How much does Geico car insurance cost? It’s a question many drivers ask, especially when looking for the best deal on their auto coverage. Geico, known for its iconic gecko mascot and catchy commercials, is a major player in the insurance industry.

But what truly sets their rates apart? This guide will explore the key factors that influence Geico’s car insurance costs, providing insights into how you can find the best possible price for your specific needs.

From your driving history and vehicle type to your location and chosen coverage options, several elements come into play when calculating your premium. We’ll break down each factor, offering examples and a handy table to illustrate their potential impact on your wallet.

Get ready to unlock the secrets of Geico’s pricing and discover how to potentially save money on your car insurance.

Geico’s Coverage Options

Geico offers a variety of coverage options to meet the needs of different drivers. Understanding these options is crucial to choosing the right coverage for you and your car.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person or property. This coverage is typically required by state law.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property Damage Liability: Covers damage to another person’s property, such as their vehicle or home, if you are at fault.

For example, if you cause an accident and injure another driver, bodily injury liability coverage would help pay for their medical bills and lost wages. If you damage the other driver’s car, property damage liability coverage would help pay for repairs.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault.

This coverage is optional, but it can be beneficial if you have a newer car or a car that is financed or leased. Collision coverage is not necessary if you have an older car with a low value.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters.

This coverage is also optional and is often bundled with collision coverage. If you have a newer car or a car with a high value, comprehensive coverage can be a wise investment.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who does not have insurance or does not have enough insurance to cover your damages.

This coverage is optional but can be essential, especially if you live in an area with a high number of uninsured drivers. UM/UIM coverage can help pay for your medical bills, lost wages, and other expenses.

Geico Coverage Options and Typical Costs

| Coverage Type | Description | Typical Cost |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or damage to another person or property. | $50

|

| Collision Coverage | Pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. | $50

|

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. | $20

|

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured in an accident caused by a driver who does not have insurance or does not have enough insurance to cover your damages. | $10

|

The actual cost of Geico car insurance will vary depending on several factors, including your driving history, age, location, vehicle, and the amount of coverage you choose. It’s important to get quotes from multiple insurers to compare prices and coverage options.

Comparing Geico to Other Insurance Providers

Choosing the right car insurance provider can be a daunting task, especially with so many options available. Geico is a popular choice, known for its competitive rates and comprehensive coverage. However, it’s essential to compare Geico with other major insurance providers to ensure you’re getting the best value for your money.

Geico vs. Other Insurance Providers, How much does Geico car insurance cost

This section compares Geico’s car insurance rates and coverage options to those of other major insurance providers. The comparison will highlight key differences in pricing, coverage, and customer service, helping you make an informed decision.

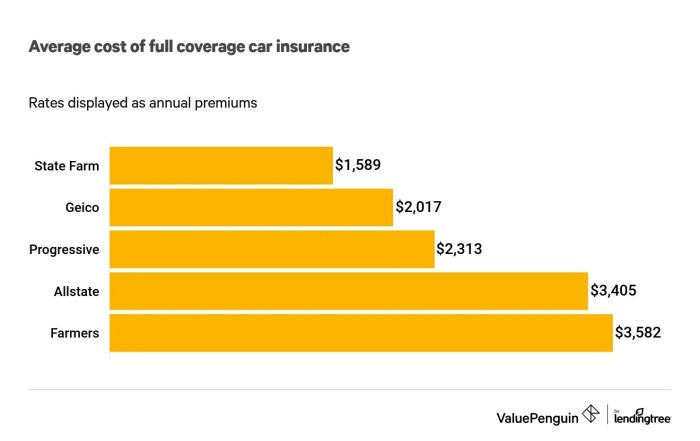

Pricing Comparison

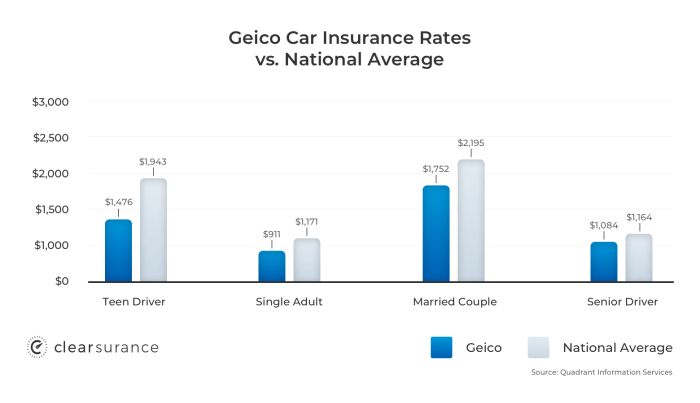

Car insurance rates vary based on several factors, including your driving history, location, vehicle type, and coverage options. However, a general comparison of average rates can provide a good starting point.

