Funeral insurance policy is a specialized type of insurance designed to cover the costs associated with a funeral. It provides financial assistance to loved ones, ensuring they can honor your final wishes without the added burden of financial stress during a difficult time.

These policies offer a variety of coverage options, from basic cremation services to more comprehensive packages including memorial services, embalming, and burial arrangements.

Imagine a world where your family isn’t burdened with the financial weight of your final goodbye. Funeral insurance allows you to pre-plan and pay for your funeral expenses, ensuring your loved ones are free to focus on grieving and celebrating your life.

What is Funeral Insurance?

Funeral insurance is a type of life insurance designed specifically to cover the costs associated with a funeral. It provides a lump sum payment upon the policyholder’s death, which can be used to pay for funeral expenses, such as burial or cremation services, memorial costs, and other related expenses.

Types of Funeral Insurance Policies

Funeral insurance policies come in various forms, each with its unique features and benefits. Understanding the different types available helps you choose the policy that best suits your needs and financial situation.

- Traditional Funeral Insurance:This type of policy provides a fixed sum of money upon death, typically ranging from $5,000 to $25,000. The payout is generally sufficient to cover basic funeral expenses, including embalming, cremation, burial, and a simple memorial service.

- Pre-Need Funeral Insurance:This policy allows individuals to pre-plan their funeral arrangements and secure funding for them in advance. It provides peace of mind knowing that their wishes will be fulfilled and their loved ones won’t be burdened with the financial and emotional stress of making arrangements during a difficult time.

- Whole Life Funeral Insurance:This policy combines life insurance with a savings component. It offers a death benefit that can be used for funeral expenses and also builds cash value over time.

- Term Life Funeral Insurance:This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. It is usually more affordable than whole life insurance but does not build cash value.

Coverage Options and Benefits

Funeral insurance policies offer various coverage options and benefits, catering to individual preferences and financial capabilities.

- Death Benefit:The core benefit of funeral insurance is the death benefit, a lump sum payment received by the beneficiary upon the policyholder’s death. This payment can be used to cover funeral expenses, including:

- Embalming and cremation or burial services

- Memorial services and interment costs

- Casket, urn, and other funeral accessories

- Transportation and burial plot costs

- Other related expenses

- Pre-Paid Funeral Arrangements:Some funeral insurance policies allow individuals to pre-plan their funeral arrangements, specifying their preferences for services, merchandise, and final resting place. This ensures that their wishes are fulfilled and eliminates the burden of making decisions during a difficult time.

- Guaranteed Acceptance:Certain funeral insurance policies offer guaranteed acceptance, meaning that individuals can secure coverage regardless of their health status. This is particularly beneficial for those with pre-existing medical conditions who may find it challenging to qualify for traditional life insurance.

- Cash Value Accumulation:Some funeral insurance policies, such as whole life policies, build cash value over time. This accumulated value can be borrowed against or withdrawn for other financial needs, providing flexibility and additional financial security.

Benefits of Funeral Insurance

Funeral insurance offers a range of advantages, providing financial security and peace of mind for you and your loved ones. It helps ensure that your final wishes are fulfilled and eases the financial burden on your family during a difficult time.

Financial Advantages

Having a funeral insurance policy offers significant financial benefits, relieving your family from the unexpected costs associated with your final arrangements.

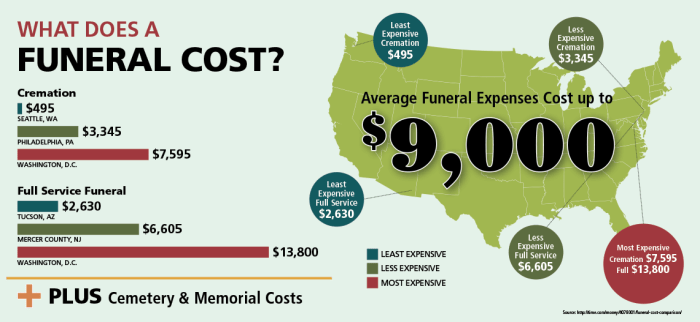

- Covers Funeral Expenses:Funeral insurance directly covers the costs associated with your funeral, such as embalming, cremation or burial, casket, memorial service, and interment. This can range from a few thousand dollars to tens of thousands, depending on your chosen arrangements.

- Reduces Financial Strain:The financial burden of funeral expenses can be overwhelming for families, especially when unexpected. Funeral insurance ensures that these costs are covered, preventing your family from having to dip into savings or take on debt.

- Provides a Lump Sum Payment:Most funeral insurance policies provide a lump sum payment to your beneficiaries upon your passing. This allows them to pay for funeral arrangements and other expenses without having to worry about managing multiple bills or loans.

Peace of Mind for Beneficiaries

Funeral insurance offers peace of mind to your loved ones, knowing that your final arrangements are taken care of and their financial burden is alleviated.

