Auto insurance quotes are your key to unlocking the best possible coverage for your vehicle. But navigating the complex world of insurance can feel like driving through a maze! Understanding how quotes are calculated, what factors influence them, and how to compare them is crucial to finding the right policy for your needs and budget.

This guide will equip you with the knowledge to confidently navigate the insurance landscape and secure the best rates.

From exploring the impact of your driving history and vehicle type to understanding the different coverage options, we’ll break down the essential elements that shape your auto insurance quote. We’ll also delve into the various methods of obtaining quotes, whether it’s through online tools, insurance agents, or directly from insurance companies.

Ultimately, our goal is to empower you to make informed decisions about your auto insurance.

Understanding Auto Insurance Quotes

Auto insurance quotes are estimates of the cost of insuring your vehicle. They are crucial for comparing different insurance policies and finding the best coverage at the most affordable price. Understanding how these quotes are calculated and what factors influence them can empower you to make informed decisions about your auto insurance.

Factors Influencing Auto Insurance Quotes

Several factors play a role in determining your auto insurance quote. These factors are analyzed by insurance companies to assess your risk profile and calculate the premium you will pay.

- Your driving history:This includes your past accidents, traffic violations, and driving experience. Drivers with a clean record generally receive lower premiums than those with a history of accidents or violations.

- Your vehicle:The make, model, year, and safety features of your car affect your insurance costs. Newer vehicles with advanced safety features often have lower premiums due to their lower risk of accidents.

- Your location:Where you live influences your insurance rate. Areas with high crime rates, traffic congestion, and frequent accidents tend to have higher insurance premiums.

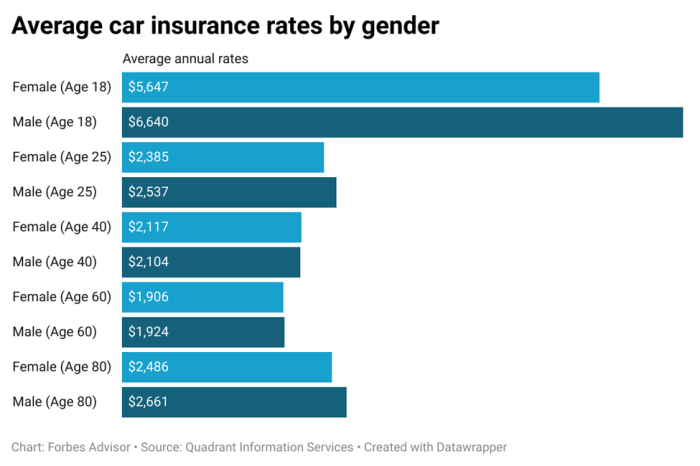

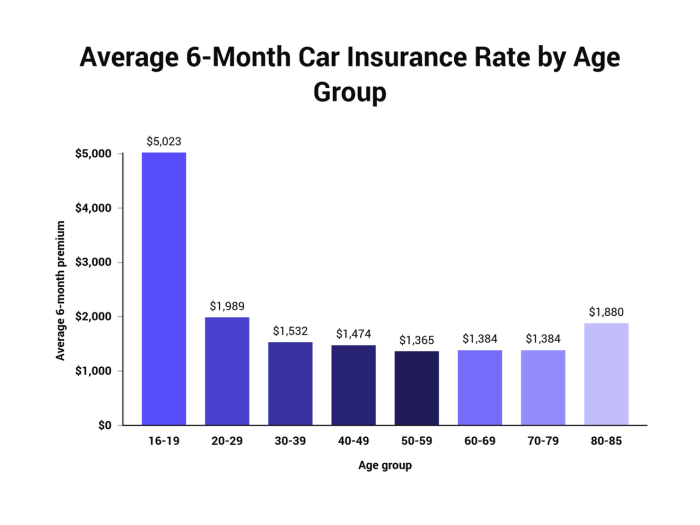

- Your age and gender:Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. Gender also plays a role, as certain studies have shown that males tend to have higher accident rates than females.

- Your credit score:In some states, insurance companies may consider your credit score as a factor in determining your premium. This is based on the idea that people with good credit are more financially responsible and therefore less likely to file claims.

- Your coverage options:The type and amount of coverage you choose will significantly impact your quote. Higher coverage limits, such as comprehensive and collision coverage, generally lead to higher premiums.