| Provider | Average Annual Premium |

|---|---|

| Geico | $1,482 |

| State Farm | $1,524 |

| Progressive | $1,567 |

| Allstate | $1,605 |

As you can see, Geico typically offers some of the lowest average annual premiums compared to other major providers. However, it’s crucial to obtain personalized quotes from multiple insurers to determine the best rates for your specific situation.

Coverage Options Comparison

While Geico and other insurance providers offer similar basic coverage options, there can be differences in specific features and benefits.

| Coverage | Geico | State Farm | Progressive | Allstate |

|---|---|---|---|---|

| Liability Coverage | Yes | Yes | Yes | Yes |

| Collision Coverage | Yes | Yes | Yes | Yes |

| Comprehensive Coverage | Yes | Yes | Yes | Yes |

| Uninsured/Underinsured Motorist Coverage | Yes | Yes | Yes | Yes |

| Rental Car Coverage | Yes | Yes | Yes | Yes |

| Roadside Assistance | Optional | Optional | Optional | Optional |

| Accident Forgiveness | Yes | Yes | Yes | Yes |

| Ride-Sharing Coverage | Yes | Yes | Yes | Yes |

It’s essential to review the specific coverage details offered by each provider to ensure they meet your individual needs.

Customer Service Comparison

Customer service is a crucial factor to consider when choosing an insurance provider. This includes factors like ease of communication, responsiveness to inquiries, and claims handling processes.

- Geicois known for its user-friendly website and mobile app, making it easy to manage your policy and file claims online. Geico also has a strong reputation for its 24/7 customer service availability.

- State Farmhas a vast network of agents across the country, providing personalized service and local support. They also have a strong reputation for handling claims efficiently.

- Progressiveoffers a variety of customer service options, including online chat, phone support, and a network of agents. They are known for their innovative features like Snapshot, which uses telematics to monitor driving habits and potentially lower premiums.

- Allstateis known for its “Your Choice” program, which allows policyholders to customize their coverage options. They also have a strong reputation for their claims handling process and customer satisfaction.

Ultimately, the best customer service experience will depend on your individual preferences and needs. Consider factors like communication methods, response times, and claim handling procedures when comparing providers.

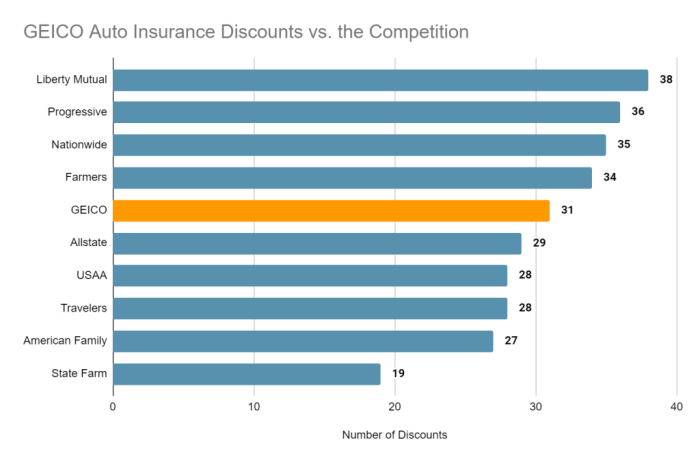

Geico’s Discounts and Savings

Saving money on your car insurance is a top priority for most drivers, and Geico offers a wide range of discounts to help you do just that. These discounts can significantly reduce your premium, making Geico a competitive option for many drivers.

Discounts and Savings Opportunities

Geico offers a variety of discounts that can help you save money on your car insurance. These discounts are based on factors such as your driving history, vehicle features, and other factors.

- Good Driver Discount:This discount is available to drivers with a clean driving record. The specific discount amount may vary depending on your driving history and the length of time you have been accident-free.

