General Liability Insurance, your business’s safety net, acts as a shield against a wide range of potential risks. Imagine this: a customer trips on a loose floorboard in your store, a delivery driver accidentally damages a client’s property, or a disgruntled customer files a lawsuit for slander.

These are just a few examples of situations where General Liability Insurance can step in and provide financial protection, helping you navigate these tricky situations with ease.

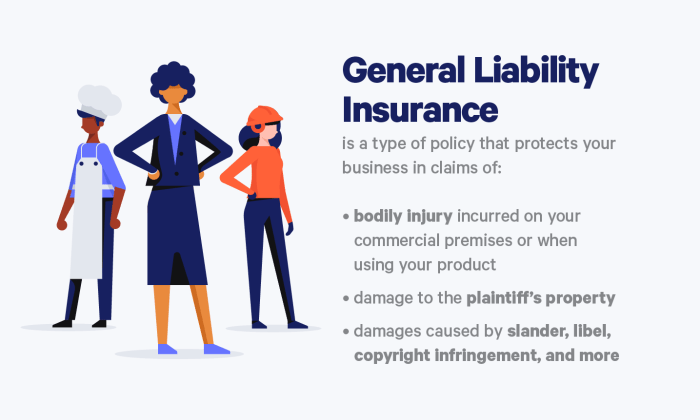

General Liability Insurance covers a variety of risks, including bodily injury, property damage, personal and advertising injury. It’s a crucial tool for businesses of all sizes, offering peace of mind and financial security in the face of unexpected events.

What is General Liability Insurance?

Imagine running a successful business, only to face a lawsuit due to an unexpected accident on your premises. This is where general liability insurance comes in, acting as a safety net for your business. It provides financial protection against a wide range of risks, helping you navigate potential legal and financial challenges.

General Liability Insurance: A Definition

General liability insurance is a crucial type of coverage that safeguards businesses against financial losses arising from third-party claims related to property damage, bodily injury, or personal and advertising injury. It acts as a shield, protecting your business from the potential costs of lawsuits, settlements, and legal defense fees.

Common Risks Covered by General Liability Insurance

General liability insurance provides protection against a variety of common risks that businesses may encounter. Here are some examples:

- Bodily Injury:This covers claims arising from injuries sustained by a third party on your premises or as a result of your business operations. For instance, if a customer slips and falls on a wet floor in your store, general liability insurance can cover the costs associated with their medical expenses and potential legal claims.

- Property Damage:This covers claims for damage to a third party’s property caused by your business operations or negligence. For example, if your business accidentally causes a fire that damages a neighboring building, general liability insurance can help cover the repair costs.

- Personal and Advertising Injury:This covers claims related to libel, slander, copyright infringement, and other forms of defamation or false advertising. If your business is accused of making false statements about a competitor’s product, general liability insurance can provide financial protection.

Key Coverages of General Liability Insurance

General liability insurance provides businesses with crucial protection against financial losses arising from various risks associated with their operations. A standard general liability insurance policy typically includes a range of coverages designed to safeguard businesses from potential liabilities.

Bodily Injury and Property Damage Liability Coverage, General liability insurance

This coverage is the cornerstone of general liability insurance. It protects businesses against claims for bodily injury or property damage caused by their operations or negligence. This coverage extends to injuries sustained by third parties on the business premises, as well as damages to property belonging to others.

For instance, if a customer slips and falls on a wet floor in your store, this coverage would help pay for medical expenses, legal fees, and any damages resulting from the accident.

Personal and Advertising Injury Coverage

This coverage safeguards businesses against claims arising from personal and advertising injuries. Personal injury refers to non-physical injuries, such as libel, slander, false arrest, or invasion of privacy. Advertising injury includes claims related to copyright infringement, misappropriation of advertising ideas, or unfair competition.

For example, if your business accidentally uses a competitor’s slogan in an advertisement, this coverage would help cover legal expenses and any settlements.

Who Needs General Liability Insurance?

