Accidental death insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with entertaining interactive style and brimming with originality from the outset. Accidental death insurance, a specialized form of coverage, provides financial support to your loved ones in the unfortunate event of your death due to an accident.

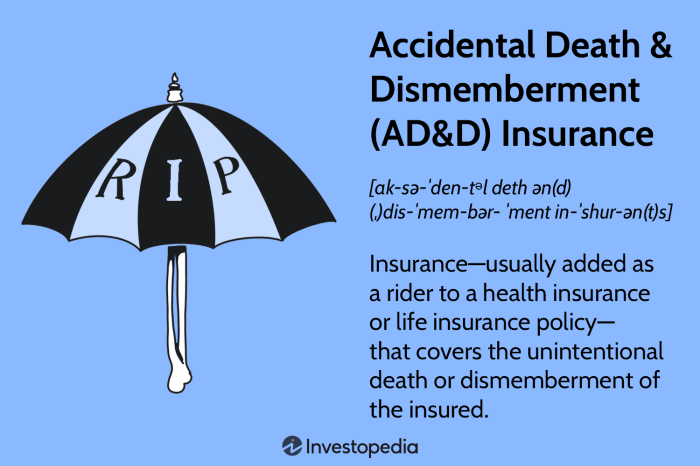

Unlike traditional life insurance, which covers death from any cause, accidental death insurance focuses specifically on accidents, offering a lump sum payment to help your family navigate the financial challenges that may arise.

Imagine this: You’re out for a bike ride, enjoying a beautiful day, when an unexpected accident occurs. Accidental death insurance acts as a safety net, ensuring that your family isn’t left with the added burden of financial strain during a difficult time.

This type of insurance can be particularly valuable for individuals with dependents, those with significant debts, or those who want to provide their loved ones with a financial cushion in the event of an unforeseen tragedy.

Accidental Death Insurance

Accidental death insurance is a type of coverage that pays out a lump sum benefit to your beneficiaries if you die as a result of an accident. It is designed to provide financial protection for your loved ones in the event of an unexpected and untimely death.

Accidental Death Insurance vs. Life Insurance

Accidental death insurance is different from traditional life insurance in several key ways. Life insurance provides a death benefit regardless of the cause of death, while accidental death insurance only pays out if the death is the result of an accident.

- Accidental death insurance typically has a lower payout than life insurance, as it only covers a specific type of death.

- Accidental death insurance premiums are generally lower than life insurance premiums, because the risk of accidental death is lower than the risk of death from any cause.

- Accidental death insurance policies often have a shorter coverage period than life insurance policies, with some policies only lasting for a few years.

Situations Covered by Accidental Death Insurance

Accidental death insurance policies typically cover a wide range of accidents, including:

- Car accidents

- Plane crashes

- Drowning

- Falls

- Poisoning

- Electrocution

- Fire

- Natural disasters

It’s important to note that accidental death insurance policies may have specific exclusions, such as death caused by suicide, self-inflicted injuries, or pre-existing conditions. It is crucial to carefully review the policy details and understand the specific coverage provided.

Types of Accidental Death Insurance

Accidental death insurance policies come in various forms, each offering distinct coverage and benefits. Understanding these differences can help you choose the policy that best suits your needs and financial situation.

Types of Accidental Death Insurance Policies

There are several types of accidental death insurance policies available, each with unique characteristics and coverage.

Accidental death insurance can be a lifesaver for your loved ones, but what about your business? Don’t let a tragedy leave your company vulnerable – consider Business insurance to protect your assets and ensure continuity. Just like accidental death insurance safeguards your family, business insurance provides a safety net for your company, protecting against unexpected events and helping you weather the storm.

- Stand-alone Accidental Death and Dismemberment (AD&D) Insurance:This type of policy provides a lump-sum payment if you die or experience a covered dismemberment due to an accident. It’s typically a separate policy from your life insurance and offers a limited benefit. For example, if you are injured in a car accident and lose a limb, the policy may provide a specific payout for the loss of the limb.

- Accidental Death Benefit Rider:This rider is an add-on to your existing life insurance policy, providing an additional payout if your death results from an accident. It’s generally less expensive than a standalone AD&D policy, but the payout is usually smaller. The payout from this rider is added to the death benefit of your life insurance policy.

For example, if your life insurance policy has a death benefit of $100,000 and you have an accidental death benefit rider for $50,000, your beneficiaries will receive $150,000 in the event of your accidental death.

