High-deductible health insurance, or HDHP, has become a popular choice for many, offering lower monthly premiums but with a higher out-of-pocket cost before coverage kicks in. This means you pay a larger sum upfront before your insurance covers the rest of your medical expenses.

While it might seem daunting at first, HDHPs can be a strategic move for individuals who are healthy, budget-conscious, and willing to take a more proactive approach to their healthcare.

The key to making HDHPs work is understanding their nuances and maximizing the benefits they offer. This includes exploring the tax advantages of Health Savings Accounts (HSAs), which are specifically designed for use with HDHPs. HSAs allow you to save pre-tax dollars for medical expenses, providing a significant financial boost.

High-Deductible Health Insurance

Imagine a health insurance plan that offers lower monthly premiums but requires you to pay more out-of-pocket before your insurance kicks in. That’s the essence of high-deductible health insurance (HDHP). It’s a type of health insurance plan that typically features lower premiums than traditional plans but has a higher deductible, which is the amount you must pay out-of-pocket before your insurance coverage begins.

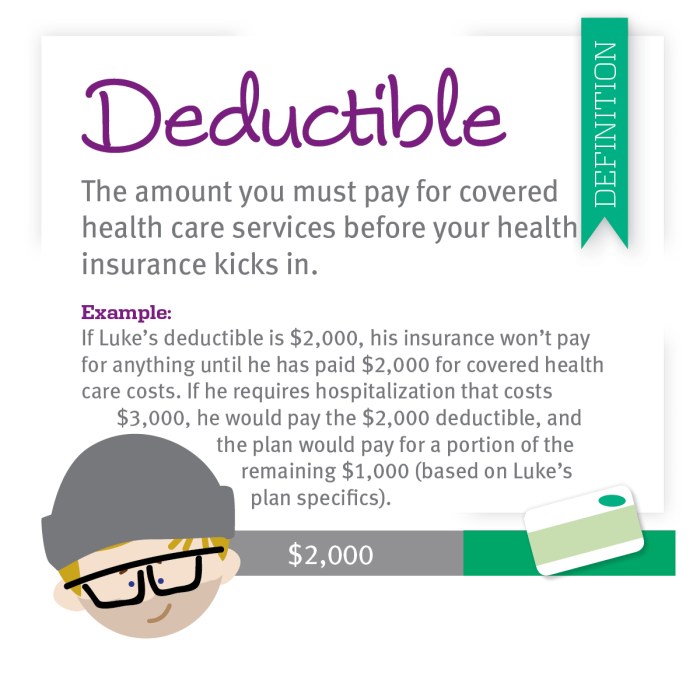

The Deductible Explained

The deductible is the amount you pay for healthcare expenses before your insurance coverage starts. For example, if your HDHP has a $5,000 deductible, you’ll need to pay the first $5,000 in medical expenses yourself. After you’ve met the deductible, your insurance will then cover the remaining costs, typically at a co-insurance rate or with a co-payment.

Characteristics of High-Deductible Health Insurance

HDHPs are characterized by the following:

- Lower Premiums:The trade-off for the higher deductible is typically lower monthly premiums. This can make HDHPs more affordable for individuals and families who are healthy and expect to use their health insurance infrequently.

- High Deductibles:As the name suggests, HDHPs have significantly higher deductibles compared to traditional health insurance plans. This means you’ll need to pay more out-of-pocket before your insurance coverage kicks in.

- Health Savings Account (HSA):HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to save money pre-tax for healthcare expenses. These accounts can help you offset the higher deductibles associated with HDHPs.

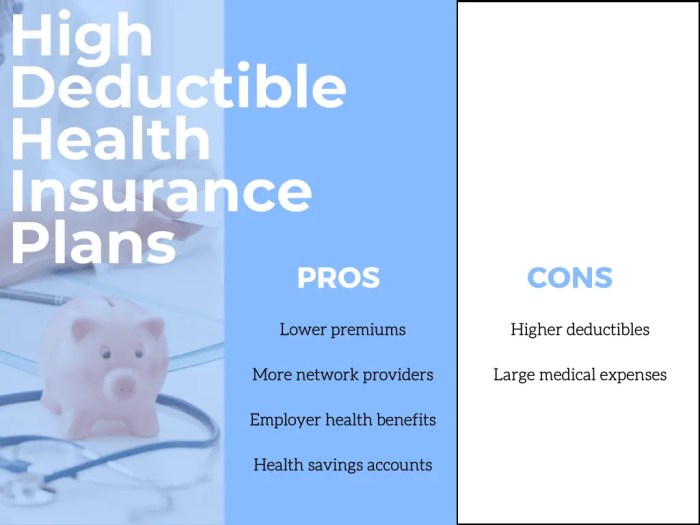

Benefits of High-Deductible Health Insurance

High-deductible health plans (HDHPs) offer a unique approach to healthcare coverage, balancing affordability with personal responsibility. While they come with a higher upfront deductible, HDHPs present several advantages that can be financially beneficial for individuals and families.

