverage and benefits to help you manage the financial burden associated with a cancer diagnosis and treatment.

Medical Expenses Coverage

Cancer insurance plans typically cover a wide range of medical expenses related to cancer treatment. This includes hospitalization costs, surgery fees, chemotherapy and radiation therapy, and other medical procedures. The specific medical expenses covered by a cancer insurance plan may vary depending on the policy.

Some common examples include:

- Hospitalization expenses: This includes room charges, nursing care, and other medical services provided during hospitalization.

- Surgery fees: This covers the cost of surgical procedures related to cancer treatment, such as tumor removal or reconstruction surgery.

- Chemotherapy and radiation therapy: These expenses cover the cost of medications, treatments, and associated services.

- Diagnostic tests: This includes the cost of tests used to diagnose cancer, such as biopsies, imaging scans, and blood tests.

- Home healthcare: This covers the cost of medical care provided at home, such as nursing services, physical therapy, and medication administration.

- Palliative care: This covers the cost of care provided to manage pain and symptoms related to cancer, improving the quality of life for the patient.

Income Replacement Benefit, Cancer insurance plans

Cancer insurance plans can also provide income replacement benefits, helping you maintain your financial stability during treatment. This benefit typically provides a monthly payment to compensate for lost income due to cancer-related illness or disability.

The income replacement benefit can be a lifeline for individuals who are unable to work due to their cancer treatment.

The amount of income replacement benefit varies depending on the policy and the individual’s income level. Some plans offer a fixed monthly amount, while others provide a percentage of the insured’s income.

Critical Illness Coverage

Cancer insurance plans often include critical illness coverage, which provides a lump sum payment upon diagnosis of a critical illness, such as cancer. This benefit can be used to cover various expenses, including medical bills, lost income, and other financial obligations.

The critical illness coverage provides a financial cushion during a challenging time, allowing individuals to focus on their health and recovery.

The amount of critical illness coverage varies depending on the policy and the type of critical illness. It is important to choose a plan with sufficient coverage to meet your individual needs.

Eligibility and Requirements: Cancer Insurance Plans

To secure cancer insurance, you need to meet specific eligibility criteria. These criteria are designed to ensure that the insurance company can accurately assess the risk associated with covering you. Understanding these requirements can help you make informed decisions about your insurance options.

Health and Lifestyle Factors

Insurance companies consider various factors related to your health and lifestyle when determining your eligibility. These factors help them assess your overall risk profile.

- Age:Insurance companies generally have age limits for eligibility. You may need to be within a specific age range to qualify for coverage. For example, a company might set a minimum age of 18 and a maximum age of 65 for new applicants.

- Health History:Your past medical history plays a crucial role in determining your eligibility. If you have a history of cancer or other serious illnesses, you may face limitations or higher premiums. However, some insurance plans might offer coverage even with pre-existing conditions, but with specific exclusions or higher premiums.

- Lifestyle Habits:Factors like smoking, excessive alcohol consumption, and unhealthy dietary habits can influence your eligibility and premiums. Insurance companies may consider these factors as they contribute to overall health risks.

- Family History:A family history of cancer can increase your risk, which may impact your eligibility or premiums. Insurance companies may ask about your family’s medical history to assess your potential risk.

Tips for Increasing Eligibility

You can improve your chances of getting approved for cancer insurance by taking proactive steps. These tips can enhance your overall health profile and make you a more attractive candidate for insurance companies.

- Maintain a Healthy Lifestyle:Engaging in regular exercise, maintaining a balanced diet, and avoiding smoking and excessive alcohol consumption can significantly improve your health and reduce your risk profile.

- Get Regular Health Checkups:Regular medical checkups can help identify any potential health issues early on, allowing for timely treatment and potentially improving your eligibility.

- Be Transparent with Your Medical History:Providing accurate and complete information about your medical history is crucial. Withholding information can lead to denial of coverage or even policy cancellation later.

- Compare Different Insurance Plans:Explore various insurance plans from different providers to find one that best suits your needs and health profile. Some insurers may have more lenient eligibility criteria or offer coverage tailored to specific health conditions.