- Accidental Death and Dismemberment Coverage as Part of a Group Policy:Some employers offer accidental death and dismemberment coverage as part of their group health insurance plan. This coverage is typically less expensive than individual policies and offers a lower payout. The benefit is often a percentage of your annual salary, and the coverage is usually limited to accidents that occur while you’re at work.

For example, if your employer offers a group AD&D policy with a benefit of 1 times your annual salary, and your annual salary is $50,000, your beneficiaries would receive $50,000 in the event of your accidental death.

Coverage Comparison, Accidental death insurance

Each type of accidental death insurance policy offers different levels of coverage. Here’s a breakdown:

| Type of Policy | Coverage | Benefits |

|---|---|---|

| Stand-alone AD&D Insurance | Covers death or dismemberment due to accidents | Lump-sum payout for death or dismemberment |

| Accidental Death Benefit Rider | Provides additional payout for accidental death | Increased death benefit payout |

| Group AD&D Coverage | Covers death or dismemberment due to accidents, typically limited to work-related accidents | Lump-sum payout for death or dismemberment, usually based on a percentage of salary |

Specific Features and Benefits

In addition to the basic coverage, some accidental death insurance policies offer additional features and benefits:

- Double Indemnity:Some policies offer double indemnity, which doubles the payout if your death results from a specific type of accident, such as a car accident or a plane crash. For example, if your policy has a $100,000 death benefit and includes double indemnity for car accidents, your beneficiaries would receive $200,000 if you died in a car accident.

- Trip Insurance:Some policies offer trip insurance, which provides coverage for accidental death or dismemberment while you’re traveling. This can be especially helpful for people who frequently travel for work or pleasure. For example, if you are traveling abroad and have a trip insurance policy, the policy may cover your medical expenses and other costs if you are injured in an accident while traveling.

- Accidental Death and Dismemberment Benefits for Specific Activities:Some policies offer additional benefits for specific activities, such as skydiving or scuba diving. These benefits may be higher than the standard benefit, as these activities are considered higher risk. For example, if you are a skydiver and have an AD&D policy that covers skydiving, the policy may provide a higher payout in the event of an accident while skydiving.

Benefits of Accidental Death Insurance

Accidental death insurance provides financial protection for your loved ones in the event of your unexpected passing due to an accident. This type of insurance can be a valuable asset, offering a financial safety net for your family during a difficult time.

Financial Protection

Accidental death insurance provides a lump-sum payout to your beneficiaries upon your death due to an accident. This payout can help cover various expenses, such as:

- Funeral costs: These expenses can be significant, ranging from a few thousand dollars to tens of thousands depending on the type of service desired.

- Outstanding debts: This includes mortgages, loans, credit card debt, and other financial obligations.

- Living expenses: This can help your family cover everyday expenses like rent, utilities, groceries, and transportation.

- Education costs: If you have children, this payout can help ensure their future education is secure.

Benefits for Families and Loved Ones

Accidental death insurance can provide significant support for your family in the event of your death.

- Financial stability: The payout from accidental death insurance can help your family maintain their financial stability, reducing the burden of debt and allowing them to focus on grieving and adjusting to their new reality.

- Peace of mind: Knowing your family is financially protected in the event of an accident can give you peace of mind and allow you to focus on your daily life without worrying about their financial future.

- Reduced stress: The financial burden of unexpected expenses is significantly reduced, allowing your family to focus on healing and moving forward.

Peace of Mind

Accidental death insurance offers peace of mind, knowing that your family will be financially protected in the event of your unexpected passing due to an accident.

- Security for loved ones: This type of insurance ensures your family’s financial security, allowing them to navigate the challenges of your absence without facing overwhelming financial strain.

- Focus on grieving: The financial burden is lifted, allowing your family to focus on healing and adjusting to their new reality without worrying about financial stability.

- Protection against unforeseen events: Accidents can happen unexpectedly, and accidental death insurance provides a safety net to protect your family from the devastating financial impact of such events.

Eligibility and Requirements

Most people are eligible to purchase accidental death insurance. However, there are some factors that may affect your eligibility and the cost of your premiums.

Eligibility Criteria

Generally, most individuals in good health can purchase accidental death insurance. Insurance companies often consider factors like:* Age:There are usually age limits for eligibility, with most insurers accepting applications from individuals between 18 and 70 years old.

Health

Individuals with pre-existing health conditions may face restrictions or higher premiums.

Occupation

Some occupations, like those involving high risks, may have higher premiums or even be excluded from coverage.

Lifestyle

Individuals engaging in high-risk activities, like skydiving or mountain climbing, may be subject to limitations or exclusions.

