Motorcycle Insurance Quotes: A world of freedom awaits on two wheels, but before you hit the open road, you need the right insurance. Navigating the world of motorcycle insurance quotes can feel like trying to decipher a foreign language, but fear not! We’re here to break down the basics, guide you through the process, and help you find the best coverage for your ride.

Think of motorcycle insurance as your safety net. It protects you and your precious bike from the unexpected. Whether you’re a seasoned rider or just starting out, understanding the different types of coverage, factors that influence premiums, and how to get the best quotes is crucial.

We’ll dive into the details, so you can ride with confidence, knowing you’re covered.

Understanding Motorcycle Insurance

Motorcycle insurance is essential for protecting yourself financially in the event of an accident. It covers damages to your motorcycle, medical expenses, and liability claims from others involved in an accident.

Types of Motorcycle Insurance Coverage

Understanding the different types of coverage available is crucial to ensure you have the right protection for your needs. Here’s a breakdown of common motorcycle insurance coverages:

- Liability Coverage:This coverage protects you from financial responsibility if you cause an accident that injures someone or damages their property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage:This coverage pays for repairs or replacement of your motorcycle if it’s damaged in an accident, regardless of who is at fault. However, it usually has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

- Comprehensive Coverage:This coverage protects your motorcycle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it typically has a deductible.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Medical Payments Coverage:This coverage pays for your medical expenses, regardless of who is at fault, if you’re injured in an accident. It can cover costs such as hospital bills, doctor visits, and physical therapy.

- Custom Parts and Equipment Coverage:This coverage protects you if your motorcycle’s custom parts or equipment are damaged or stolen. It’s important to have this coverage if you’ve invested in expensive aftermarket upgrades.

Factors Influencing Motorcycle Insurance Premiums

Several factors determine your motorcycle insurance premium. Understanding these factors can help you find ways to lower your costs:

- Motorcycle Type and Value:The type and value of your motorcycle play a significant role in your premium. Higher-performance motorcycles or those with a higher market value are generally more expensive to insure.

- Your Riding Experience:Your riding history, including your age, driving record, and years of experience, affects your premium. Drivers with a clean driving record and more experience tend to receive lower premiums.

- Location:Where you live can impact your insurance premium. Areas with higher rates of motorcycle accidents or theft may have higher premiums.

- Credit Score:Your credit score can also be a factor in determining your premium. This is because insurance companies often use credit scores to assess risk. A higher credit score generally leads to lower premiums.

- Coverage Levels:The level of coverage you choose, such as the deductible amount and the types of coverage included, directly impacts your premium. Higher coverage levels typically lead to higher premiums.

- Safety Features:Motorcycles with safety features, such as anti-lock brakes (ABS) or stability control, may qualify for discounts, reducing your premium.

Obtaining Motorcycle Insurance Quotes

Getting motorcycle insurance quotes is a straightforward process. Here’s a step-by-step guide:

- Gather Your Information:Before you start, gather essential information about yourself and your motorcycle, including your driver’s license number, motorcycle VIN, and any relevant details about your riding history and any safety features.

- Contact Insurance Companies:You can contact multiple insurance companies directly through their websites or by phone. You can also use online comparison websites that allow you to compare quotes from different insurers side-by-side.

- Provide Your Information:When you contact an insurance company, they will ask for your personal and motorcycle information. Be accurate and complete when providing this information to ensure you receive an accurate quote.

- Compare Quotes:Once you have received quotes from several insurance companies, compare them carefully. Consider factors like the coverage offered, the premium amount, and the insurer’s reputation.

- Choose Your Policy:Select the policy that best meets your needs and budget. Remember to read the policy carefully before you agree to it.

Key Considerations for Motorcycle Insurance Quotes

Finding the right motorcycle insurance can be a daunting task, but it doesn’t have to be a wild ride! With a little planning and comparison, you can find a policy that fits your needs and budget.

Comparing Quotes from Multiple Insurers

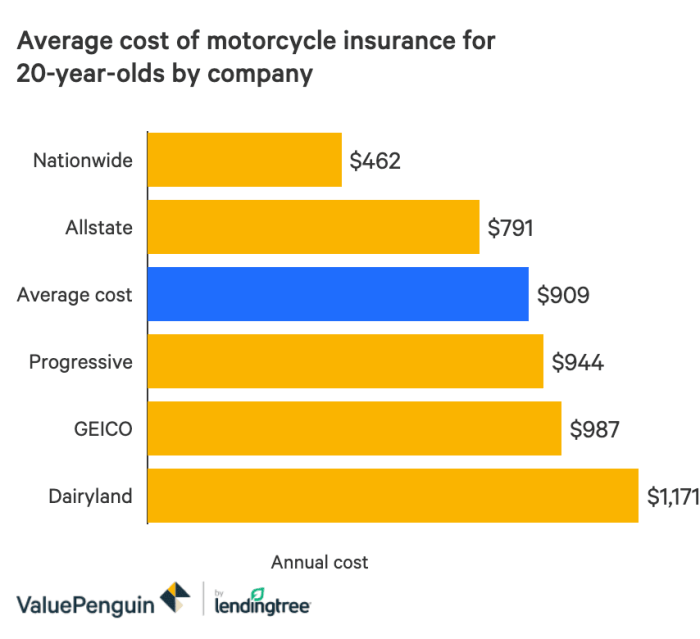

It’s crucial to get quotes from multiple insurers before making a decision. Each insurer has its own pricing structure and coverage options, so comparing quotes allows you to find the best value for your money. You can use online comparison tools or contact insurers directly to obtain quotes.