General liability insurance is not just for large corporations; it’s a vital safety net for many businesses, protecting them from financial ruin in the face of unexpected liability claims. It’s essential to understand who needs this coverage and why.

Businesses in a wide range of industries can benefit from general liability insurance. This is because it offers protection against a broad spectrum of risks, including bodily injury, property damage, and even reputational harm. The level of risk varies significantly across different industries, making some more susceptible to liability claims than others.

Industries Typically Requiring General Liability Insurance

Many industries are more prone to liability risks due to the nature of their operations or interactions with customers. These industries are highly recommended to have general liability insurance to mitigate potential financial burdens from lawsuits or claims.

- Construction:Construction sites are inherently dangerous environments, increasing the likelihood of accidents and injuries. Contractors, subcontractors, and other construction professionals need general liability insurance to protect themselves from claims arising from accidents, injuries, or property damage.

- Healthcare:Medical negligence, misdiagnosis, and treatment errors can lead to serious legal issues and significant financial repercussions. Healthcare providers, including hospitals, clinics, and doctors, require general liability insurance to safeguard against malpractice lawsuits.

- Retail:Retail businesses are constantly interacting with customers and handling merchandise, increasing the risk of slip-and-fall accidents, product liability claims, or other incidents that could result in injury or damage.

- Restaurants:Food poisoning, slips, and falls are common risks in restaurants. General liability insurance protects restaurant owners from claims arising from these incidents, as well as claims related to customer injuries or property damage.

- Professional Services:Professionals like lawyers, accountants, and consultants can be held liable for errors or omissions that lead to financial losses for their clients. General liability insurance provides a safety net for these professionals in case of negligence or malpractice claims.

- Event Planning:Event planners are responsible for the safety and well-being of attendees at events they organize. General liability insurance protects them from claims related to accidents, injuries, or property damage that occur during events.

- Real Estate:Property owners, landlords, and real estate agents can be held liable for injuries or property damage that occur on their properties. General liability insurance provides protection against these claims.

- Transportation:Businesses involved in transportation, including trucking companies and taxi services, face a high risk of accidents and injuries. General liability insurance protects them from claims related to accidents, injuries, or property damage.

Examples of Scenarios Where General Liability Insurance Is Crucial

It’s not always easy to predict when a liability claim might arise, but it’s important to be prepared. Here are some common scenarios where general liability insurance can be invaluable:

- A customer slips and falls in your store:This is a common occurrence in retail settings, and the injured customer could sue your business for medical expenses, lost wages, and pain and suffering. General liability insurance will cover your legal defense costs and any settlements or judgments.

- A contractor damages a customer’s property while working on a project:This can happen in a variety of industries, such as construction, plumbing, or electrical work. General liability insurance will cover the cost of repairs or replacements, as well as any legal expenses.

- A customer alleges that they were injured by a product you sold:Product liability claims can be very costly, and general liability insurance will protect you from these claims.

- You are sued for defamation or libel:This can happen if you make a false statement about someone that damages their reputation. General liability insurance will cover your legal defense costs and any settlements or judgments.

- You are accused of copyright infringement:This can happen if you use someone else’s copyrighted material without permission. General liability insurance will cover your legal defense costs and any settlements or judgments.

Understanding Policy Limits and Exclusions

General liability insurance policies have specific limits and exclusions that determine the extent of coverage. Understanding these aspects is crucial for policyholders to avoid surprises and ensure adequate protection.

Policy Limits

Policy limits define the maximum amount an insurance company will pay for covered losses. These limits are usually expressed as a dollar amount per occurrence or per policy period.

For instance, a policy with a $1 million per occurrence limit will pay up to $1 million for a single covered incident, while a policy with a $2 million aggregate limit will pay up to $2 million for all covered incidents during the policy period.

Knowing the policy limits helps businesses understand their financial exposure and determine if they have adequate coverage.