Factors Influencing Premium Costs

The cost of your accidental death insurance premium can vary based on several factors:* Age:Younger individuals typically pay lower premiums than older individuals.

Health

Individuals with a good health history often enjoy lower premiums than those with pre-existing conditions.

Coverage Amount

The amount of coverage you choose directly impacts the premium. Higher coverage means higher premiums.

Occupation

High-risk occupations usually lead to higher premiums due to the increased likelihood of accidents.

Lifestyle

Individuals participating in dangerous hobbies or activities often face higher premiums.

Common Exclusions and Limitations

Accidental death insurance policies typically exclude certain situations, including:* Suicide:Accidental death insurance policies generally don’t cover deaths resulting from suicide.

Self-inflicted injuries

Injuries intentionally caused by the insured person are not covered.

Pre-existing conditions

Deaths caused by pre-existing health conditions are often excluded.

War or acts of terrorism

Coverage may be limited or excluded for deaths occurring during war or terrorist attacks.

Certain activities

Some policies may exclude coverage for specific activities, such as extreme sports or dangerous hobbies.

It’s essential to carefully read the policy details and understand the exclusions and limitations before purchasing accidental death insurance.

Claim Process and Considerations

The claim process for accidental death insurance is designed to be straightforward, but it’s essential to understand the steps involved and the documentation required for a successful claim. This section will guide you through the process, highlighting key considerations to ensure a smooth experience.

Claim Filing Procedure

Following an accidental death, the beneficiary or designated representative should initiate the claim process by contacting the insurance company.

- The insurance company will provide a claim form, which must be completed with accurate and detailed information about the deceased, the incident, and the policy details.

- The claim form typically requires information such as the policy number, the deceased’s name, date of birth, and the date and cause of death.

- It’s crucial to submit all required documentation, including a copy of the death certificate, police report, and any other relevant medical records.

Documentation Requirements

The documentation required for an accidental death insurance claim varies depending on the insurance company and the specific circumstances of the death. However, some common documents include:

- Death Certificate:This official document verifies the deceased’s identity and cause of death.

- Police Report:This document provides details about the accident and the circumstances surrounding the death.

- Medical Records:These records document the deceased’s medical history and the treatment received before and after the accident.

- Autopsy Report:If an autopsy was performed, this report provides a detailed examination of the cause of death.

- Witness Statements:Statements from individuals who witnessed the accident can be crucial in establishing the cause of death.

Claim Process Challenges

While the claim process is generally straightforward, there are potential challenges that may arise:

- Determining the Cause of Death:If the cause of death is unclear or disputed, the insurance company may require additional investigation to verify the claim.

- Pre-existing Conditions:If the deceased had pre-existing conditions that may have contributed to the death, the insurance company may deny the claim or reduce the payout.

- Policy Exclusions:Accidental death insurance policies typically have exclusions, such as deaths caused by suicide or self-inflicted injuries.

- Timely Submission:Filing a claim within the specified timeframe is crucial, as delays may result in the claim being denied.

- Fraudulent Claims:Insurance companies are vigilant about fraudulent claims and may investigate any suspicious activity.

Claim Process Considerations

To ensure a smooth and successful claim process, it’s essential to:

- Understand Your Policy:Review your policy carefully to understand the coverage, exclusions, and claim procedures.

- Maintain Accurate Records:Keep all relevant documentation, including the policy, death certificate, and medical records, organized and readily accessible.

- Communicate Effectively:Contact the insurance company promptly and provide all required information and documentation.

- Seek Legal Advice:If you encounter difficulties with the claim process or believe your claim has been unfairly denied, consider seeking legal advice from an experienced insurance attorney.

Comparing Accidental Death Insurance Providers

Choosing the right Accidental Death Insurance provider is crucial to ensure you get the best coverage and value for your money. Several factors should be considered, such as coverage options, premium costs, customer reviews, and the provider’s financial stability.