The Auto Insurance Quote Process

The process of obtaining an auto insurance quote involves several steps:

- Gather your information:You will need to provide personal details such as your name, address, date of birth, driving history, and vehicle information.

- Contact insurance companies:You can obtain quotes online, over the phone, or by visiting an insurance agent in person. Some websites allow you to compare quotes from multiple insurance companies simultaneously.

- Provide your information:Each insurance company will ask you to provide your personal and vehicle details. This information is used to generate your personalized quote.

- Review the quote:Carefully review the quote to understand the coverage options, premiums, and deductibles. Ensure you understand the terms and conditions of the policy.

- Compare quotes:Obtain quotes from several insurance companies to compare prices and coverage options. This allows you to find the best value for your needs.

- Choose a policy:Once you have compared quotes, select the policy that best suits your needs and budget. Make sure to read the policy document carefully before signing it.

Key Factors Affecting Auto Insurance Quotes

Your auto insurance premium isn’t just pulled out of thin air. It’s a carefully calculated amount based on a number of factors that insurance companies use to assess your risk as a driver. Let’s dive into the key factors that influence your auto insurance quote.

Vehicle Type and Make

The type and make of your vehicle play a significant role in determining your insurance premium. Insurance companies consider factors such as:

- Repair Costs:Cars with expensive parts or complex repair procedures will generally have higher insurance premiums. For example, luxury vehicles often have more expensive parts and labor costs, leading to higher repair bills in case of an accident.

- Safety Features:Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are considered safer and therefore may have lower premiums. Insurance companies often offer discounts for vehicles with these features.

- Theft Risk:Certain car models are more prone to theft than others. Vehicles with a higher theft risk will generally have higher insurance premiums.

Driving History and Experience

Your driving history is a crucial factor in determining your auto insurance premium. Insurance companies look at:

- Accidents:A history of accidents, even if they were not your fault, can significantly increase your premium. The severity of the accident and the number of claims filed will also be considered.

- Traffic Violations:Traffic violations, such as speeding tickets or reckless driving citations, indicate a higher risk of future accidents and can result in higher premiums.

- Years of Driving Experience:Drivers with more years of experience generally have lower premiums. This is because they are considered to be more experienced and less likely to be involved in accidents.

Location and Demographics

Where you live and your demographic information can also impact your auto insurance quote. Insurance companies consider:

- Population Density:Areas with high population density tend to have more traffic and a higher risk of accidents, which can lead to higher insurance premiums.

- Crime Rates:Areas with higher crime rates, especially vehicle theft, will generally have higher premiums.

- Weather Conditions:Regions with harsh weather conditions, such as heavy snow or frequent hailstorms, can increase the risk of accidents and lead to higher premiums.

- Age and Gender:Statistics show that younger drivers and males are more likely to be involved in accidents. Therefore, insurance premiums for these groups may be higher.

Coverage Levels and Deductibles

The amount of coverage you choose and your deductible also affect your premium.

- Coverage Levels:Higher coverage levels, such as comprehensive and collision coverage, provide more protection in case of an accident but will also result in higher premiums.

- Deductibles:A higher deductible, the amount you pay out of pocket before your insurance kicks in, will generally result in a lower premium.

Obtaining Auto Insurance Quotes

Now that you understand the factors that influence auto insurance quotes, it’s time to start getting quotes from different insurance companies. You have several options available to you, each with its own set of advantages and disadvantages. Let’s explore these options and guide you through the process of obtaining quotes.

Obtaining Quotes Online

Online platforms offer a convenient and efficient way to obtain auto insurance quotes. You can easily compare quotes from multiple insurance companies in one place. These platforms typically require you to provide basic information about yourself, your vehicle, and your driving history.

Here’s how you can obtain quotes online:

Visit a comparison website

Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from various insurance companies simultaneously.

Go directly to an insurance company’s website

Many insurance companies have user-friendly websites where you can request a quote online.

Use an insurance aggregator

These platforms, like Google or Amazon, gather quotes from various insurance companies based on your specific needs.

Obtaining Quotes Through Insurance Agents or Brokers

Insurance agents and brokers can be valuable resources when obtaining auto insurance quotes. They have access to a wider range of insurance companies and can help you navigate the process.

Insurance agents

Typically represent one insurance company and offer quotes for that specific company’s products.

Insurance brokers

Work with multiple insurance companies and can provide you with quotes from several providers.Here are some benefits of working with an agent or broker:

Personalized guidance

They can offer expert advice and help you find the best coverage for your needs.