Customizing Your Motorcycle Insurance Policy

Motorcycle insurance policies are highly customizable, allowing you to tailor them to your specific needs and budget. Consider the following factors when customizing your policy:* Coverage Options:Motorcycle insurance offers various coverage options, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments.

You can choose the coverage levels that best suit your risk tolerance and financial situation.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums. Choose a deductible that you can comfortably afford.

Discounts

Many insurers offer discounts for various factors, such as safety courses, anti-theft devices, and good driving records. Inquire about available discounts to potentially lower your premiums.

Factors to Consider When Choosing a Motorcycle Insurance Provider, Motorcycle insurance quotes

Several factors are crucial when selecting a motorcycle insurance provider. Consider these aspects:* Financial Stability:Choose an insurer with a strong financial rating, indicating its ability to pay claims in the event of an accident. You can check the financial ratings of insurers through organizations like AM Best or Standard & Poor’s.

Customer Service

Look for an insurer with a reputation for excellent customer service. Read online reviews or contact the insurer directly to inquire about their customer service policies.

Claims Process

Investigate the insurer’s claims process to understand how they handle claims and the time it takes to process them.

Coverage Options

Ensure the insurer offers the coverage options you need at a price you can afford.

Reputation

Consider the insurer’s reputation in the industry and its track record of handling claims.

Obtaining Motorcycle Insurance Quotes

You’ve learned the basics of motorcycle insurance and considered key factors for your quotes. Now, let’s dive into the exciting part: getting those quotes! There are several ways to obtain motorcycle insurance quotes, each with its own advantages and disadvantages.

Methods for Obtaining Motorcycle Insurance Quotes

There are several methods to obtain motorcycle insurance quotes. Let’s explore them:| Method | Description | Advantages | Disadvantages ||—|—|—|—|| Online Quote Tools| These tools allow you to enter your information and receive quotes from multiple insurers instantly. | Convenient, fast, and easy to compare quotes.

| May not offer all available options or insurers. || Direct Contact with Insurers| You can contact insurance companies directly by phone, email, or visiting their websites. | Allows you to ask specific questions and receive personalized service. | Can be time-consuming to contact multiple insurers.

|| Insurance Brokers| Brokers work with multiple insurance companies and can help you find the best policy for your needs. | Can provide expert advice and negotiate better rates. | May charge a fee for their services. || Insurance Comparison Websites| Websites that allow you to compare quotes from multiple insurers.

| Convenient and efficient for comparing quotes from different insurers. | May not include all available insurers. |

Reputable Online Platforms for Comparing Motorcycle Insurance Quotes

Comparing quotes from different insurance providers is essential to find the best deal. Here are some reputable online platforms that can help:

Insurify

Insurify allows you to compare quotes from multiple insurers in one place. They offer a wide range of insurance providers and provide detailed information about each policy.

Policygenius

Policygenius is another popular platform for comparing insurance quotes. They offer a user-friendly interface and provide personalized recommendations based on your needs.

NerdWallet

NerdWallet is a personal finance website that also offers a tool for comparing insurance quotes. They provide detailed reviews of different insurers and offer insights into the best policies for different situations.

Contacting Motorcycle Insurance Providers Directly

If you prefer to contact insurance providers directly, here’s a step-by-step guide:

1. Gather your information

This includes your personal details, motorcycle information, and driving history.

2. Choose your preferred method of contact

You can call the insurer, email them, or visit their website.

3. Provide your information

The insurer will ask for your details to generate a quote.

4. Ask questions

Don’t hesitate to ask any questions you have about the policy or coverage.

Motorcycle insurance quotes can vary wildly depending on your bike, riding history, and even your zip code. But just like your bike needs protection on the road, your next adventure needs protection too! Travel insurance quotes can help you avoid unexpected costs while you’re exploring the world, so you can focus on enjoying the ride.

And speaking of riding, remember to factor in the cost of motorcycle insurance when planning your next trip – it’s a vital part of responsible riding!

5. Review the quote

Once you receive the quote, carefully review the terms and conditions.

6. Compare quotes

Compare quotes from multiple insurers to find the best deal.

Factors Affecting Motorcycle Insurance Quotes

Insurance companies assess various factors to determine your motorcycle insurance premium. These factors are designed to evaluate the risk associated with insuring you and your motorcycle. Let’s delve into some of the key factors that can influence your insurance quotes.