Premium and Cost Factors

Cancer insurance premiums are calculated based on a variety of factors, aiming to ensure a fair balance between the risk of paying out claims and the cost of providing coverage. These factors are carefully considered to create a pricing structure that reflects individual circumstances and the potential for claims.

Factors Influencing Premium Costs

- Age: As individuals age, the likelihood of developing cancer increases, leading to higher premiums. This reflects the increased risk associated with older age groups.

- Health Status: Individuals with pre-existing conditions or a family history of cancer may face higher premiums. This reflects the greater risk of developing cancer in these individuals.

- Coverage Amount: The amount of coverage chosen, including the maximum benefit amount and the types of cancer covered, significantly influences the premium. Higher coverage levels generally lead to higher premiums.

- Plan Type: Different cancer insurance plans offer varying levels of coverage and benefits, influencing the premium. For example, plans with more comprehensive coverage or additional benefits, such as coverage for alternative therapies, tend to have higher premiums.

- Lifestyle Factors: Lifestyle choices, such as smoking, alcohol consumption, and diet, can impact the risk of developing cancer. Insurance companies may adjust premiums based on these factors.

- Geographic Location: Premiums can vary based on geographic location due to differences in healthcare costs and the prevalence of cancer in different areas.

Premium Range Examples

Here are some illustrative examples of premium ranges for different cancer insurance plans and coverage levels:

| Plan Type | Coverage Amount | Age | Approximate Monthly Premium |

|---|---|---|---|

| Basic Cancer Insurance | $100,000 | 40 | $50

|

| Comprehensive Cancer Insurance | $250,000 | 50 | $150

|

| Advanced Cancer Insurance | $500,000 | 60 | $300

|

It is important to note that these are just estimates and actual premiums may vary based on the specific factors mentioned earlier.

Claims Process and Procedures

Understanding the claims process is crucial for navigating your cancer insurance policy effectively. When you need to file a claim, knowing the steps involved can help you ensure a smooth and timely process.

Documentation Required

The documentation required for filing a claim varies depending on the specific insurance plan and the stage of your cancer treatment. However, common documents include:

- Policy details:Your policy number, effective date, and coverage details.

- Medical records:Diagnosis confirmation, treatment plan, and medical bills.

- Claim form:The insurer’s claim form, which is typically available online or through your insurance agent.

- Proof of payment:Receipts for medical expenses and other relevant costs.

- Other supporting documents:Depending on the specific claim, you may need additional documents like doctor’s notes, test results, or specialist reports.

Process for Receiving Benefits

Once you submit your claim with the required documentation, the insurer will review it to verify eligibility and coverage.

- Claim review:The insurer will assess the submitted documentation to ensure it meets the policy’s requirements and that the medical expenses are covered.

- Benefit determination:Based on the policy’s terms and conditions, the insurer will determine the amount of benefits payable for the covered expenses.

- Payment processing:Once the claim is approved, the insurer will process the payment to the beneficiary or directly to the healthcare providers, depending on the policy’s provisions.

Timelines for Claim Approval and Payment

The time it takes to process a claim varies depending on the complexity of the case and the insurer’s procedures.

Typical claim processing times range from a few weeks to a few months.

- Simple claims:Claims with straightforward documentation and clear coverage can be processed quickly, often within a few weeks.

- Complex claims:Claims involving multiple treatments, specialists, or pre-authorization requirements may take longer, potentially extending to several months.

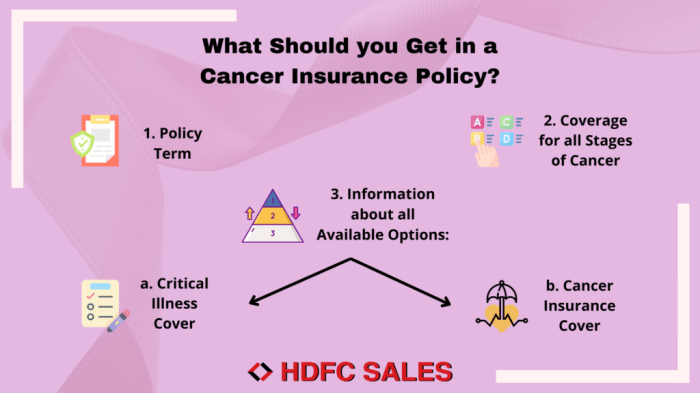

Choosing the Right Plan

Choosing the right cancer insurance plan is crucial to ensure you have the financial protection you need in case of a diagnosis. This decision requires careful consideration of your individual circumstances and financial goals.