Access to multiple companies

They can provide quotes from a broader range of insurers.

Assistance with the application process

They can help you complete the necessary paperwork and answer any questions you may have.

Requesting Quotes Directly from Insurance Companies

You can also request quotes directly from individual insurance companies. This approach allows you to gather information and compare policies before making a decision.Here’s a step-by-step guide to requesting quotes directly from insurance companies:

1. Gather your information

Collect your driver’s license, vehicle registration, and any other relevant documents.

2. Visit the insurance company’s website

Go to the website of the insurance company you’re interested in.

3. Start the quote process

Look for a “Get a Quote” or “Request a Quote” button.

4. Provide your information

Fill out the online form with your personal and vehicle details.

5. Review the quote

Carefully examine the quote and compare it to other offers you’ve received.

Navigating the world of auto insurance quotes can feel like a labyrinth, but don’t worry, you’re not alone! Just like saying “Hello world!” Hello world! is the first step in programming, comparing quotes is the first step in finding the right coverage for your needs.

So, take a deep breath, grab a coffee, and let’s dive into the exciting world of auto insurance quotes!

6. Contact the insurance company

If you have any questions or need clarification, contact the company directly.

Analyzing and Comparing Auto Insurance Quotes

You’ve gathered several auto insurance quotes, but now what? This is where the real work begins. You need to carefully analyze each quote to determine which offers the best value for your specific needs. This involves more than just comparing prices; you need to understand the coverage, terms, and conditions of each policy.

Key Factors to Consider When Comparing Quotes

To help you make an informed decision, here’s a table outlining key factors to consider when comparing quotes:

| Factor | Description |

|---|---|

| Coverage Options | Compare the types of coverage offered by each insurer, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. |

| Deductibles | Understand the deductible amounts for each type of coverage and how they impact your out-of-pocket expenses in case of an accident. |

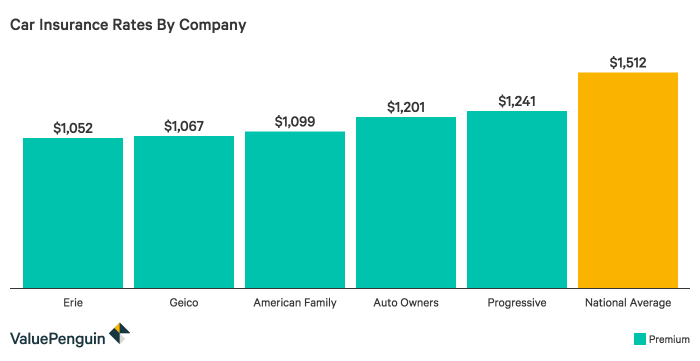

| Premiums | Compare the monthly or annual premium costs, considering factors like discounts and payment options. |

| Policy Limits | Check the maximum amount of coverage available for each type of coverage and ensure it meets your needs. |

| Discounts | Inquire about available discounts for safe driving, good credit, multiple vehicles, and other factors. |

| Customer Service | Research each insurer’s reputation for customer service, claims handling, and overall satisfaction. |

| Financial Stability | Consider the insurer’s financial strength and ability to pay claims in the event of a major accident. |

Evaluating Quote Details and Coverage Options, Auto insurance quotes

Once you have a good understanding of the key factors to consider, you can use a checklist to evaluate quote details and coverage options:

- Coverage Types:Do the coverage options offered meet your specific needs? For example, if you have a new car, comprehensive coverage might be essential.

- Deductibles:Are the deductibles affordable for you? Higher deductibles generally mean lower premiums, but you’ll pay more out-of-pocket in case of an accident.

- Premiums:Compare the premiums for similar coverage levels and make sure you understand any discounts or fees.

- Policy Limits:Are the policy limits high enough to cover your potential losses in case of an accident? Consider the value of your vehicle and potential liability costs.

- Discounts:Have you been offered all available discounts? Ask about discounts for safe driving, good credit, multiple vehicles, and other factors.

- Customer Service:Check reviews and ratings to assess the insurer’s reputation for customer service and claims handling.

- Financial Stability:Research the insurer’s financial strength to ensure they can pay claims if needed.

Understanding Policy Terms and Conditions

It’s crucial to carefully review the policy terms and conditions before making a decision. This includes:

- Exclusions:Understand what situations or events are not covered by the policy. For example, some policies may exclude coverage for certain types of accidents or damage.