- Multi-Policy Discount:If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you can save money on your premiums. This discount is often referred to as a “multi-policy discount” or a “bundling discount.”

- Good Student Discount:Students who maintain a good academic record may qualify for a discount on their car insurance. This discount is typically available to students who are enrolled full-time and have a GPA of 3.0 or higher.

- Defensive Driving Course Discount:Completing a defensive driving course can qualify you for a discount on your car insurance. These courses teach drivers safe driving practices and can help reduce the risk of accidents.

- Anti-theft Device Discount:If your vehicle has an anti-theft device installed, such as an alarm system or a GPS tracker, you may be eligible for a discount. These devices can deter theft and help reduce the risk of claims.

- Military Discount:Active military personnel, veterans, and their families may qualify for a discount on their car insurance. This discount is offered as a way to thank those who serve our country.

- Safe Driver Discount:Geico offers a safe driver discount to policyholders who maintain a clean driving record. This discount can be significant, especially for drivers who have been accident-free for several years.

- Vehicle Safety Features Discount:If your vehicle has safety features such as anti-lock brakes, airbags, or electronic stability control, you may qualify for a discount on your car insurance. These features can help reduce the severity of accidents and claims.

- Loyalty Discount:Geico rewards long-term customers with a loyalty discount. The longer you have been a Geico policyholder, the more you can save on your premiums.

Maximizing Savings with Geico

To maximize your savings with Geico, you can:

- Bundle your insurance:Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can result in significant savings.

- Maintain a clean driving record:A clean driving record is essential for qualifying for many discounts, including the good driver discount and the safe driver discount.

- Take a defensive driving course:Completing a defensive driving course can qualify you for a discount and also improve your driving skills.

- Install safety features:Installing safety features such as anti-lock brakes or airbags can qualify you for a discount and also make your vehicle safer.

- Compare quotes regularly:It is always a good idea to compare quotes from different insurance companies to ensure you are getting the best rate.

- Ask about discounts:Be sure to ask your Geico agent about all the discounts you may be eligible for. They can help you identify opportunities to save money.

Customer Reviews and Experiences

Understanding what other customers have experienced with Geico car insurance is crucial when making a decision. By analyzing customer reviews, you can gain insights into the strengths and weaknesses of the company, helping you determine if it aligns with your needs and expectations.

Positive Reviews and Experiences

Many customers praise Geico for its excellent customer service, affordable rates, and straightforward claims process. They appreciate the company’s user-friendly website and mobile app, making it easy to manage their policies and contact customer support. Here are some key themes that emerge from positive reviews:

- Affordable Rates:Many customers highlight Geico’s competitive pricing, often finding it significantly cheaper than other insurance providers.

- Excellent Customer Service:Customers consistently praise Geico’s responsive and helpful customer service representatives, both over the phone and online.

- Smooth Claims Process:Customers appreciate the ease and efficiency of filing claims with Geico, with many reporting positive experiences.

- User-Friendly Website and Mobile App:Geico’s digital platforms are widely praised for their intuitive design and ease of use.

“I’ve been with Geico for years and have always been happy with their service. Their rates are very competitive, and I’ve never had any issues with claims. Their website and app are also very easy to use.”

John S.

“I recently had to file a claim after an accident, and the process was so easy and straightforward. The customer service representative was very helpful and made sure I understood everything. I was very impressed with Geico’s handling of the entire situation.”

Mary L.

Negative Reviews and Experiences

While many customers have positive experiences with Geico, some have encountered challenges. These negative reviews often highlight issues with:

- Price Increases:Some customers have reported experiencing unexpected rate increases after renewing their policies, even with no changes in their driving history or coverage.

- Limited Coverage Options:A few customers have expressed dissatisfaction with the limited coverage options available with Geico, particularly for specific types of vehicles or drivers.

- Claims Handling Delays:In some instances, customers have reported delays in processing claims or receiving payouts, leading to frustration.

- Customer Service Issues:While generally positive, some customers have encountered unhelpful or unresponsive customer service representatives, particularly during busy periods.

“I’ve been with Geico for a while, but my rates have gone up significantly in the last year. I’m not sure why, as I haven’t had any accidents or tickets. I’m considering switching to another provider.”

David M.