Lower Monthly Premiums

One of the most significant advantages of HDHPs is their lower monthly premiums. Since the plan covers fewer routine medical expenses, the insurance company can offer a lower monthly cost. This can be a substantial saving, especially for individuals and families who are budget-conscious.

For instance, a family with a $5,000 deductible might pay $300 per month in premiums for an HDHP, compared to $500 per month for a traditional plan with a lower deductible.

Encouraging Responsible Healthcare Spending

HDHPs encourage individuals to be more mindful of their healthcare spending. By having to pay a higher deductible, people are more likely to consider the costs associated with their healthcare decisions. This can lead to more responsible use of healthcare services and a focus on preventive care.

For example, an individual with an HDHP might choose to explore less expensive alternatives for routine checkups or consider generic medications instead of brand-name drugs.

Tax Benefits of HDHPs

HDHPs are eligible for tax-advantaged Health Savings Accounts (HSAs). HSAs allow individuals to contribute pre-tax dollars to a dedicated savings account that can be used for qualified medical expenses. This can result in significant tax savings, especially for individuals in higher tax brackets.

For instance, an individual in the 22% tax bracket who contributes $3,500 to an HSA would save $770 in taxes annually.

Drawbacks of High-Deductible Health Insurance

High-deductible health plans (HDHPs) offer lower monthly premiums, making them appealing to budget-conscious individuals. However, their potential drawbacks should be carefully considered, particularly when it comes to unexpected medical expenses and the impact on individuals with pre-existing conditions.

Potential Challenges with High Deductibles

High deductibles can pose significant financial challenges, especially when unexpected medical expenses arise. Before choosing an HDHP, it’s crucial to understand the potential financial burden it might impose.

- Unexpected Medical Expenses:A high deductible can create a substantial financial barrier when unexpected medical emergencies occur. Imagine needing emergency surgery or hospitalization. You’ll be responsible for paying a significant portion of the cost out-of-pocket before your insurance kicks in. This can strain your finances, potentially leading to debt or even delaying necessary treatment.

- Financial Strain:The high deductible can strain your finances, particularly if you face multiple medical expenses within a short period. This can lead to financial hardship, impacting your ability to meet other financial obligations, like rent or mortgage payments.

- Impact on Savings:You may need to dip into your savings to cover the deductible, potentially depleting funds intended for other important goals like retirement or education.

Impact on Individuals with Pre-Existing Conditions

For individuals with pre-existing conditions, HDHPs may not be the most suitable option. Pre-existing conditions often require regular medical care, leading to higher healthcare costs.

- Higher Healthcare Costs:Individuals with pre-existing conditions typically have higher healthcare costs due to regular check-ups, medications, and specialized treatments. With a high deductible, they may end up paying a significant amount out-of-pocket.

- Limited Coverage:Some HDHPs may have limitations on coverage for pre-existing conditions, potentially leaving individuals with higher out-of-pocket expenses for treatments and medications.

Suitability for Different Income Levels and Healthcare Needs

The suitability of HDHPs varies depending on income levels and healthcare needs.

- Income Level:Individuals with lower incomes may find it challenging to manage high deductibles, especially during unexpected medical events. A lower deductible plan might be more financially manageable.

- Healthcare Needs:Individuals with chronic conditions or a history of frequent medical needs might be better off with a plan that has lower deductibles and copayments. This can provide better financial protection and ensure timely access to necessary care.

Health Savings Accounts (HSAs) and High-Deductible Health Insurance

High-deductible health plans (HDHPs) and health savings accounts (HSAs) are a powerful combination that can help individuals manage their healthcare costs. While HDHPs offer lower monthly premiums, they come with a high deductible that you must pay before insurance coverage kicks in.

High-deductible health insurance can be a smart move if you’re a healthy individual, but it’s crucial to have a financial safety net in place. Just like you’d want to compare auto insurance quotes to find the best deal, you should also consider a health savings account (HSA) to help cover those high deductibles.

An HSA can be a real game-changer, allowing you to save pre-tax dollars for healthcare expenses, so you can feel more secure about managing your health costs.

HSAs are designed to work in tandem with HDHPs, offering a tax-advantaged way to save for healthcare expenses.

Tax Advantages of HSAs

HSAs offer significant tax benefits, making them a valuable tool for healthcare savings.

- Tax-deductible contributions:Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This can result in significant tax savings, especially for those in higher tax brackets. For example, if you contribute $3,500 to your HSA and are in the 22% tax bracket, you’ll save $770 in taxes.

- Tax-free withdrawals for qualified medical expenses:Withdrawals from an HSA for qualified medical expenses are tax-free, both at the federal and state levels. This means you can use your HSA funds to pay for medical expenses without incurring any taxes on the withdrawals. This can be a significant advantage, especially for those facing high healthcare costs.

- Investment potential:HSA funds can be invested in a variety of assets, such as stocks, bonds, and mutual funds. This allows your HSA balance to grow over time, potentially outpacing inflation and providing even greater financial security for future healthcare expenses.