Factors to Consider

It is important to carefully evaluate several factors when selecting a cancer insurance plan to ensure it aligns with your needs and budget.

- Coverage Amount:Determine the amount of coverage you require based on potential medical expenses, treatment costs, and your financial situation. Consider the average cost of cancer treatment in your area and the potential for long-term care.

- Types of Cancer Covered:Review the policy’s coverage for various types of cancer, including common and rare cancers. Some plans may have exclusions or limitations for specific types.

- Benefits Offered:Understand the range of benefits provided by the plan, such as lump-sum payments, critical illness coverage, and coverage for specific treatments or procedures.

- Premium Costs:Compare premiums from different insurers to find the most affordable option that fits your budget. Consider factors such as coverage amount, benefits, and age.

- Waiting Period:Check the waiting period before coverage kicks in. This period typically ranges from 30 to 90 days and can impact your ability to receive benefits immediately after diagnosis.

- Claims Process:Understand the insurer’s claims process, including required documentation and timelines for processing. Look for plans with streamlined procedures and transparent communication.

- Financial Stability of the Insurer:Research the financial stability of the insurance company to ensure they have a strong track record and are likely to be able to pay claims in the future.

Comparing Plans

To find the best cancer insurance plan for your needs, comparing different plans is essential.

- Use Online Comparison Tools:Utilize online comparison tools to quickly and easily compare plans from various insurers based on your specific requirements. These tools allow you to filter options by coverage amount, benefits, and premium costs.

- Read Policy Documents:Carefully review the policy documents of each plan you are considering. Pay close attention to the fine print, including exclusions, limitations, and terms and conditions.

- Seek Expert Advice:Consult with a financial advisor or insurance broker who specializes in cancer insurance. They can provide personalized guidance and help you navigate the complexities of choosing the right plan.

Ensuring the Plan Meets Your Needs

After comparing plans and considering your factors, ensure the chosen plan aligns with your individual needs and financial goals.

- Review Your Budget:Make sure the premium costs fit comfortably within your budget. Consider your income, expenses, and financial obligations.

- Assess Coverage Adequacy:Ensure the coverage amount is sufficient to cover potential medical expenses, treatment costs, and other financial needs. Consider the potential for long-term care and the possibility of rising healthcare costs.

- Understand the Benefits:Confirm that the plan provides the specific benefits you require, such as lump-sum payments, critical illness coverage, and coverage for specific treatments or procedures.

Advantages and Disadvantages

Cancer insurance, also known as critical illness insurance, offers financial protection against the devastating financial impact of a cancer diagnosis. While it can provide peace of mind and financial security during a challenging time, it’s crucial to understand both its advantages and potential drawbacks to make an informed decision.

Advantages of Cancer Insurance

Cancer insurance offers several significant benefits that can ease the financial burden and emotional stress associated with a cancer diagnosis.

- Financial Support for Treatment Costs:Cancer treatment can be incredibly expensive, with costs encompassing doctor visits, surgeries, chemotherapy, radiation therapy, and medications. Cancer insurance provides a lump-sum payout that can cover these expenses, alleviating financial strain on you and your family.

- Financial Security for Lost Income:Cancer treatment often requires time off work, leading to lost income. Cancer insurance can provide financial support during this period, ensuring that you can focus on your recovery without worrying about bills.

- Peace of Mind and Reduced Stress:Knowing you have financial protection against the costs of cancer treatment can provide peace of mind and reduce stress during an already challenging time. This allows you to focus on your health and well-being without the added burden of financial worries.

- Coverage for Specific Cancer Stages:Some cancer insurance plans offer coverage for specific cancer stages, such as early or advanced stages, providing targeted financial assistance for specific treatment needs.

- Flexibility in Using the Payout:The lump-sum payout from cancer insurance can be used for various expenses related to cancer treatment, including medical bills, alternative therapies, travel costs, or even living expenses. You have the flexibility to use the money as needed.