- Reduces Emotional Stress:Losing a loved one is a deeply emotional experience. Funeral insurance eliminates the added stress of worrying about funeral expenses, allowing your family to focus on grieving and celebrating your life.

- Ensures Your Wishes are Fulfilled:With a funeral insurance policy, you can specify your desired funeral arrangements, ensuring that your wishes are honored. This can include the type of service, location, and even the selection of a specific casket or urn.

- Provides Financial Security:Knowing that your funeral expenses are covered gives your family peace of mind. They can rest assured that they won’t have to worry about the financial implications of your passing, allowing them to focus on their emotional well-being.

Alleviating the Burden on Loved Ones

Funeral insurance significantly alleviates the financial and emotional burden on your loved ones during a difficult time.

- Prevents Financial Strain:Funeral costs can be substantial, and without insurance, your family may be forced to make difficult choices or take on debt to cover these expenses. Funeral insurance ensures that your loved ones don’t have to face this financial strain.

- Provides Time for Grieving:By taking care of funeral costs, funeral insurance allows your family to focus on grieving and celebrating your life, rather than dealing with financial worries and logistical arrangements.

- Offers a Sense of Closure:Knowing that your final wishes are fulfilled and your loved ones are financially secure can bring a sense of closure and peace during a time of loss.

Factors to Consider When Choosing Funeral Insurance: Funeral Insurance Policy

Choosing the right funeral insurance policy can be a daunting task. With various providers and plans available, it’s essential to consider several factors to ensure you make an informed decision that aligns with your needs and financial situation.

Coverage Amount

The coverage amount determines the financial assistance you’ll receive to cover funeral expenses. It’s crucial to assess the average funeral costs in your area, taking into account factors like embalming, cremation, burial, and memorial services.

Consider consulting with funeral homes to get an accurate estimate of the costs.

Premiums and Payment Options

Premiums are the monthly or annual payments you make for your funeral insurance policy. They vary based on factors like your age, health, and the coverage amount you choose. It’s important to compare premiums from different providers and explore payment options, such as monthly installments or lump-sum payments, to find the most convenient and affordable plan.

Funeral insurance policies can help ease the financial burden of a loved one’s passing, but what about the potential costs of running a funeral home itself? That’s where Commercial liability insurance comes in, protecting businesses from claims arising from accidents or negligence.

Just like a funeral insurance policy safeguards families, commercial liability insurance provides a safety net for funeral homes, ensuring they can continue serving families during difficult times.

Policy Features

Funeral insurance policies can include additional features beyond basic coverage. These features may include:

- Guaranteed Issue:This feature guarantees policy acceptance regardless of your health condition. However, it may come with higher premiums.

- Cash Value:Some policies accumulate cash value that you can withdraw or borrow against.

- Waiver of Premium:This feature waives premium payments if you become disabled.

These features can enhance the benefits of your policy but may also increase premiums. Consider your individual needs and financial situation to determine if these additional features are worth the extra cost.

Financial Stability of the Provider

Choosing a financially stable and reputable insurance provider is crucial to ensure your policy will be honored when you need it. Look for providers with a strong track record, good financial ratings, and positive customer reviews.

Reputable and Reliable Provider

Research and compare different funeral insurance providers to find one that aligns with your needs and budget. Look for providers with a strong reputation, positive customer reviews, and a clear understanding of their policies and procedures.

Consider consulting with a financial advisor for additional guidance on choosing a reputable and reliable insurance provider.

The Application Process and Policy Details

Applying for funeral insurance is generally a straightforward process. It usually involves providing personal information, health details, and your desired coverage amount. The insurer will then assess your application and decide whether to offer you a policy.

Policy Details and Terms, Funeral insurance policy

It is crucial to understand the key details and terms of your funeral insurance policy to ensure it meets your needs and expectations.

Coverage Amount

The coverage amount is the maximum sum the insurer will pay out upon your death to cover your funeral expenses. The coverage amount you choose will affect your premium payments.

Premiums

Premiums are the regular payments you make to maintain your funeral insurance policy. The premium amount is influenced by factors such as your age, health, and the coverage amount you select.

Exclusions

Every funeral insurance policy has exclusions, which are specific circumstances or events that are not covered by the policy. These exclusions can vary between insurers, but some common examples include:

- Death due to suicide within a certain period after policy inception.

- Death resulting from participation in dangerous activities or hobbies.

- Death caused by pre-existing conditions not disclosed during the application process.

Importance of Understanding Policy Terms

It is essential to read and understand your policy document carefully before signing. Pay close attention to the following:

- Coverage details:Ensure the coverage amount is sufficient to cover your expected funeral costs.

- Premium payments:Understand the payment schedule and how your premiums may change over time.

- Exclusions:Be aware of any activities or circumstances that are not covered by your policy.

- Claim process:Familiarize yourself with the procedures for filing a claim and the required documentation.

- Policy cancellation:Understand the terms and conditions for canceling your policy and any potential refund options.