Managing Healthcare Costs with HSAs

HSAs can be used to effectively manage healthcare costs associated with HDHPs.

- Paying deductibles:HSAs can be used to pay for your deductible, the amount you must pay out-of-pocket before your insurance coverage kicks in. This can significantly reduce the financial burden of unexpected healthcare expenses.

- Covering copayments and coinsurance:HSAs can also be used to cover copayments and coinsurance, the amounts you pay for covered services after meeting your deductible. This can help you avoid surprises and manage your out-of-pocket healthcare costs.

- Saving for future healthcare expenses:Since HSA funds can be used for qualified medical expenses at any age, you can use them to save for future healthcare costs, such as long-term care or unexpected medical needs. This can provide peace of mind and financial security for your future health.

“HSAs are like a personal savings account for healthcare, with the added benefit of tax advantages. They can help you manage your healthcare costs, save for future medical expenses, and potentially reduce your overall tax burden.”

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan is a crucial decision that can significantly impact your financial well-being and access to healthcare. It’s essential to carefully consider your individual needs, health status, and financial situation to make an informed choice. This section will guide you through the factors to consider when deciding between high-deductible health plans (HDHPs) and traditional health insurance plans.

Comparing HDHPs and Traditional Plans

To make an informed decision, it’s helpful to compare the key differences between HDHPs and traditional health insurance plans. Here’s a table summarizing the main characteristics:| Feature | HDHP | Traditional Plan ||——————|—————————————–|————————————————-|| Premiums | Generally lower than traditional plans | Typically higher than HDHPs || Deductibles | Higher than traditional plans | Lower than HDHPs || Coverage | Covers essential health benefits, but with a higher deductible | Covers a wider range of services with lower deductibles || Out-of-pocket Costs | Can be significantly higher before the deductible is met | Generally lower, especially for routine care || Health Savings Account (HSA) | Eligible for an HSA | Not eligible for an HSA |

Choosing the Right Plan

To determine the most suitable health insurance plan for your needs, consider the following factors:* Your health status:If you anticipate needing frequent medical care, a traditional plan might be more beneficial due to its lower deductibles and broader coverage.

Your budget

HDHPs can be more cost-effective in the long run if you’re generally healthy and don’t anticipate needing extensive medical care.

Your risk tolerance

HDHPs involve a higher risk of out-of-pocket expenses, but they also offer the potential for lower premiums.

Your age

Younger, healthier individuals may benefit from HDHPs, while older individuals with chronic conditions may find traditional plans more suitable.

Your financial situation

Consider your savings and ability to manage potential high out-of-pocket expenses if you choose an HDHP.

Flowchart for Selecting a Health Insurance Plan

The following flowchart can help guide you through the decision-making process:“`[START]|| Do you anticipate needing frequent medical care?| YES

-> Traditional Plan

| NO

-> HDHP

|| Are you comfortable with a higher deductible?| YES

-> HDHP

| NO

-> Traditional Plan

|| Do you have a health savings account (HSA)?| YES

-> HDHP

| NO

-> Traditional Plan

|| Are you financially prepared for potential high out-of-pocket costs?| YES

-> HDHP

| NO

-> Traditional Plan

|[END]“`This flowchart provides a simple framework for evaluating your needs and preferences to select the most suitable health insurance plan. Remember to consult with a healthcare professional or insurance agent to discuss your specific circumstances and receive personalized advice.

Strategies for Managing Healthcare Costs with High-Deductible Health Insurance

High-deductible health plans (HDHPs) can save you money on premiums, but they come with a high deductible that you must pay out-of-pocket before your insurance kicks in. This can be a challenge, but there are strategies you can use to manage your healthcare costs and keep your expenses in check.

Preventive Care and Its Role in Reducing Overall Healthcare Costs, High-deductible health insurance

Preventive care is crucial for managing healthcare costs with an HDHP. By staying on top of regular checkups, screenings, and vaccinations, you can prevent potential health issues from developing into more serious and costly conditions. For example, getting a yearly flu shot can help you avoid the high costs of treating influenza.

Conclusion

Ultimately, choosing the right health insurance plan depends on your individual needs and circumstances. If you’re young, healthy, and financially savvy, an HDHP might be a smart option. However, if you have pre-existing conditions, frequent healthcare needs, or are concerned about unexpected medical expenses, a traditional health insurance plan might be a better fit.

Understanding the pros and cons of each type of plan is essential to making an informed decision that aligns with your unique health and financial goals.

Commonly Asked Questions

What happens if I have a major medical event with an HDHP?

While the high deductible might seem daunting, most HDHPs have a maximum out-of-pocket limit. Once you reach that limit, your insurance covers the rest of your medical expenses for the year. It’s important to check your policy details for specific limits and coverage.

Can I use my HSA funds for non-medical expenses?

While HSAs offer tax advantages, they are specifically designed for medical expenses. Using HSA funds for non-medical purposes is generally not allowed and can result in penalties. However, there are some exceptions, such as using funds for over-the-counter medications or certain long-term care expenses.

Consult with a tax professional for specific guidance.