The Claims Process

The claims process is the mechanism by which you, as the policyholder, can access the coverage provided by your general liability insurance policy. This process is designed to ensure that you receive the financial protection you need in the event of a covered claim.

Steps Involved in Filing a Claim

The claims process typically involves the following steps:

- Notify your insurer immediately.Once you become aware of a potential claim, it’s crucial to contact your insurer promptly. This allows them to begin the investigation process and gather relevant information.

- Provide details of the incident.Your insurer will need a detailed account of the incident that led to the claim. This includes information such as the date, time, location, and circumstances of the incident.

- Cooperate with the insurer’s investigation.Your insurer will likely conduct an investigation to verify the details of the claim and determine its validity. This may involve interviewing witnesses, reviewing documents, and obtaining evidence.

- Negotiate a settlement.If the claim is deemed valid, your insurer will work with you to negotiate a settlement. This involves determining the amount of compensation you are entitled to receive.

- File a lawsuit if necessary.In some cases, the parties may not be able to reach a settlement agreement. If this happens, the injured party may file a lawsuit against you. Your insurer will then handle the legal defense on your behalf.

The Role of the Insurer in Handling and Investigating Claims

Your insurer plays a vital role in the claims process. They are responsible for:

- Investigating claims.Insurers have dedicated claims adjusters who are trained to investigate claims thoroughly and fairly. They will gather evidence, interview witnesses, and assess the validity of the claim.

- Negotiating settlements.If the claim is valid, the insurer will work with you and the injured party to negotiate a settlement. This may involve paying a cash settlement, providing medical payments, or covering other expenses.

- Defending against lawsuits.If a lawsuit is filed against you, your insurer will handle the legal defense. This includes hiring an attorney, preparing for trial, and negotiating a settlement or defending the case in court.

Negotiating Settlements and Defending Against Lawsuits

The process of negotiating settlements and defending against lawsuits can be complex. Your insurer will work with you to:

- Evaluate the claim.The insurer will assess the strength of the claim and the potential liability you face. This will help them determine the appropriate course of action.

- Negotiate with the injured party.The insurer will attempt to reach a settlement with the injured party that is fair and reasonable to both sides. This may involve offering a cash settlement, providing medical payments, or covering other expenses.

- Prepare for trial.If a settlement cannot be reached, the insurer will prepare for trial. This includes gathering evidence, interviewing witnesses, and preparing legal arguments.

- Represent you in court.If the case goes to trial, the insurer will represent you in court. This includes presenting evidence, arguing your case, and negotiating with the other party.

It’s important to note that your insurer’s role in the claims process is to protect your interests and minimize your financial exposure. They will work to resolve claims fairly and efficiently, while also protecting you from unnecessary legal expenses.

Factors Influencing Premium Costs

The cost of general liability insurance premiums is influenced by several factors. These factors are considered by insurance companies to assess the risk associated with your business and determine the premium you will pay.

Business Size

The size of your business plays a significant role in determining your premium. Larger businesses generally face a higher risk of lawsuits and claims, resulting in higher premiums. This is because larger businesses typically have more employees, operate in more locations, and handle more transactions, all of which can increase the likelihood of accidents or incidents leading to claims.

For example, a small retail store with a handful of employees might have a lower premium compared to a large corporation with thousands of employees operating in multiple states.

Industry

The industry your business operates in is another crucial factor. Certain industries are inherently riskier than others. For example, construction companies, manufacturing facilities, and healthcare providers face higher risks of accidents and injuries, leading to higher premiums. In contrast, businesses in low-risk industries like retail or services may have lower premiums.

Risk Profile

Your business’s risk profile, which includes factors like safety practices, training programs, and previous claims history, can significantly influence your premium. Businesses with strong safety measures and a low claims history are considered lower risk and may receive lower premiums.

Conversely, businesses with poor safety records or a history of frequent claims are considered higher risk and may face higher premiums.

Claims History

Your business’s claims history is a critical factor in determining your premium. Insurance companies use your past claims experience to assess your risk. Businesses with a history of frequent or large claims are considered higher risk and may face higher premiums.