“Understanding the terms and conditions of your funeral insurance policy is crucial to ensure you are adequately protected and your loved ones are financially supported during a difficult time.”

Common Misconceptions about Funeral Insurance

Funeral insurance is often misunderstood, leading to misconceptions that can hinder informed decision-making. It’s essential to separate facts from fiction to make an educated choice about this type of coverage.

Funeral Insurance vs. Life Insurance

Understanding the difference between funeral insurance and life insurance is crucial. Funeral insurance is a specialized type of coverage designed to cover funeral expenses, while life insurance provides a death benefit to beneficiaries. While both can help with funeral costs, their purposes and benefits differ significantly.

- Funeral Insurance:Primarily covers funeral expenses, offering a smaller payout, typically ranging from $5,000 to $15,000. It often has a simpler application process and may be available to individuals with health issues. However, the coverage is limited to funeral expenses and may not provide financial support for other needs.

- Life Insurance:Provides a larger death benefit, potentially covering a broader range of expenses, including debts, living expenses, or financial support for loved ones. While it can cover funeral costs, its primary purpose is to provide financial security for beneficiaries after the insured’s death.

The application process can be more complex, and coverage may depend on the insured’s health and financial status.

Limitations and Potential Risks

While funeral insurance can provide financial support for funeral costs, it’s essential to consider its limitations and potential risks:

- Limited Coverage:Funeral insurance policies typically offer a fixed payout, which may not cover all funeral expenses, especially in cases of complex or elaborate arrangements.

- Higher Premiums:Compared to traditional life insurance, funeral insurance premiums may be higher for the amount of coverage offered. This is because the coverage is limited and the payout is smaller.

- Potential for Overpayment:If the policyholder dies before using the full coverage, the remaining amount may not be returned to beneficiaries or the policyholder’s estate.

- Limited Investment Potential:Funeral insurance policies typically do not offer investment options, meaning the premiums paid are solely for coverage and do not accumulate interest or grow in value.

Alternatives to Funeral Insurance

While funeral insurance provides a convenient and straightforward way to cover funeral expenses, it’s not the only option available. Several alternatives can help you plan for final expenses, each with its own advantages and drawbacks. Exploring these alternatives can help you make an informed decision based on your individual needs and circumstances.

Pre-Need Funeral Arrangements

Pre-need funeral arrangements involve planning and paying for your funeral in advance. This can offer peace of mind, knowing your wishes will be carried out, and potentially save your loved ones from making difficult decisions during a difficult time.

- Pros:

- Ensures your funeral preferences are met.

- Locks in current prices, protecting against future inflation.

- Reduces financial burden on your family.

- Cons:

- Requires upfront payment, which may not be feasible for everyone.

- May not cover all potential costs, such as transportation or memorial services.

- Requires careful planning and documentation to ensure your wishes are legally binding.

Using Savings

Setting aside funds specifically for funeral expenses is a straightforward way to cover these costs. You can create a dedicated savings account or use existing funds to build a nest egg for your final arrangements.

- Pros:

- Provides complete control over how the funds are used.

- Offers flexibility to adjust the amount saved as needed.

- Can be used for other purposes if necessary.

- Cons:

- Requires consistent saving habits to accumulate sufficient funds.

- May not provide adequate coverage if unexpected expenses arise.

- Requires diligent management to ensure the funds are available when needed.

Life Insurance

Life insurance policies can provide a death benefit that can be used to cover funeral expenses. This option offers flexibility, as the death benefit can be used for various purposes, including final expenses, debt repayment, or financial support for loved ones.

- Pros:

- Provides a substantial sum of money upon death.

- Offers flexibility in how the death benefit is used.

- Can be tailored to specific needs and financial circumstances.

- Cons:

- May require regular premium payments.

- Can be expensive depending on the coverage amount and policy type.

- May not be suitable for individuals with limited financial resources.

Final Review

Planning for the inevitable might not be the most cheerful topic, but funeral insurance offers a sense of peace of mind, knowing your loved ones won’t be left to shoulder the financial burden of your passing. By carefully considering your options and choosing a reputable provider, you can secure a plan that aligns with your needs and wishes, leaving a legacy of care and love for those you leave behind.

Essential Questionnaire

How much does funeral insurance cost?

The cost of funeral insurance varies depending on factors like age, health, coverage amount, and the insurance provider. It’s best to get quotes from multiple companies to compare prices and find the best value for your needs.

Can I still get funeral insurance if I have pre-existing health conditions?

Yes, but some providers may charge higher premiums or have specific exclusions depending on the severity of your condition. It’s essential to be upfront about any pre-existing conditions during the application process.

What happens if I die before the policy is paid off?

The death benefit will still be paid to your beneficiaries, covering the funeral expenses. The remaining balance on the policy may be covered by a beneficiary or a life insurance policy, if applicable.

Is funeral insurance the same as life insurance?

No, funeral insurance is specifically designed to cover funeral expenses, while life insurance provides a larger death benefit that can be used for various purposes, including funeral costs.