Motorcycle Type and Model

The type and model of your motorcycle significantly impact your insurance premium. This is because different motorcycles have varying levels of risk associated with them. For example, high-performance motorcycles with powerful engines are considered riskier than standard motorcycles, resulting in higher premiums.

- Engine Size:Motorcycles with larger engine sizes often have higher premiums due to their increased power and potential for higher speeds, which can lead to more severe accidents.

- Value and Theft Risk:Expensive motorcycles are more attractive targets for theft, resulting in higher insurance premiums. Some models are known for their higher theft rates, leading to increased insurance costs.

- Safety Features:Motorcycles equipped with safety features like anti-lock brakes (ABS) and traction control systems may qualify for lower premiums. These features can enhance rider safety and reduce the risk of accidents.

Rider Experience and Driving History

Your experience as a motorcycle rider and your driving history play a crucial role in determining your insurance premium.

- Years of Riding Experience:New riders with limited experience are considered higher risk, leading to higher premiums. As you gain experience and demonstrate responsible riding habits, your premiums may decrease.

- Driving Record:A clean driving record with no accidents or traffic violations is essential for obtaining lower premiums. Insurance companies consider a history of accidents or traffic violations as indicators of higher risk, resulting in higher premiums.

- Motorcycle Safety Courses:Completing motorcycle safety courses can demonstrate your commitment to safe riding and may qualify you for discounts. These courses teach valuable skills and enhance your knowledge of motorcycle safety.

Location and Geographical Factors

Your location and the surrounding geographical factors can significantly influence your insurance premiums.

- Traffic Density:Areas with high traffic density have a higher risk of accidents, leading to higher premiums.

- Climate Conditions:Regions with extreme weather conditions like heavy rain, snow, or ice can increase the risk of accidents, potentially leading to higher premiums.

- Crime Rates:Areas with higher crime rates, especially motorcycle theft, may result in higher premiums due to the increased risk of theft.

Additional Considerations for Motorcycle Insurance

You’ve gotten quotes, you understand the basics, and you’re ready to choose your motorcycle insurance policy. But before you sign on the dotted line, there are a few more things to consider. This final step is crucial to ensure you’re getting the best coverage at the most affordable price.

Tips for Reducing Motorcycle Insurance Premiums

Finding ways to lower your motorcycle insurance premiums can save you a significant amount of money over time. Several strategies can help you achieve this:

- Maintain a Good Driving Record:Your driving history is a primary factor in determining your insurance rates. A clean record with no accidents or violations will earn you lower premiums.

- Consider a Higher Deductible:Choosing a higher deductible means you’ll pay more out-of-pocket in case of an accident, but it will also lower your monthly premiums.

- Take a Motorcycle Safety Course:Completing a certified motorcycle safety course demonstrates your commitment to safe riding and can often result in lower insurance rates.

- Bundle Your Insurance:Many insurance companies offer discounts for bundling your motorcycle insurance with other policies, such as auto or homeowners insurance.

- Ask About Discounts:Don’t hesitate to inquire about any available discounts, such as those for good credit, anti-theft devices, or being a member of certain organizations.

Understanding Policy Terms and Conditions

Your motorcycle insurance policy is a legal contract, and it’s essential to understand its terms and conditions thoroughly. This includes:

- Coverage Limits:Carefully review the limits of liability coverage, collision coverage, and comprehensive coverage to ensure they meet your needs.

- Exclusions:Understand what situations are not covered by your policy, such as racing or riding under the influence of alcohol or drugs.

- Deductibles:Be aware of the amount you’ll need to pay out-of-pocket in case of an accident or claim.

- Renewal Provisions:Understand how your policy will be renewed, including any potential changes in premiums or coverage.

Seeking Professional Advice

While researching and comparing quotes online is a great starting point, consulting with a licensed insurance agent can provide invaluable assistance.

- Personalized Guidance:An insurance agent can help you assess your specific needs and recommend the best coverage options.

- Negotiation Skills:They can often negotiate lower premiums on your behalf and help you find discounts you might not have been aware of.

- Expert Knowledge:Insurance agents are knowledgeable about industry regulations and can answer any questions you may have about your policy.

Ending Remarks

In the end, finding the right motorcycle insurance is about more than just getting the lowest quote. It’s about finding a policy that meets your specific needs and provides peace of mind. With a little research, comparison, and understanding, you can confidently choose the insurance that’s perfect for you and your ride.

So, rev up your engines, grab your helmets, and hit the road knowing you’re protected!

Top FAQs

What is the difference between liability and comprehensive coverage?

Liability coverage protects you financially if you cause an accident, while comprehensive coverage protects your bike from damage caused by things like theft, vandalism, or natural disasters.

How often should I review my motorcycle insurance policy?

It’s a good idea to review your policy annually to make sure it still meets your needs and to see if you qualify for any discounts. Your needs may change as you gain experience, modify your bike, or even just move to a new location.

What are some tips for lowering my motorcycle insurance premiums?

Consider taking a motorcycle safety course, increasing your deductible, choosing a less powerful bike, and maintaining a clean driving record. These can all help you get lower rates.