How do I cancel my GEICO insurance policy – Canceling your GEICO insurance policy might seem daunting, but it’s actually a pretty straightforward process. Whether you’re switching to a different provider, selling your car, or simply don’t need coverage anymore, we’ll guide you through the steps to ensure a smooth transition.

Let’s explore the different ways to cancel your policy, the paperwork involved, and what to expect after you’ve made the decision.

We’ll delve into the details of cancellation fees, the impact on your future premiums, and even explore alternative options like suspending your policy instead of canceling it altogether. So, if you’re ready to bid farewell to GEICO, read on and let’s get this done!

Understanding GEICO Cancellation Policies

Canceling your GEICO insurance policy might be necessary for various reasons, such as switching to a different insurer, selling your vehicle, or simply deciding you no longer need coverage. It’s important to understand the process and potential implications before making a decision.

Reasons for Canceling a GEICO Policy

There are several reasons why you might need to cancel your GEICO insurance policy. Understanding these reasons will help you determine the best course of action for your situation.

- Switching to a Different Insurer:If you find a better rate or coverage options with another insurer, you may decide to switch. In this case, you’ll need to cancel your GEICO policy before your new insurance policy takes effect.

- Selling Your Vehicle:When you sell your vehicle, you no longer need insurance for it. You can cancel your GEICO policy once the sale is complete.

- No Longer Needing Coverage:If you no longer own a vehicle or no longer need insurance for other reasons, you can cancel your policy. For example, if you’re retiring and no longer driving, you may choose to cancel your insurance.

- Moving to a New State:If you’re moving to a new state, you might need to switch to an insurer that operates in that state. In this case, you’ll need to cancel your GEICO policy before your move.

- Policy Changes:If GEICO makes changes to your policy that you’re not happy with, you may decide to cancel your policy. For example, if they increase your premium significantly or reduce your coverage.

Cancellation Fees

GEICO may charge cancellation fees depending on the reason for cancellation and the specific policy terms. These fees are usually Artikeld in your policy documents.

- Short-Term Cancellation:If you cancel your policy before the end of your policy term, you may be charged a prorated premium for the remaining time. This is because you’re essentially paying for coverage you’re not using.

- Administrative Fees:GEICO may also charge a small administrative fee for processing your cancellation request.

- Late Payment Cancellation:If you cancel your policy due to non-payment, you may be charged a late payment fee, in addition to the prorated premium.

Impact on Future Premiums

Canceling your GEICO policy can potentially affect your future insurance premiums, depending on the reason for cancellation and your insurance history.

- Cancellation for Non-Payment:Canceling your policy due to non-payment can negatively impact your insurance history. Future insurers may view this as a risk factor and charge you higher premiums.

- Frequent Cancellations:If you frequently cancel your insurance policies, it can be seen as a sign of instability, and future insurers may charge you higher premiums.

- Switching to a Different Insurer:If you cancel your GEICO policy to switch to a different insurer, it’s unlikely to have a significant impact on your future premiums, as long as you maintain a good driving record and pay your premiums on time.

Cancellation Methods

You have several options for canceling your GEICO insurance policy. The method you choose will depend on your individual circumstances and preferences.

Canceling Online, How do I cancel my GEICO insurance policy

GEICO makes it easy to cancel your policy online. Here’s how:

- Log in to your GEICO account.You’ll need your policy number and email address to access your account.

- Navigate to the “My Policies” section.This is where you can manage your existing policies.

- Select the policy you want to cancel.

- Follow the prompts to cancel your policy.You’ll be asked to provide a reason for cancellation and confirm your request.

- Review and submit your cancellation request.GEICO will send you a confirmation email once your policy has been canceled.

Canceling by Phone

If you prefer to speak with a GEICO representative, you can cancel your policy over the phone.

- Call GEICO’s customer service line.You can find the number on their website or on your insurance card.

- Provide your policy number and personal information.

- Explain that you want to cancel your policy.The representative will ask you for the reason for cancellation.

- Confirm your cancellation request.The representative will confirm the cancellation date and provide you with any necessary information.