- Limitations:Be aware of any limitations on coverage amounts or timeframes. For instance, there may be a limit on the amount of coverage for rental car reimbursement.

- Cancellation Policies:Understand the insurer’s cancellation policy and any associated fees.

- Dispute Resolution:Familiarize yourself with the process for resolving disputes or making claims.

Tips for Negotiating Quotes and Securing the Best Rates

While you can’t always negotiate the price of insurance, there are ways to improve your chances of getting a better rate:

- Shop Around:Get quotes from multiple insurers to compare prices and coverage options.

- Bundle Policies:Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, for potential discounts.

- Improve Your Credit Score:A good credit score can often lead to lower premiums.

- Ask About Discounts:Inquire about all available discounts, such as safe driver, good student, or multi-car discounts.

- Negotiate Deductibles:Consider increasing your deductibles to lower your premiums, but make sure you can afford the higher out-of-pocket costs in case of an accident.

- Review Your Policy Regularly:Review your policy annually to ensure you have the right coverage and that your premiums are still competitive.

Auto Insurance Quote Resources

Finding the right auto insurance policy involves more than just comparing prices. It’s crucial to understand the coverage options and factors that influence premiums. Thankfully, numerous resources are available to help you navigate this process.

Reputable Websites for Free Online Auto Insurance Quotes

Many websites offer free online auto insurance quote tools, allowing you to compare prices from multiple insurers without leaving your home. Here are a few reputable options:

- The Zebra:This website aggregates quotes from over 100 insurance companies, providing a comprehensive comparison.

- Insurify:Similar to The Zebra, Insurify compares quotes from various insurers, highlighting potential savings and offering personalized recommendations.

- Policygenius:This platform focuses on personalized insurance advice, comparing quotes from various providers and offering expert guidance.

- NerdWallet:This website provides detailed information about different insurance companies, including their coverage options and customer reviews.

- Bankrate:This site offers a range of financial tools, including auto insurance quote comparisons, helping you find the best deals.

Benefits of Using Comparison Websites

Comparison websites offer several benefits when searching for auto insurance quotes:

- Convenience:You can obtain quotes from multiple insurers in minutes, saving you time and effort.

- Transparency:Comparison websites display quotes side-by-side, allowing you to easily compare prices and coverage options.

- Potential Savings:By comparing quotes, you can identify insurers offering competitive rates and potentially save money on your premiums.

Resources for Learning About Insurance Terminology and Concepts

Understanding insurance terminology is essential for making informed decisions about your coverage. Here are some resources that can help:

- Insurance Information Institute (III):This organization provides comprehensive information about insurance, including definitions of key terms and explanations of different types of coverage.

- National Association of Insurance Commissioners (NAIC):The NAIC offers resources for consumers, including information about insurance regulations and consumer protection.

- Your State Insurance Department:Each state has a dedicated insurance department that provides information about insurance companies operating in the state, consumer rights, and complaint resolution.

Trusted Insurance Companies and Their Services

Here’s a table of some trusted insurance companies and their services:

| Insurance Company | Services Offered |

|---|---|

| State Farm | Auto, Home, Life, Health, Business Insurance |

| Geico | Auto, Motorcycle, Homeowners, Renters, Condo, Boat, RV, Commercial Insurance |

| Progressive | Auto, Home, Motorcycle, Boat, RV, Commercial Insurance |

| Allstate | Auto, Home, Life, Renters, Condo, Business Insurance |

| Liberty Mutual | Auto, Home, Life, Business Insurance |

Final Conclusion

Armed with this knowledge, you can confidently compare quotes, negotiate rates, and secure the best auto insurance coverage for your needs. Remember, the process of finding the right policy doesn’t have to be daunting. By taking the time to understand your options and exploring the resources available, you can find a policy that provides peace of mind and fits your budget perfectly.

FAQ Insights

How often should I get new auto insurance quotes?

It’s a good idea to get new quotes at least once a year, especially if your driving record has improved, you’ve made changes to your vehicle, or you’ve moved to a new location.

What is a credit-based insurance score, and how does it affect my quote?

A credit-based insurance score is a numerical representation of your credit history, which some insurance companies use to assess your risk. A higher score typically results in lower premiums, while a lower score may lead to higher premiums.

Can I bundle my auto insurance with other types of insurance for a discount?

Yes, many insurance companies offer discounts for bundling multiple types of insurance, such as home, renters, or life insurance, with your auto insurance.