Comparing Key Features and Benefits

This section provides a comparison of various Accidental Death Insurance providers, highlighting their key features and benefits.

| Provider Name | Coverage Options | Premium Costs | Customer Reviews | Reputation and Financial Stability |

|---|---|---|---|---|

| Provider A | [List coverage options offered by Provider A] | [Provide information on premium costs, including factors that influence them] | [Summarize customer reviews from reliable sources, mentioning positive and negative aspects] | [Describe Provider A’s reputation in the industry and its financial stability, referencing any relevant ratings or reports] |

| Provider B | [List coverage options offered by Provider B] | [Provide information on premium costs, including factors that influence them] | [Summarize customer reviews from reliable sources, mentioning positive and negative aspects] | [Describe Provider B’s reputation in the industry and its financial stability, referencing any relevant ratings or reports] |

| Provider C | [List coverage options offered by Provider C] | [Provide information on premium costs, including factors that influence them] | [Summarize customer reviews from reliable sources, mentioning positive and negative aspects] | [Describe Provider C’s reputation in the industry and its financial stability, referencing any relevant ratings or reports] |

Importance of Financial Planning

Financial planning is crucial for securing your family’s future and ensuring their well-being, especially in the face of unforeseen events. Accidental death insurance can be a vital component of a comprehensive financial plan, providing a financial safety net for your loved ones in the event of your untimely demise.

Importance of Other Insurance Policies

It’s essential to consider other insurance policies alongside accidental death insurance to create a robust financial plan. This holistic approach ensures that your family is protected against a wide range of risks.

- Life Insurance:Life insurance provides a death benefit to your beneficiaries regardless of the cause of death. This policy serves as a fundamental pillar of financial planning, ensuring your family has the resources to cover expenses like mortgage payments, living costs, and education.

- Health Insurance:Health insurance protects you and your family from the financial burden of medical expenses. This policy is essential for covering the costs of treatment, hospitalization, and other healthcare services, ensuring that your family can access necessary medical care without facing financial hardship.

- Disability Insurance:Disability insurance provides income replacement if you become unable to work due to an illness or injury. This policy safeguards your family’s financial stability during a time when your earning capacity is compromised, preventing financial strain during a difficult period.

Determining Appropriate Coverage Amount

Determining the appropriate coverage amount for your accidental death insurance policy requires careful consideration of your individual circumstances and financial needs. A comprehensive assessment of your family’s financial obligations and future aspirations is crucial.

- Outstanding Debts:Consider the amount of outstanding debt you have, such as mortgage payments, student loans, and credit card balances. The death benefit should be sufficient to cover these debts and prevent your family from being burdened by them.

- Living Expenses:Estimate your family’s annual living expenses, including housing, food, utilities, transportation, and healthcare. The death benefit should provide enough funds to cover these expenses for a reasonable period, allowing your family to maintain their standard of living.

- Future Goals:Consider your family’s future goals, such as your children’s education, retirement savings, or other financial aspirations. The death benefit should be sufficient to help your family achieve these goals without facing financial constraints.

A good rule of thumb is to have a death benefit that is at least 10 times your annual income. However, this is just a general guideline, and the appropriate coverage amount will vary based on your individual circumstances.

Conclusion: Accidental Death Insurance

Accidental death insurance provides a safety net for your loved ones in the unfortunate event of your untimely demise due to an accident. It offers a financial cushion to help cover funeral expenses, outstanding debts, and ongoing living costs, ensuring your family’s financial stability during a difficult time.

Key Takeaways and Considerations

Accidental death insurance is a valuable addition to your overall financial plan, but it’s essential to carefully consider its benefits and limitations. Here’s a summary of key takeaways and considerations:

- Benefits: Accidental death insurance provides a lump-sum payout to your beneficiaries upon your death due to an accident, offering financial security and peace of mind. It can help cover various expenses, such as funeral costs, outstanding debts, and ongoing living costs.

- Limitations: Accidental death insurance policies typically have specific exclusions and limitations, such as pre-existing conditions or certain types of accidents. It’s crucial to thoroughly review the policy terms and conditions before making a decision.

- Importance of Professional Advice: Seeking advice from a qualified financial advisor is essential when considering any type of insurance, including accidental death insurance. A financial advisor can help you assess your individual needs, compare different policy options, and determine if this type of insurance is right for you.

Ultimate Conclusion

Accidental death insurance is a powerful tool for financial planning, offering peace of mind and a safety net for your loved ones. It’s important to consider your individual needs and circumstances when determining if this type of coverage is right for you.

By understanding the benefits, types, and intricacies of accidental death insurance, you can make informed decisions about protecting your family’s financial future. Remember, life is unpredictable, but with the right insurance plan, you can navigate the unexpected with confidence.

Quick FAQs

What are some common exclusions in accidental death insurance policies?

Exclusions can vary, but common ones include death caused by pre-existing conditions, suicide, or death due to illegal activities.

How much accidental death insurance do I need?

The amount depends on your individual circumstances, including your income, debts, dependents, and desired level of coverage. It’s wise to consult a financial advisor to determine the right amount for you.

Can I purchase accidental death insurance online?

Yes, many insurance providers offer online quotes and purchase options for accidental death insurance.