Canceling in Person

While GEICO doesn’t have physical offices in every location, you can still cancel your policy in person at a GEICO office.

- Find a GEICO office near you.You can use GEICO’s website or app to locate an office.

- Visit the office during business hours.

- Provide your policy number and personal information.

- Inform the representative that you want to cancel your policy.

- Confirm your cancellation request.The representative will confirm the cancellation date and provide you with any necessary information.

Required Documentation

When canceling your GEICO insurance policy, you need to provide certain documents to ensure a smooth process. These documents verify your identity and help GEICO process your cancellation request accurately.

Required Documents for Policy Cancellation

The following documents are typically required when canceling a GEICO insurance policy:

- Policy Number:This unique number identifies your insurance policy and is essential for locating your account.

- Driver’s License or State-Issued ID:This document verifies your identity and confirms you are authorized to cancel the policy.

- Proof of New Insurance (if applicable):If you are switching insurance providers, you’ll need to provide proof of your new policy to ensure continuous coverage.

Note:The specific documents required may vary depending on your state and the type of policy you have. It’s always best to contact GEICO directly to confirm the exact requirements for your situation.

Cancellation Process Flowchart

The cancellation process for GEICO insurance policies typically involves the following steps: Step 1:Contact GEICO to initiate the cancellation process. This can be done by phone, online, or in person at a GEICO office. Step 2:Provide the required documentation to verify your identity and policy details.

Step 3:GEICO will confirm the cancellation details and provide you with a confirmation number. Step 4:You will receive a final cancellation notice with the effective date of cancellation. Step 5:Ensure you receive a refund or pro-rated premium for any unused coverage.

Cancellation Confirmation

After you’ve initiated the cancellation process, it’s essential to confirm that your GEICO policy has been successfully canceled. This ensures you’re not liable for any further premiums or coverage.

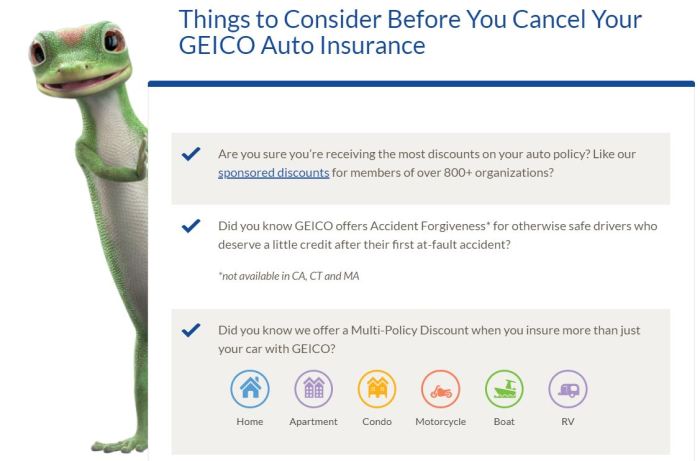

Canceling your GEICO policy? It’s usually a simple process, but before you jump ship, have you checked out all the ways to save? You might be surprised to learn about all the discounts GEICO offers , from safe driving to bundling policies.

It could be worth exploring those options before making a final decision.

Methods to Confirm Cancellation

Confirmation of your cancellation is crucial to ensure you’re not held responsible for any outstanding premiums or coverage. Here are the common methods to verify your cancellation:

- Check your email:GEICO will typically send you a confirmation email upon successful cancellation. Keep an eye on your inbox, including your spam folder, for this important notification.

- Contact GEICO directly:You can call GEICO’s customer service line or use their online chat service to inquire about the status of your cancellation. Provide your policy details for verification.

- Review your account online:If you have an online account with GEICO, log in and check your policy details. The cancellation status should be reflected in your account.

Receiving Written Confirmation

It’s always a good practice to request written confirmation of your cancellation. This serves as official documentation in case of any disputes or misunderstandings.

- Email request:Send an email to GEICO requesting a written confirmation of your cancellation. Include your policy details and the date of cancellation in your email.