Conversely, businesses with a clean claims history are considered lower risk and may qualify for lower premiums.

Safety Measures

Implementing effective safety measures can significantly reduce your premium. Businesses that demonstrate a commitment to safety through training programs, safety audits, and accident prevention measures are considered lower risk and may receive lower premiums.

Importance of Coverage for Small Businesses

Small businesses are the backbone of the American economy, contributing significantly to job creation and overall economic growth. However, they often face unique challenges, including limited resources and a higher risk of financial instability. General liability insurance plays a crucial role in mitigating these risks and ensuring the long-term sustainability of small businesses.

Financial and Legal Consequences of Operating Without Coverage

Operating a small business without general liability insurance can expose the business owner to significant financial and legal consequences.

- Financial Loss:A single lawsuit, even if unfounded, can lead to substantial legal fees, settlements, and potential damage awards. These costs can cripple a small business, leading to bankruptcy or closure.

- Legal Liability:Without general liability insurance, business owners are personally liable for any damages or injuries caused by their business operations. This can include claims arising from customer injuries, property damage, or even defamation.

- Reputation Damage:A lawsuit or negative publicity can severely damage a small business’s reputation, leading to lost customers and revenue.

Real-World Scenarios Where General Liability Insurance Protected Small Businesses

- Customer Injury:A customer slips and falls in a restaurant, resulting in a broken leg. The restaurant’s general liability insurance covers the medical expenses and legal fees associated with the claim, preventing the owner from facing financial ruin.

- Property Damage:A construction company accidentally damages a nearby building during a renovation project. The general liability insurance covers the cost of repairs, protecting the company from significant financial loss.

- Defamation:A small business owner is sued for libel after making a false statement about a competitor. The general liability insurance covers the legal fees and potential settlement costs, protecting the business owner from personal liability.

General Liability Insurance and Legal Compliance

General liability insurance plays a crucial role in protecting businesses from financial losses arising from various legal liabilities. Beyond financial protection, it also helps businesses navigate the complex legal landscape and fulfill their legal obligations.

Legal Requirements for General Liability Insurance

In many jurisdictions, general liability insurance is not mandatory for all businesses. However, certain industries or types of businesses are legally required to carry general liability insurance. These requirements often stem from regulations aimed at protecting consumers, employees, or the general public.For instance:

- Construction Companies:Many states mandate general liability insurance for construction companies to protect against potential injuries or property damage caused during construction projects.

- Healthcare Providers:Hospitals, clinics, and other healthcare facilities are often required to carry general liability insurance to cover potential medical malpractice claims or other liabilities arising from patient care.

- Professional Service Providers:Lawyers, accountants, and other professional service providers may be required to have general liability insurance to cover errors or omissions in their professional services.

Meeting Legal Obligations with General Liability Insurance

General liability insurance can help businesses meet their legal obligations in various ways:

- Protecting Against Lawsuits:General liability insurance provides financial protection against lawsuits arising from bodily injury, property damage, or other liabilities. This coverage can help businesses avoid significant financial losses and potential business disruptions.

- Compliance with Contracts:Many contracts, including leases, vendor agreements, and construction contracts, require businesses to carry a specific amount of general liability insurance. General liability insurance ensures compliance with these contractual obligations, preventing potential legal disputes or breaches.

- Satisfying Regulatory Requirements:Certain industries or businesses are subject to specific regulations that require them to carry general liability insurance. General liability insurance helps businesses comply with these regulations and avoid fines or penalties.

Examples of Legal Penalties for Lack of Coverage

Failing to meet legal requirements for general liability insurance can lead to various consequences, including:

- Fines and Penalties:Regulatory bodies may impose fines or penalties on businesses that operate without the required general liability insurance.

- License Revocation:In some cases, lack of general liability insurance can lead to the revocation of business licenses or permits, effectively shutting down operations.