Disadvantages of Cancer Insurance

While cancer insurance offers significant benefits, it’s essential to consider its potential drawbacks as well.

- Limited Coverage:Cancer insurance typically covers only a specific list of cancers, and some plans may exclude certain types or stages of cancer. It’s crucial to review the policy carefully to understand the specific cancers covered.

- Premium Costs:Cancer insurance premiums can be expensive, especially for individuals with pre-existing conditions or a family history of cancer. It’s essential to compare premiums from different insurers and weigh the cost against the potential benefits.

- Potential for Overlap with Other Coverage:If you already have comprehensive health insurance that covers cancer treatment, the benefits of cancer insurance may overlap. It’s important to assess your existing coverage before purchasing cancer insurance.

- Limited Claim Success:The claims process for cancer insurance can be complex, and some claims may be denied due to policy limitations or specific medical conditions. It’s crucial to understand the claims process and policy terms before purchasing.

- Limited Duration of Coverage:Some cancer insurance plans have a limited duration of coverage, typically covering a specific period after diagnosis. It’s important to understand the coverage period and consider whether it aligns with your needs.

Alternatives to Cancer Insurance

Cancer insurance offers valuable financial protection in the face of a devastating diagnosis, but it’s not the only option available. Exploring alternative solutions can help you find the right coverage for your needs and budget.

Critical Illness Insurance

Critical illness insurance provides a lump-sum payout if you are diagnosed with a specific critical illness, including cancer. It offers flexibility in how you use the funds, whether it’s for medical expenses, lost income, or other needs.

- Advantages:

- Provides a lump-sum payment, offering financial flexibility.

- Covers a wider range of critical illnesses, not just cancer.

- Premiums are generally lower than cancer insurance.

- Disadvantages:

- May not cover all cancer stages or types.

- Benefits are paid out as a lump sum, which may not cover all long-term costs.

- The payout may be limited to a specific amount.

Health Insurance

Comprehensive health insurance plans typically cover cancer treatment costs, including hospitalization, surgery, chemotherapy, and radiation therapy.

- Advantages:

- Covers a wide range of medical expenses, including cancer treatment.

- Provides ongoing coverage for treatment, unlike critical illness insurance.

- May offer preventive care benefits, helping to detect cancer early.

- Disadvantages:

- Premiums can be higher than cancer insurance.

- May have coverage limitations or deductibles.

- May not cover all treatment costs, especially for advanced or rare cancers.

Savings Plans

Building a robust savings plan can provide financial security in the event of a critical illness. This can include emergency funds, retirement savings, or dedicated health savings accounts.

Cancer insurance plans are a smart move for anyone concerned about the financial burden of a diagnosis. But what about the long-term care needs that might arise after treatment? That’s where Long-term care insurance comes in, providing financial support for things like assisted living or home health care.

While cancer insurance focuses on the immediate fight, long-term care insurance helps you navigate the road to recovery and beyond.

- Advantages:

- Offers complete control over your finances.

- Provides flexibility in how you use the funds.

- Can help build a strong financial foundation for the future.

- Disadvantages:

- Requires disciplined saving habits and time to accumulate sufficient funds.

- May not be enough to cover all cancer-related costs.

- Can be impacted by market fluctuations or unexpected expenses.

Final Conclusion

In the end, cancer insurance isn’t just about financial protection; it’s about peace of mind. It’s about knowing that you and your loved ones have a safety net in place, giving you the strength and resilience to face whatever challenges lie ahead.

So, take the time to explore your options, compare plans, and choose the one that best fits your individual needs and financial goals. You’ll be glad you did.

Quick FAQs

How much does cancer insurance cost?

The cost of cancer insurance varies depending on factors like your age, health status, coverage amount, and the specific plan you choose. It’s best to get quotes from different insurers to compare prices.

What happens if I’m diagnosed with cancer after buying a policy?

Once you have a cancer insurance policy, you’ll be covered for the specified benefits if you’re diagnosed with cancer. The policy will Artikel the specific coverage and limitations.

Is cancer insurance worth it?

Whether cancer insurance is worth it depends on your individual circumstances and risk tolerance. If you’re concerned about the financial impact of a cancer diagnosis, it can provide valuable peace of mind and financial protection.