“I was disappointed with the limited coverage options available with Geico. I wanted to add some specific features, but they weren’t offered. I ended up switching to a different insurance company.”

So you’re wondering how much Geico car insurance costs, huh? Well, that depends on a bunch of factors, like your driving record and the type of car you have. But while you’re thinking about protecting your vehicle, have you considered protecting your loved ones?

Accidental Death Insurance: Protecting Your Loved Ones can provide financial security for your family in the unfortunate event of an accident. And speaking of security, you can get a free Geico quote online in just a few minutes, so why not check it out?

Sarah J.

Geico’s Customer Service and Claims Process: How Much Does Geico Car Insurance Cost

Geico prioritizes providing excellent customer service and a smooth claims process. They offer a variety of communication channels, including phone support, online resources, and a mobile app, to ensure a convenient experience for their policyholders. Their claims process is designed to be straightforward and efficient, with dedicated claims representatives available to guide you through every step.

Customer Service Channels

Geico provides multiple channels for customers to access support and information. These include:

- Phone Support:Geico offers 24/7 phone support, allowing customers to reach a representative at any time, day or night. Their phone number is readily available on their website and marketing materials.

- Online Resources:Geico’s website provides a comprehensive library of resources, including policy information, FAQs, and online claim filing options. Customers can access their policy details, make payments, and manage their accounts online.

- Mobile App:Geico’s mobile app offers convenient access to policy information, claims reporting, roadside assistance, and other features. The app is available for both Android and iOS devices.

Claims Process

Geico’s claims process is designed to be simple and efficient. The process typically involves the following steps:

- Report the Accident:Customers can report an accident through Geico’s website, mobile app, or by calling their 24/7 claims line. They should provide details about the accident, including the date, time, location, and parties involved.

- Claim Review:Once a claim is reported, Geico will review the details and begin the investigation process. This may involve contacting witnesses, obtaining police reports, and reviewing vehicle damage assessments.

- Damage Assessment:Geico will arrange for an independent assessment of the vehicle damage. This assessment will determine the extent of the repairs needed and provide an estimated cost.

- Claim Settlement:Based on the investigation and damage assessment, Geico will determine the amount of compensation to be paid. This may include coverage for repairs, medical expenses, lost wages, and other related costs.

- Payment:Geico will process the payment for the claim, which may be sent directly to the repair shop, medical provider, or the policyholder. The payment method will depend on the specific claim and the policyholder’s preferences.

Claims Handling Procedures

Geico’s claims handling procedures are designed to ensure fairness and efficiency. They aim to:

- Investigate claims thoroughly:Geico conducts comprehensive investigations to gather all relevant information and ensure accurate assessments.

- Provide timely updates:Geico keeps policyholders informed throughout the claims process, providing regular updates on the status of their claim.

- Resolve claims promptly:Geico strives to resolve claims efficiently, minimizing delays and providing timely compensation to policyholders.

- Offer various payment options:Geico provides flexible payment options to accommodate policyholders’ needs and preferences.

Customer Satisfaction Ratings

Geico consistently receives high customer satisfaction ratings for its claims handling process. According to J.D. Power, Geico ranks among the top insurance companies in terms of customer satisfaction with claims. This positive feedback reflects Geico’s commitment to providing a smooth and efficient claims experience for its policyholders.

End of Discussion

Navigating the world of car insurance can feel like a maze, but understanding how Geico calculates its premiums can help you make informed decisions. By considering the factors that influence your rates, exploring their coverage options, and taking advantage of available discounts, you can find a policy that fits your budget and provides the protection you need.

Remember, getting quotes from multiple insurers is always a good idea to ensure you’re getting the best deal. So, get out there, explore your options, and drive confidently knowing you’ve secured the right insurance coverage.

User Queries

What factors affect my Geico car insurance rate?

Your driving history, vehicle type, location, coverage options, and age are some of the key factors that determine your Geico car insurance rate.

How do I get a Geico car insurance quote?

You can easily obtain a quote online through their website, using their mobile app, or by calling their customer service line.

What discounts does Geico offer?

Geico offers a variety of discounts, including safe driver, multi-policy, good student, and more. Check their website for a complete list and eligibility criteria.

How do I file a claim with Geico?

You can file a claim online, through their mobile app, or by calling their claims department.