- Contractual Disputes:Failure to meet contractual obligations regarding general liability insurance can lead to legal disputes, potential breaches of contract, and financial losses.

- Increased Liability:In the absence of general liability insurance, businesses may be held personally liable for damages or injuries, putting their personal assets at risk.

General Liability Insurance for Specific Industries

General liability insurance is a crucial aspect of risk management for businesses across various sectors. Understanding the unique risks and coverage needs of each industry is essential to tailor insurance policies effectively. This section will explore how general liability insurance applies to different industries, highlighting key risks, coverage recommendations, and real-life examples.

General liability insurance is your safety net, protecting you from lawsuits arising from accidents or injuries on your property. But what about your own health? Don’t forget to secure your well-being with a solid health insurance plan! Check out health insurance quotes to find the right coverage for you.

Just like general liability, a good health insurance plan can provide peace of mind, knowing you’re protected in case of unexpected medical expenses.

General Liability Insurance for Specific Industries

General liability insurance policies can be customized to meet the specific needs of various industries. The following table Artikels the unique risks, coverage recommendations, and illustrative scenarios for some key industries:

| Industry | Key Risks | Coverage Recommendations | Example Scenarios |

|---|---|---|---|

| Healthcare |

|

|

|

| Construction |

|

|

|

| Retail |

|

|

|

Tips for Choosing the Right Policy: General Liability Insurance

Navigating the world of general liability insurance can feel overwhelming, but with a little preparation, you can find the perfect policy to protect your business. Here’s a guide to help you make informed decisions.

Comparing Quotes

Obtaining quotes from multiple insurance providers is crucial for finding the best value. Each insurer has different risk assessments and pricing structures, so comparing quotes allows you to identify the most competitive options.

“Don’t settle for the first quote you get. Shop around and compare at least three to five different insurers.”

Evaluating Policy Options

Once you have a few quotes, carefully evaluate the policy details to ensure you understand the coverage provided.

- Policy Limits:The maximum amount the insurer will pay for a single claim or during the policy period. Higher limits generally translate to higher premiums.

- Deductibles:The amount you pay out-of-pocket before the insurer covers the remaining costs. Higher deductibles usually result in lower premiums.

- Exclusions:Specific events or circumstances not covered by the policy. Carefully review the exclusions to ensure they align with your business operations.

- Coverage Types:Some policies offer additional coverages, such as product liability or advertising injury. Determine if these add-ons are necessary for your specific needs.

Understanding Your Business Needs

Before you start comparing quotes, take time to assess your business’s specific risks.

- Industry:Certain industries face higher risks than others. For example, construction companies might need higher liability limits than a retail store.

- Operations:The nature of your business operations will influence the types of risks you face. A company that handles hazardous materials will need different coverage than a software development firm.

- Location:Your business’s geographic location can impact your risk profile. For example, a business in a high-crime area might require additional coverage.

- Employees:The number of employees you have and their job responsibilities can affect your liability exposure. Larger companies with more employees generally have higher risks.

Seeking Expert Advice

Don’t hesitate to consult with an insurance broker or agent for guidance. They can help you understand the intricacies of general liability insurance and tailor a policy to your specific needs.

“An experienced broker can act as your advocate and ensure you have the right coverage in place.”

Last Point

In today’s world, where lawsuits are a constant threat, General Liability Insurance is more than just a policy, it’s a strategic investment in your business’s future. By securing this essential coverage, you’re safeguarding your assets, protecting your reputation, and ensuring that your business can weather any storm that comes its way.

Question & Answer Hub

What happens if I have a claim?

If you need to file a claim, your insurer will guide you through the process, investigate the claim, and handle negotiations with the other party.

Do I need General Liability Insurance if I work from home?

Even if you work from home, you may still need General Liability Insurance, especially if you meet clients or operate a business from your residence.

How much does General Liability Insurance cost?

The cost of General Liability Insurance varies depending on factors like your business size, industry, risk profile, and claims history.