- Written request:If you prefer a physical copy, send a written request via mail to GEICO’s address. Include your policy details and the date of cancellation.

Keeping Records of the Cancellation Process

Maintaining accurate records of your cancellation process is essential for your peace of mind.

- Save all communication:Keep copies of all emails, letters, and any other correspondence related to your cancellation. This includes confirmation emails, cancellation requests, and any responses from GEICO.

- Document cancellation details:Note down the date and time of your cancellation request, the method used (phone, email, online), and any reference numbers provided by GEICO.

- Retain confirmation:Store your written confirmation of cancellation in a safe and accessible location.

Alternative Options

Sometimes, canceling your GEICO policy might not be the best option. You might be able to temporarily suspend your policy instead. Let’s explore the advantages and disadvantages of suspending your GEICO policy, as well as alternative insurance options you could consider.

Suspending Your GEICO Policy

Suspending your GEICO policy allows you to temporarily pause coverage for a specific period, usually for a few months. This can be beneficial if you’re not using your vehicle, such as during a long trip, or if you’re facing financial difficulties.

Advantages of Suspending

- Cost Savings:Suspending your policy can significantly reduce your insurance premiums, as you won’t be paying for coverage you’re not using.

- Maintaining Coverage:Suspending your policy allows you to easily reinstate coverage when you need it, avoiding the hassle of getting a new policy.

- Flexibility:You can choose the suspension period that best suits your needs, allowing you to adjust your coverage based on your circumstances.

Disadvantages of Suspending

- Limited Availability:Not all insurance companies offer policy suspension, and GEICO might have specific requirements or restrictions.

- Potential Coverage Gaps:If you need coverage during the suspension period and your policy is suspended, you won’t be covered for any accidents or incidents.

- Possible Rate Increases:When you reinstate your policy after suspension, you might face a rate increase due to factors like time elapsed since the last coverage period.

Other Insurance Options

If you’re considering canceling your GEICO policy, several other insurance options are available, depending on your specific needs and situation.

Other Insurance Companies

- Comparison Websites:Websites like Policygenius, Insurance.com, and The Zebra allow you to compare quotes from multiple insurance companies, helping you find the best rates and coverage for your needs.

- Direct Writers:Companies like Geico, Progressive, and USAA offer competitive rates and convenient online services, eliminating the need for an insurance agent.

- Independent Agents:Independent insurance agents work with multiple insurance companies, allowing you to compare options from various providers.

Alternative Insurance Types

- Short-Term Insurance:This type of insurance provides coverage for a short period, typically 30 to 90 days, and is ideal for temporary needs, like covering a vehicle during a short trip or while waiting for a new policy.

- Non-Owner Insurance:This insurance covers you as a driver if you don’t own a vehicle, providing liability coverage for accidents you might cause while driving someone else’s car.

Final Summary: How Do I Cancel My GEICO Insurance Policy

Canceling your GEICO insurance policy doesn’t have to be a stressful experience. By understanding the process, gathering the necessary documents, and choosing the right cancellation method, you can ensure a smooth transition. Remember, keeping records of your cancellation is crucial, so you can always refer back to them if needed.

Now, you’re equipped with the knowledge to confidently manage your insurance needs, whether you’re staying with GEICO or exploring other options.

FAQ Summary

What if I cancel my policy early?

If you cancel your policy before the end of your term, you may have to pay a cancellation fee. The amount of the fee depends on your state and the type of policy you have.

Can I cancel my policy over the phone?

Yes, you can cancel your policy over the phone by calling GEICO’s customer service line. Be sure to have your policy number and other relevant information ready.

What if I need to cancel my policy due to a change in my circumstances?

GEICO offers flexible cancellation options, so if your circumstances change (like selling your car), they’ll work with you to find the best solution.

Will canceling my policy affect my future insurance rates?

It’s possible that canceling your GEICO policy could affect your future insurance rates, especially if you have a history of frequent cancellations.

What are the different ways to contact GEICO?

You can contact GEICO through their website, phone line, or by visiting a local office.